Flexible Infrastructure Is Crucial to a Best-of-Breed Strategy

January 18, 2024

By: Tyler Brown

Digital Banking and APIs

It’s not easy for organizations with limited technology resources to offer competitive digital banking services, and as such, it’s difficult for them to chase, keep up with, or even get ahead of competitors. With the technical flexibility to react to sudden shifts in the competitive landscape or to the emergence of new features and functionality, they may change that. But this requires a commitment to achieving such flexibility and a desire to pursue a multifaceted fintech strategy — also known as best of breed, by which financial institutions (FIs) shop around for the most suitable solutions for specific functions or use cases, rather than getting everything from a single vendor, a strategy generally termed best of suite.

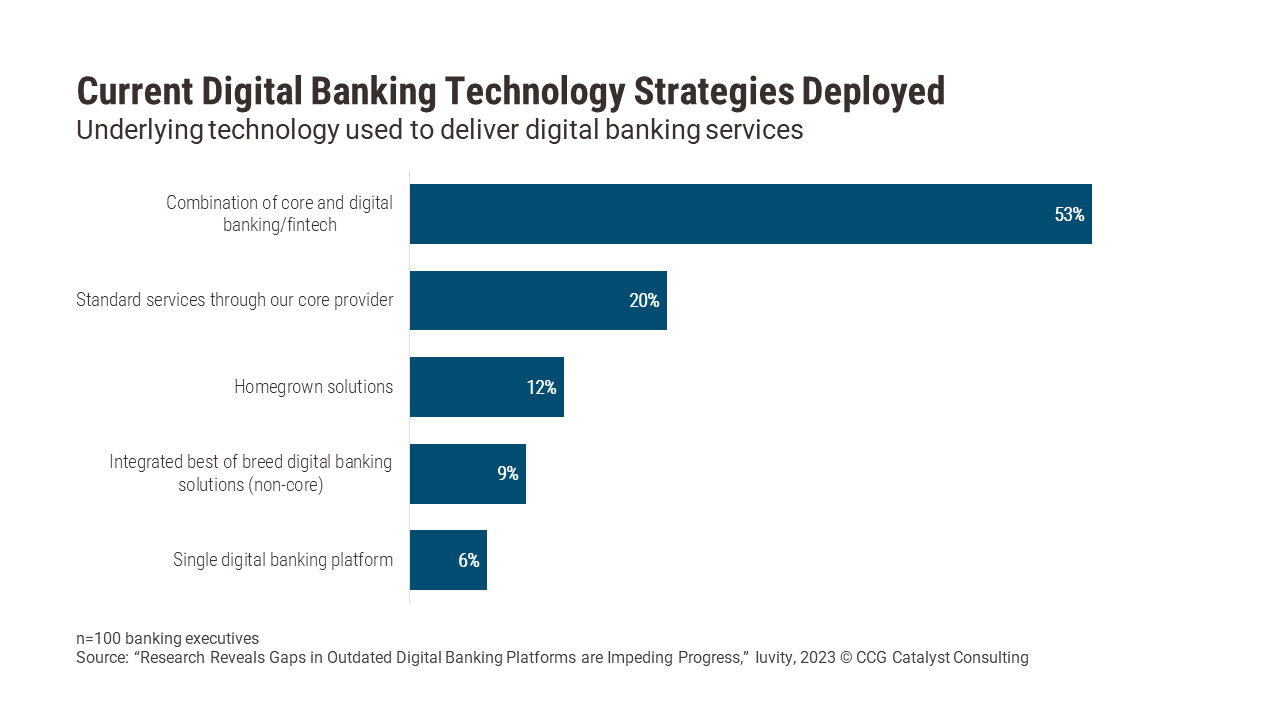

According to a survey commissioned by Iuvity, 73% of banking executives said their core provider is part of their digital banking apparatus, with a fifth relying on their core provider alone. Only a small slice assembles best-of-breed digital banking services. The biggest problem here is that it’s not easy to differentiate based on digital banking (or any services) if FIs all use all-in-one offerings from just a handful of vendors. The 21% of FIs who build their own digital products or integrate best-of-breed solutions are best positioned to differentiate their digital banking services, and the ones integrating fintech solutions are poised to do so quickly if they have the right infrastructure in place.

Real-time, unconstrained flow of data among an FI’s systems is crucial to a best-of-breed approach. As we’ve written, this free flow of data requires flexible, application programming interface (API)-enabled infrastructure, delivered either via an interoperability layer that sits above the core, including solutions from companies like MuleSoft, Boomi, and Jitterbit, or an API-native core system, such as those from firms like Finxact, 10x, and Thought Machine. Once they have API-friendly infrastructure in place, FIs have many choices to make. In the context of digital banking, those choices will be about the third-party products and services FIs offer customers as part of their digital experience, from digital onboarding to personal financial management (PFM).

Looking ahead, extensible platforms will be necessary to the adoption of artificial intelligence (AI)-driven functions across the bank. The leadership at many FIs know it: As we’ve also written, integration fears are the top barrier to greater adoption of AI in banking and payments, hindering the contributions it could make to functions like customer service, loan underwriting, and risk management. Strategists at FIs need to evaluate and consciously pursue a technology strategy that makes it easy for them to iterate, either with a modern stack or through an external orchestration layer. Fintechs — on the infrastructure side and for features and functions — are there to help them do it.