Consumers Weigh Environmental Sustainability When Choosing a Bank

March 9, 2023

By: Kate Drew

Bank Customers and Environmental Sustainability

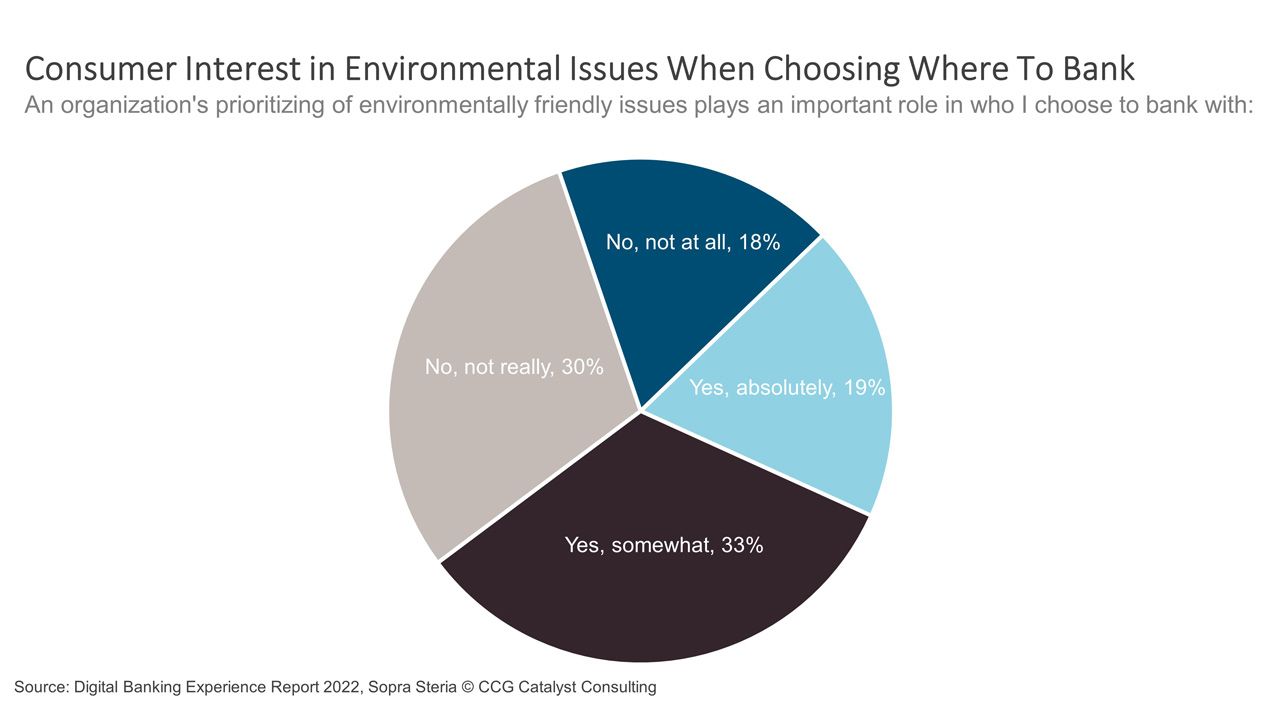

The move toward environmental sustainability in banking, particularly in the context of carbon-related initiatives, is seeing increased activity in the US and globally. That’s being driven by demand from a number of stakeholders, including regulators, investors, employees, and of course, customers. Customers is a big one, because their needs and desires speak to where the market is headed as a whole and what baseline expectations will be from a competitive standpoint. And when it comes to environmental issues, bank customers are getting more and more clear on what it is they want — specifically, according to a 2022 report published by Sopra Steria, more than half of global consumers surveyed said an organization’s prioritizing of environmentally friendly issues plays an important role in who they choose to bank with.

Environmental sustainability refers to the concept of conserving the world’s natural resources to support the viability of the planet now and in the future. While there are many ways the spirit of this idea could be interpreted, for most banks, it generally equates to reducing their carbon or greenhouse gas (GHG) emissions, with the ultimate goal to get to net zero by 2050 in accordance with The Paris Agreement’s target to limit warming to 1.5 °C. Typically, a sustainability strategy for a bank will include preparing a GHG emissions inventory and disclosing those emissions across Scopes 1-3 of the GHG Protocol. From there, an institution can begin to mitigate or reduce its footprint. All of this, though, is extremely technical for customers. Of course, it goes without saying that banks today should be thinking about sustainability and how it applies to their business and own stakeholders, but beyond that, how do you go about satisfying customer demand in an area that is so scientific and complex? How do you work to communicate your efforts in way that is effective?

This gets to the heart of the idea Sopra Steria’s data presents — consumers are making choices based on how they perceive institutions to be prioritizing environmental issues. That’s the key. It’s not enough to craft and implement an environmental sustainability strategy — which many banks are either already doing or at least thinking about — you’ve got to also have a plan for how you will convey that strategy, and critically, the wins that come out of it to your stakeholders in order to maximize the benefit back to the bank. We’re heading into an environment where sustainability efforts are no longer optional and can serve as a real differentiator in vying for customers and their business. But capitalizing on that opportunity will require beating your drum beyond lengthy, onerous disclosures. Creating engaging content that centers on knowledge-sharing with customers tied together under a cohesive campaign will be a vital tool for anyone looking to turn environmental sustainability into a difference-maker in the market.