The Importance of UX to Differentiation

June 2, 2022

UX and Differentiation

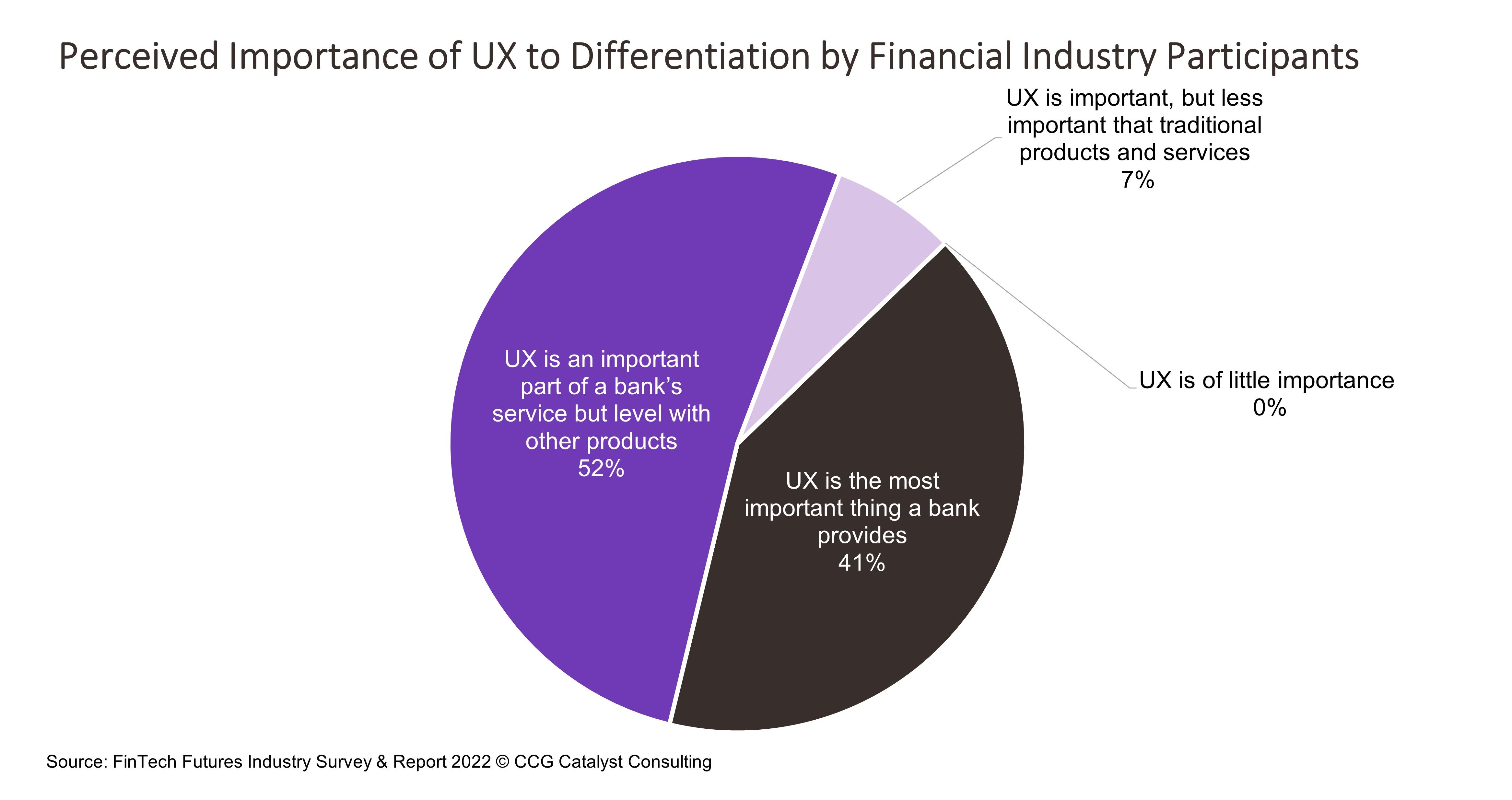

Differentiation is hard to come by in banking today. That’s for a couple of reasons — first, banks in the US are used to outsourcing a lot of their technology needs while, at the same time, working with just a handful of the same vendors; and second, this is an industry where everyone likes to play follow the leader (it’s true, we all know it). As a result, very few build their own stuff and even fewer break away from the pack. But, in an environment where fintech startups and other new entrants are building their entire propositions on differentiation, it’s becoming a more important component. And, as we look to embrace this need to better differentiate, at the heart of the conversation is user experience (UX). In fact, according to the FinTech Futures Industry Survey & Report 2022, 41% of financial services industry respondents believe UX is the most important thing a bank provides in differentiating its services.

UX is a tricky animal because it can mean many things. At a base level, though, it refers to how your customers engage with your institution and the interactions they have. If those interactions are mainly physical, the experiences will be mainly physical. If those interactions are digital, the experiences will be mainly digital. So it’s important to first understand how customers are interacting with your institution before building or creating anything. You need a deep understanding of who your customers are, what they want to accomplish, and how they are using your services to design for them, whether that’s inside or outside of the digital channel. That means research — a lot of it, especially as, realistically, most banks will have customer bases that are hybrid, which means they need to design for different channels across the physical and digital worlds. As a result, getting an understanding not only of how customers interact with the bank but also how those interactions can be tied together in a seamless way will be key.

Most designers will tell you that a good UX is one the user doesn’t have to think about at all. It’s innate — like when you choose a new show from Netflix or make a purchase on Amazon. In those moments, you aren’t thinking about where to click or how to make it work. It just happens. That’s how we should be approaching UX in banking, as well. We should be trying to eliminate any thought on the part of the customer when it comes to the interaction they are having, freeing them to focus only on what they are getting or accomplishing — a new house, a new car, paying off that student loan, etc. Chances are they aren’t going to come away thinking, “Man, that was a really great user experience.” (At least, the average customer won’t.) But they will come away feeling good, and that’s the goal. To make them feel good in their interactions with your bank, so they associate with it positively. And, critically, so they come back for more.