It’s Time To Bring CX Into Fraud Prevention

March 31, 2022

Fraud Prevention and Customer Experience

Do we ever think about fraud prevention as part of customer experience? Probably not. Or, at least, not really. Fraud prevention is first and foremost about safety, about protecting customers’ assets, as it should be. But, like anything else, there are ways to do it well and ways to do it better. Preventing fraud is important, but it can also be an area of immense friction. And this is a friction that is extremely relatable — ever have a legitimate transaction declined right in front of you? Incredibly frustrating, right?

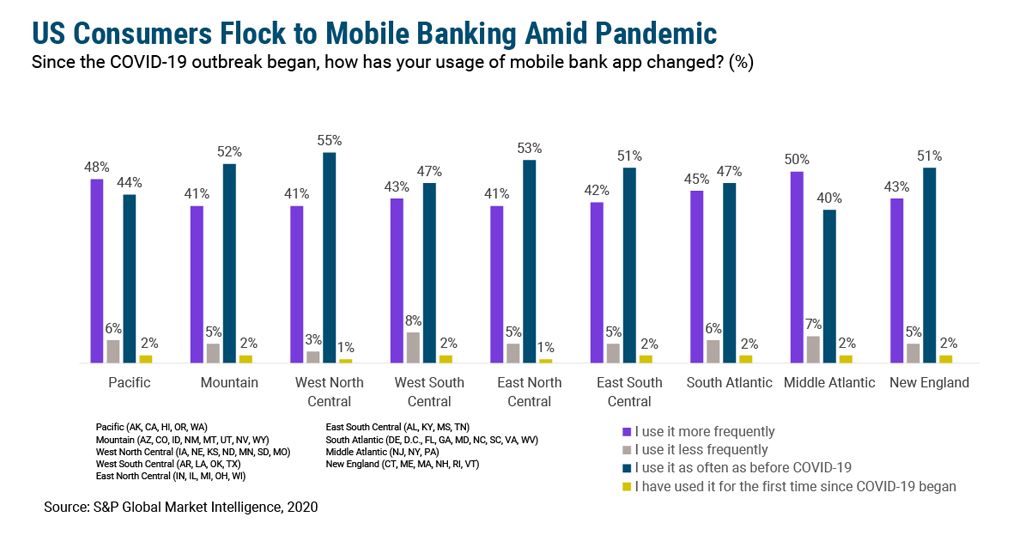

Customers today are very sensitive to friction because many companies they touch daily are hyper-focused on removing it. Their bank should be thinking about friction this way, as well, and not just in areas that involve regular engagement like mobile or online banking. The first step is finding out where that friction is, and on the fraud prevention front, it seems to be tied in large part to communication. Specifically, according to a recent survey by FICO, the top issue for customers related to fraud prevention is when alerts don’t arrive in a timely manner or at all. This suggests that no matter how well fraud protocols are at actually keeping customers safe, they are going to balk if their bank isn’t effectively explaining what’s going on and why. Perhaps alert delivery is a backend issue that gets little attention in favor of making sure fraudulent transactions are blocked to begin with, but either/or might not be the right approach here. How a customer perceives your response to fraud drives their experience and satisfaction. And it could impact their loyalty — per the report, over a quarter of customers surveyed would change their bank if unsatisfied with how it handled a fraud event.

Ultimately, this comes back to how banks approach development and delivery, and how wide or narrow those approaches are. We live in a world where technology companies are A/B testing on the colors of buttons. (Yes, seriously.) It’s no longer about general interfaces and screens. It’s about the holistic experience your customer has when engaging with your bank at all points of contact. Fraud prevention is just one area that probably needs a bit more love. There are likely many more — think, for example, about how customers are notified if they have a low balance or if an automatic payment is disrupted for some reason. These are potential points of friction that can be solved for with a little foresight and a good communication strategy. It’s important, though, to put all of this into the context of your own customers. The goal isn’t to go out and find all possible issues. It’s to truly understand how people engage with your bank and how their interactions can be improved. So, talk to them and see. Then, you can begin to enhance their experiences in ways you may never have considered.