Data Reliability a Challenge for Bank Marketers

September 14, 2023

By: Kate Drew

Data and Bank Marketing

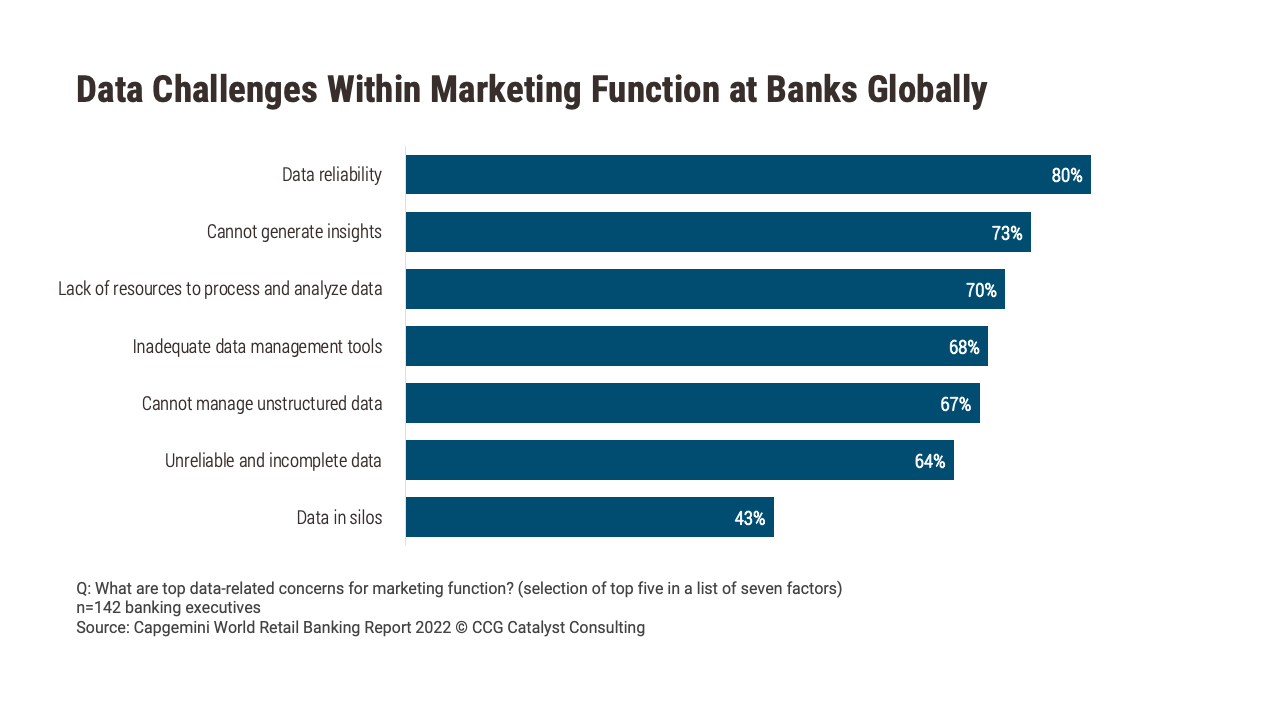

A bank’s marketing function is one of the key areas of the organization that can benefit from data analytics. Data-driven insights can help marketing with many different things, from personalized campaigns based on a user’s preferences to improving the precision of recommender systems or next-best action. As in other areas, though, marketing faces challenges in making use of all of the data an institution has. And the top challenge? Reliability, says Capgemini’s World Retail Banking Report 2022.

This is a tricky one because it doesn’t speak to silos or the inability to access data (which is further down on the list). Rather, it is more about how data is consolidated and organized for use. Or, put another way, it’s about the integrity of the data. The concept of data integrity refers to the collection of processes and standards that ensure data being leveraged is complete, accurate, and standardized in a consistent manner. It is a very important part of making data useable. Unfortunately, it is also very hard to do, requiring highly skilled technical talent as well as an overarching strategy that makes this a priority. And that is another problem — lack of resources to process and analyze data took the number three slot on Capgemini’s list. (Inability to generate insights was number two and is very much tied to these other challenges.)

Ultimately, banks that want to make their data useful (for marketing and for other functions) will need to think about it holistically. It’s not just about getting data out of silos or getting the right analytics tools in place (although those things are important, too). As we’ve discussed before, being able to drive insights from bank data, including the ability to generate the much-desired and elusive 360-degree view of the customer for personalization purposes, requires having a well-defined strategy and roadmap that spans technology, operations, and people.

Especially as artificial intelligence (AI) comes further into the mix, it will be important to have a unified approach to handle greater complexity associated with larger data sets. Eventually, that will include the combination of data that sits inside of the bank with data from outside of the bank, making process and organization absolutely critical.