Banks Lag on Technical Hiring

March 3, 2022

Banks and Staffing

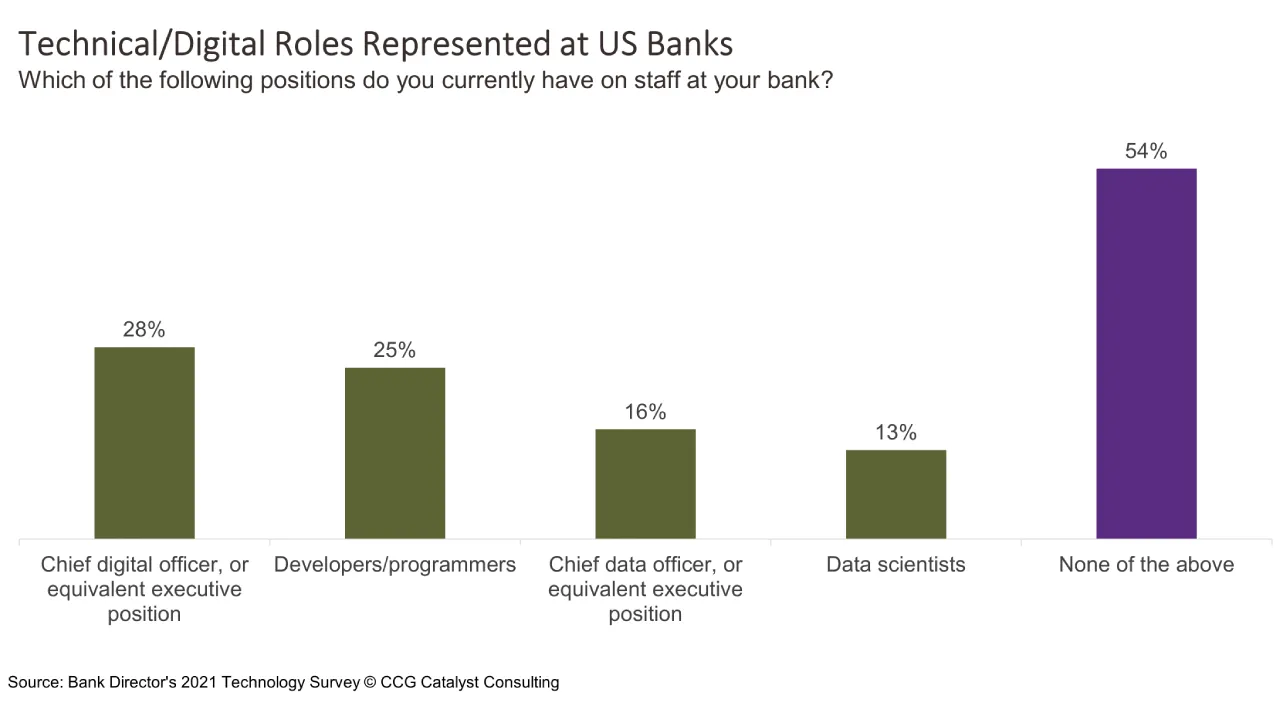

We’ve been embracing the innovation wave for a while in financial services. Pushed forward by fintech startups, particularly progressive institutions, and of course, the Covid-19 pandemic, US banks have made serious inroads toward upgrading their technology and experimenting with new value propositions for customers in the last couple of years. But, when it comes to codifying those intentions in their employee base, many are still falling short. In fact, according to Bank Director’s 2021 Technology Survey, more than half of institutions surveyed still do not have a chief digital officer, chief data officer, or developers/data scientists on staff. This is worrisome, as these digital/technical roles are key to driving long-term innovation efforts.

It’s probably not all that surprising that banks are behind here — some of these roles didn’t even formally exist until recently, and US institutions are known for outsourcing a lot of their technology needs. But it’s time to really start thinking about what these organizations should look like in an environment where innovation is a permanent aspect of their business. This is especially true for leadership roles, where individuals can set the tone from the top down. Innovation efforts are happening everywhere; if we aren’t hiring to support them, then who is leading? How will all of these efforts come together under one roof? How will you prioritize and execute? It seems as though we’ve begun to drive the car forward (and are now accelerating quite quickly) without a dedicated driver and some very key parts under the hood.

This really all comes back to strategy. It’s important to have a cohesive innovation strategy underpinning your operations, and doing that effectively requires the right talent. Without the right people in place, you risk initiatives falling by the wayside in a series of starts and stops. Even some of the most technology-driven companies fall victim to this — Google famously scrapped plans for its Plex checking account after the project’s key sponsor left the company. But, while Google can afford to throw things at the wall, many banks cannot. Hiring and retaining people who can bring your institution into the future will be crucial to ensuring innovation seeps deep into the bank, rather than sitting off to the side, or worse, being scattered about. It merits noting that such talent can be notoriously hard to win over, so understanding the value in creating a culture that is attractive to forward-thinking leaders and employees will be key. And that will take work. It’s likely to be worth it, though. Champions usually are.