APIs Remain in Spotlight for Financial Institutions

August 18, 2022

By: Kate Drew

Banking and Emerging Technologies

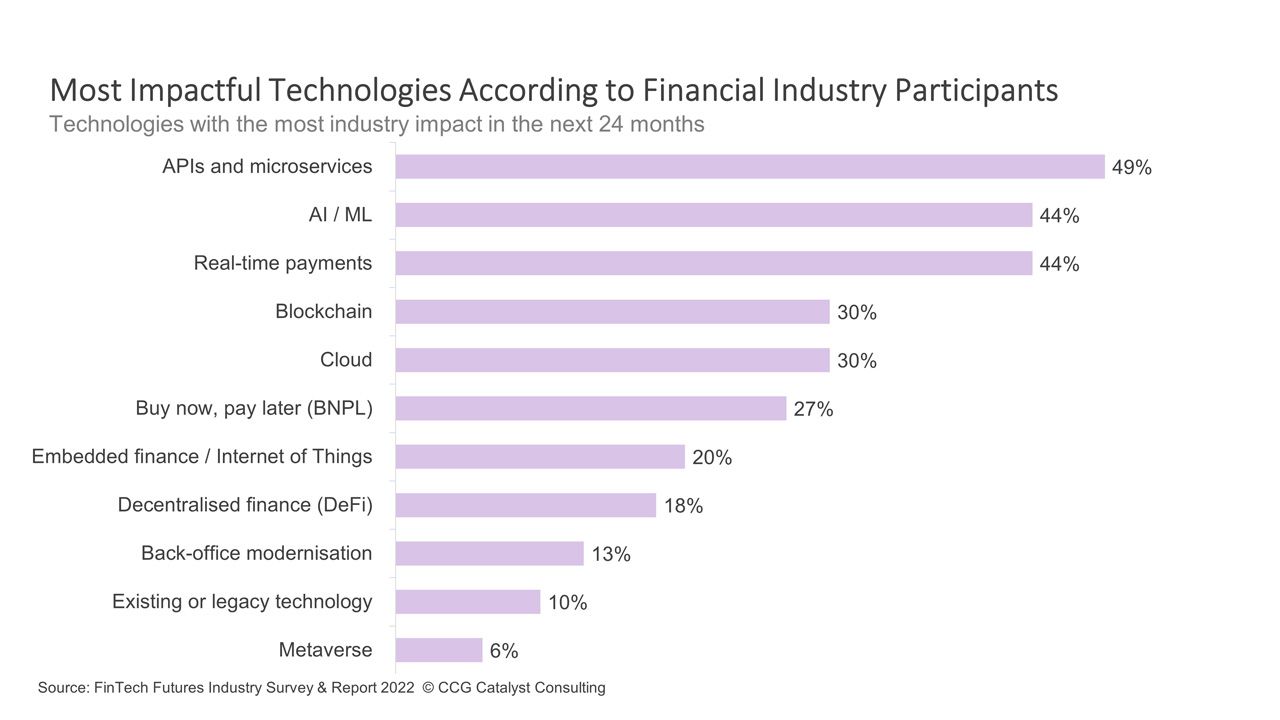

The ability to easily integrate systems and processes in financial services continues to be top of mind for the industry. In fact, according to the FinTech Futures Industry Survey & Report 2022, application programming interfaces (APIs) and microservices, which allow for streamlined integration and communication between applications and service components, came out on top when respondents were asked which technologies would have the most impact on the financial industry in the next 24 months across a range of choices. This suggests that industry participants believe the ability to overcome legacy infrastructure by introducing flexible, modern architecture that supports interoperability is going to be key to their long-term survival and success.

This data coincides with another trend we’ve been seeing toward best-of-breed approaches to technology by which banking providers look to identify market-leading solutions for different functional areas rather than getting a majority of their infrastructure from a single provider. For example, a bank may use one provider for digital banking, another for digital account opening, and yet another for applicant/identity decisioning. In such a setup, it is absolutely critical that all of these different components are able to work in tandem with one another via easy integration and reasonable implementation timeframes. That can only really happen if a bank’s underlying systems are set up to deliver data and information via easily consumable APIs, which is likely why there is so much attention being put on such capabilities.

How a bank gets to this point is going to come down largely to strategy. As we’ve discussed many times before, there are a number of potential paths, including working with your core provider to build the integrations you need, building modern architecture around your existing systems that can help make interoperability easier, or potentially migrating to a next-generation core system that is fully API-enabled from the start. Regardless of which path you choose, though, the starting point is always going to be looking at your current infrastructure and determining what it needs in order to support an API-first future. In time, it is likely that best of breed will become the new normal — financial services executives are clearly embracing this idea, pushing it into reality. That means understanding the gaps between your current and desired future state today is crucial. Once you have a handle on how far you are from your ultimate destination, you can start planning the ways in which you will get there.