Only a Quarter of US Banks Feel Confident Serving Gen Z

October 6, 2022

By: Kate Drew

Banks and Gen Z

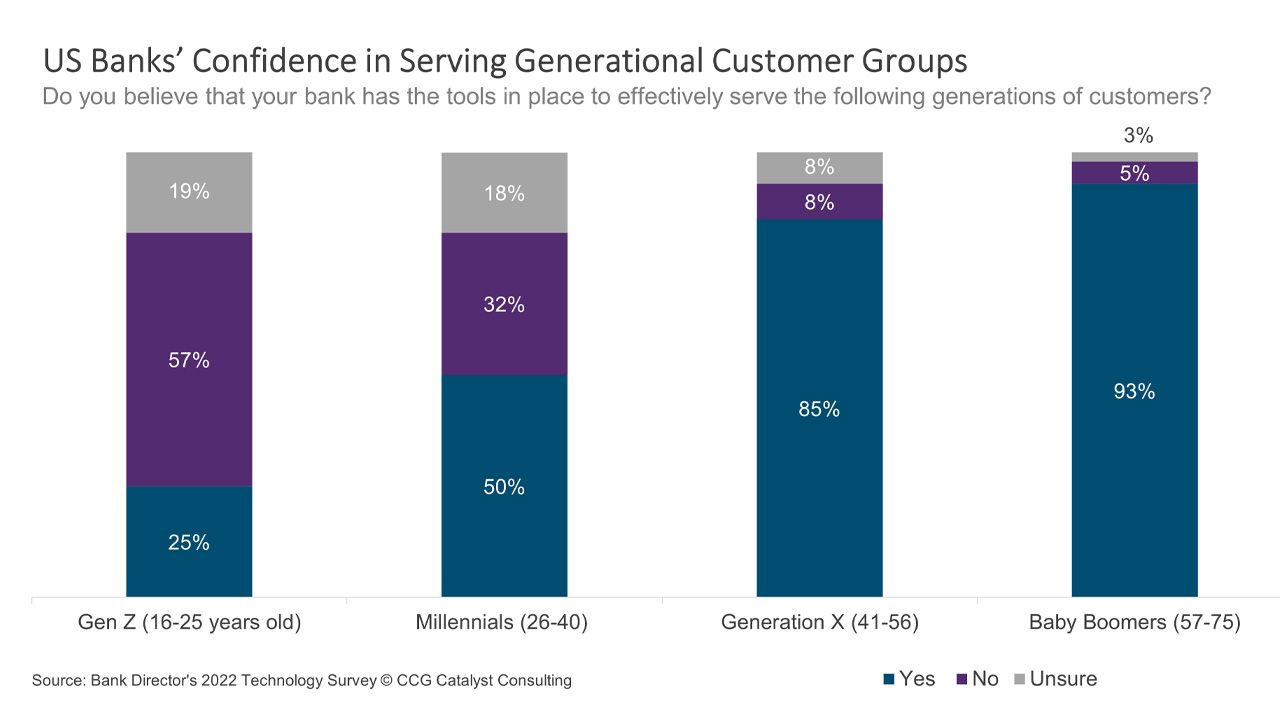

Young consumers are a real problem for US banks. In fact, according to Bank Director’s 2022 Technology Survey, just 25% of respondents said their bank is prepared to serve Gen Z, or those aged 16-25. This year marks the first time the fledgling cohort was included in the report, and the data is extremely disappointing, as this group represents the next critical generation to come into the workforce after millennials.

Gen Z is known for showing some kinship with their millennial elders, such as an affinity for technology and digital products. But they also have their own unique attributes — Gen Z, for instance, has shown a particular proclivity for saving and boasts a reputation for being thrifty, likely as a result of their experience with economic uncertainty during critical years of their development: first, with the 2008 recession of their early childhoods and then the Covid-19 pandemic and subsequent turmoil that’s plagued their adolescence and young adult years. Specifically, according to Bloomberg, Gen Z, on average, tucks away about a third of their income.

Understanding such nuances is a good first step to getting prepared to serve this group of individuals, but the smartest organizations will go even further. The information above is largely anecdotal, it speaks to the generation as a whole, but with no context related to things like geography or income level. If banks want to win these consumers, they need to look at exactly who they are targeting and really work to identify their needs. The question in Bank Director’s survey asked whether or not banks felt they had the right tools in place to reach different generations, but in order to accomplish that, you first need to identify what the right tools are.

Again, it all comes back to user research. There are fintech providers targeting these consumers that make this the backbone of what they do. And such companies have been able to rake in large swathes of customers — for example, Gen Z-focused finance app Frich managed to sign up more than 30,000 users in the roughly year or so after its September 2021 launch. “A lot of financial services companies don’t understand that Gen Z manages their money totally differently than any other generation. Gen Z is not looking for a neobank that has a pretty design — they need financial tools that actually teach them how to manage their money,” Katrin Kaurov, cofounder and CEO at Frich, told CCG Catalyst. For fintechs, it’s all about data-driven insight and understanding. If you have that part solved, delivery gets much, much easier. Banks looking to create a relationship with Gen Z (and others, for that matter) would do well to take a page out of this book. Sooner rather than later, too.