Will the Bank of the Future Be Online-Only?

September 28, 2022

By: Kate Drew

Bank of the Future

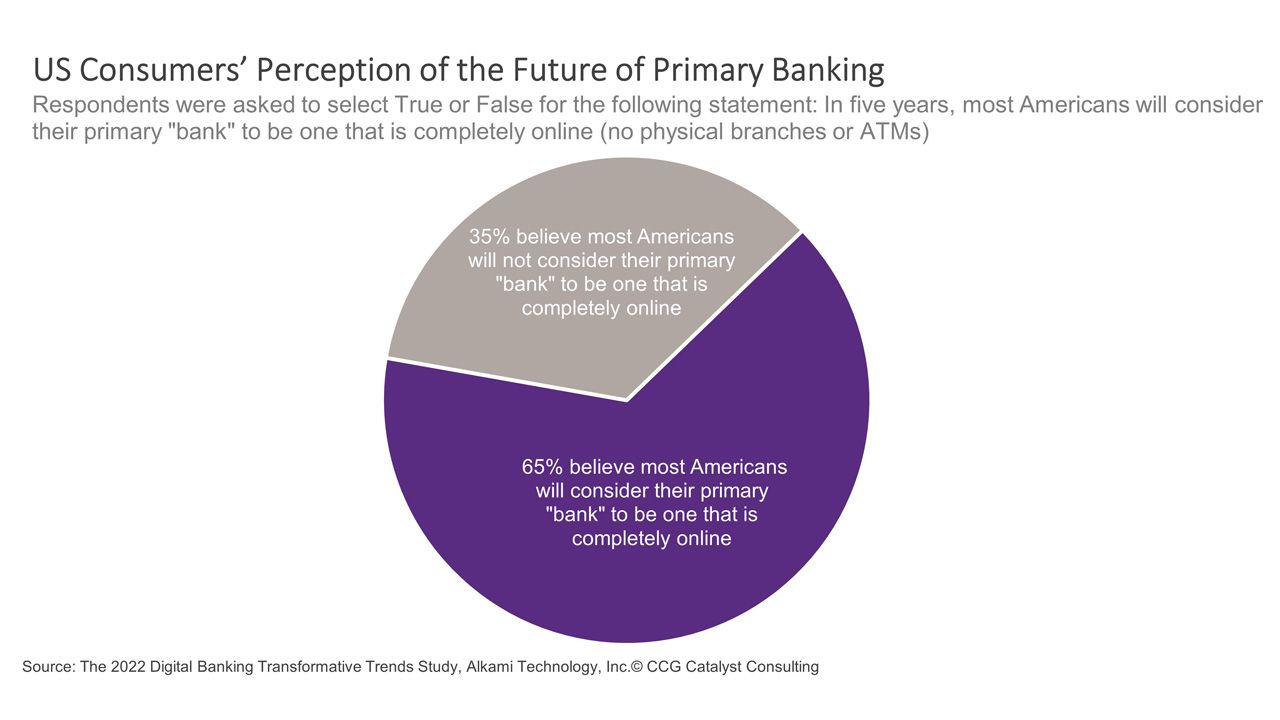

Will the bank of the future be online-only? A majority of consumers seem to think so — in fact, according to a recent survey by Alkami, a whopping 65% of respondents said they think most Americans will consider their primary bank to be one that is completely online in five years’ time. Based on this data (and similar results from many other studies), it’s quite clear that consumers broadly are thinking about digital channels as the central method of delivery for financial services by this point. And that means banks, even those who consider physical locations vital to their community-serving positions, need to be willing to make major shifts in their operations to stay on top of those needs. However, there are nuances in these expectations that bank executives will need to solve for as we move closer to an online-only world.

The first thing to consider is that online-only doesn’t necessarily mean no person-to-person interaction. According to a separate study by Temenos, even as consumers increasingly embrace digital, the top item they want banks to focus on is making it easier to speak to a representative. While this might seem counterintuitive, it actually makes a whole lot of sense — the more digital we get, the more important it’s becoming to be able to access a human when we need to, reinforcing the idea that hybrid interactions, whether the bank itself is online-only or not, are likely the way of the future. For a long time, we’ve known that consumers generally want easy, digital interfaces for simple tasks and an actual person for more complex transactions. The question now is, “How do we deliver this in a virtually dominant environment?” The answer to that will come from getting creative about how we tackle the hybrid experience. Maybe it’s beefing up call centers with routing powered by artificial intelligence (AI) or the use of video-calling. It all depends on the bank and its customers.

Another important point is that online-only can manifest in a number of ways. Some fintech providers, for example, are mobile-only. These providers tend to cater to younger consumers who are used to doing pretty much everything from their phones, and they’ve done extensive user research to determine that a desktop experience isn’t necessary. Banks will need to employ similar efforts to understand which channels make the most sense for their particular customers and how to prioritize them. This is where multichannel delivery comes into play — the truth is, most customer bases will vary somewhat in their needs, so the ability to provide a consistent experience across different mediums will more likely than not be necessary. It’s important, though, that choosing which channels to dedicate effort to in the first place is informed by who your customers are and what exactly it is they want.

Now, you’re probably thinking, “Is this for real? Are we really talking about getting rid of physical locations entirely?” No, we’re not. Consumer sentiment is one lens through which to look at the future. It’s an important one, but it’s not the only one. The goal, rather, is to look at this data directionally and use it to help inform your choices as you move forward. Every bank is going to have to make decisions about how to better serve their customers, and that will require thinking through what it means to emphasize digital channels; however, the actual mechanisms for doing this will vary. Online-only is an end state that we may never reach entirely, even as we all march along the path heading that way. As such, we should be charting the course accordingly, and thoughtfully. As always, it all comes back to the customer. Talk to the people who use your services, survey them. Get your own data, and then you’ll be well positioned to make a move.