Fintechs Remain Top Competitive Threat to Financial Institutions

November 2, 2023

By: Kate Drew

Fintech Competition

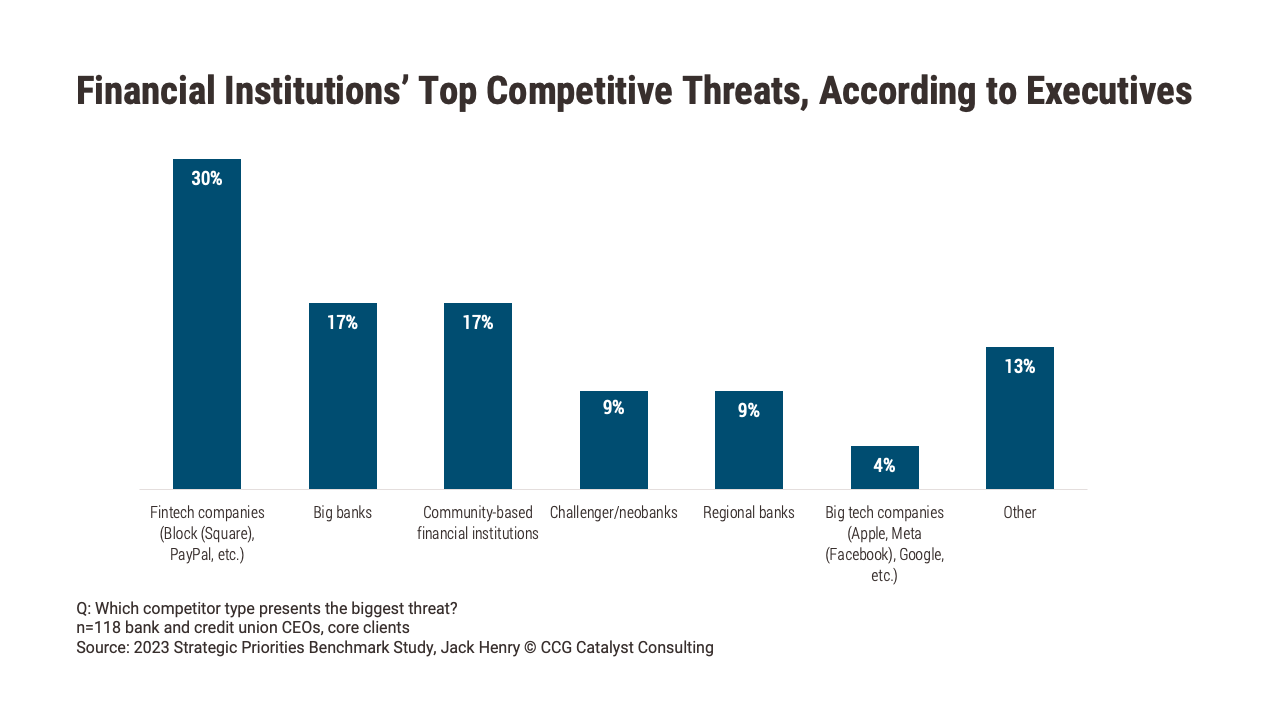

Despite the fintech industry’s many recent challenges, financial institutions (FIs) still see these companies as top competitors. In fact, according to Jack Henry’s 2023 Strategic Priorities Benchmark Study, 30% of bank and credit union executive leaders who are core clients of the technology provider say fintech companies like Block (Square) and PayPal represent the biggest competitive threat, followed not particularly closely by big banks and community-based FIs, each at 17%.

This data is particularly interesting against a backdrop characterized by declining fintech funding globally as well as a myriad of compliance-related challenges miring the sector. Given these dynamics, one might be tempted to think the fintech threat is waning, allowing traditional FIs to breathe a sigh of relief. Instead, though, it seems that these institutions remain concerned about the impact such companies could have long term. This isn’t unreasonable as it is quite likely that, as the wheat is separated from the chaff, weaker fintech companies will fall away, leaving the strongest behind. That could result in a fiercer industry overall once the current storm passes, with lasting fintech titans poised to continue to win a greater portion of consumers’ financial lives.

But there is another element at play here. As we’ve discussed before, with the recalibration fintech is experiencing, we are also witnessing a shift in focus from business-to-consumer (B2C) to business-to-business (B2B) propositions. This trend is clear in the companies who have been able to raise in the current environment: Payments giant Stripe raised $6.5 billion earlier this year, while Banking-as-a-Service (BaaS) provider Treasury Prime, payments company Moov, infrastructure player Nymbus, and credit data analytics platform Nova Credit have all managed to rake in capital recently. And those names are part of a longer list. This should signal an opportunity for traditional FIs — with greater emphasis on B2B propositions, we may also see a shift in how these companies interact with the broader industry. Specifically, we may increasingly see them going from competitor to partner.

Going forward, we can expect to see a crop of prevailing fintech competitors continually raising the bar and challenging the status quo. That’s not up for debate. However, we are also likely to see a lot more propositions centered around improving how traditional FIs operate, do business, and ultimately, serve their customers. As such, banks and credit unions may want to adjust their mindsets a little bit. Instead of coming from a place of fear, approaching the fintech sector as a source of opportunity may be a better way to go. Ironically, it will probably be those who see beyond the competitive threat, and understand the ways in which fintech is shaping up to support the traditional system, who are able to develop the most competitive offerings themselves.