Community Banks Tackle Digital Engagement, Talent in 2022

February 24, 2022

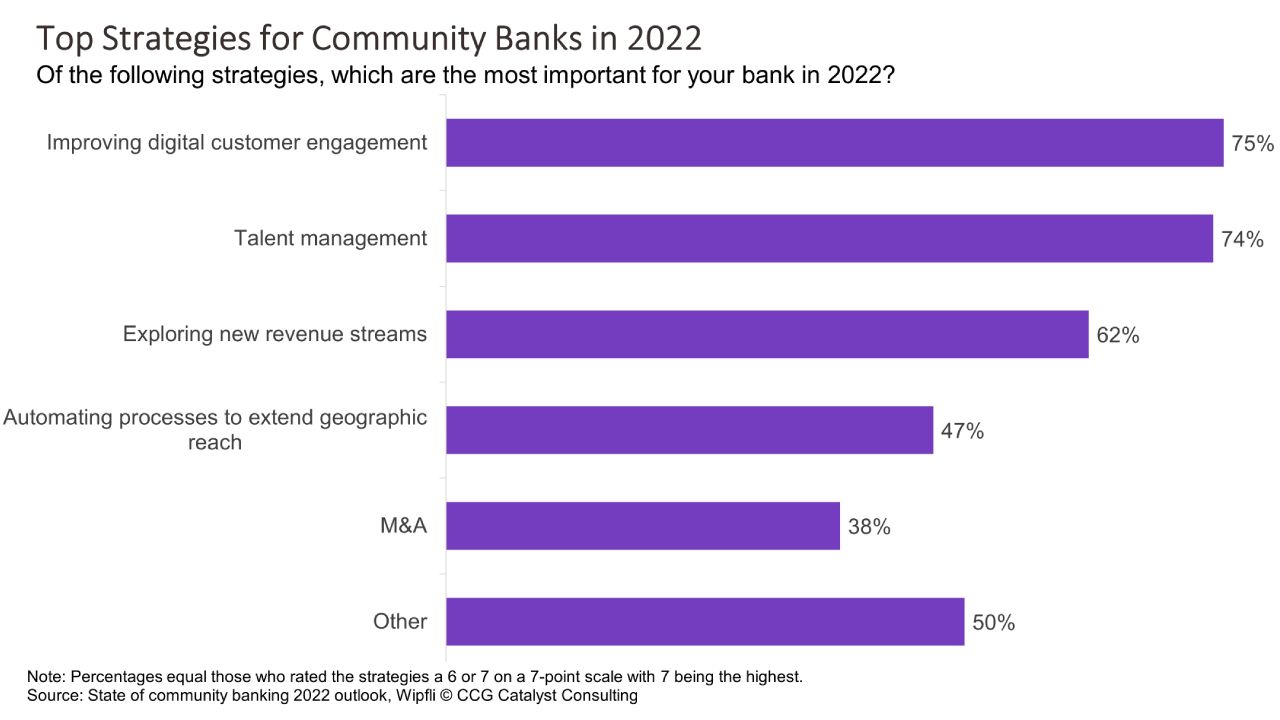

Community Bank Strategies in 2022

As 2022 gets underway, everyone is looking with hope toward a new normal. In the community banking arena, that’s translating into finally putting strategies in place that are less about survival in a pandemic and more about the future. Specifically, according to Wipfli’s State of community banking 2022 outlook, executives are focusing on two key areas: improving digital customer engagement and talent management. This data is extremely refreshing for a couple of reasons. First, it suggests that community banks understand how valuable it is to create digital stickiness with their customer base — a notion that fintech neobanks have been doubling down on for quite some time. And second, the emphasis on talent management indicates that community bankers are finally waking up to how important it is to hire and retain the right people with the skills necessary to drive their businesses forward.

Based on the data, it seems that community banks in the US are essentially drawing from the fintech playbook. Fintechs are known for creating experiences that keep their users coming back again and again through extensive research and customer feedback cycles. And they do this by investing heavily in their staff, especially in functions like product development. It’s promising to see community bank executives highlighting each of these areas in their go-forward strategies. What would be truly interesting, however, is to understand whether they are making the connection between the two. Improving digital customer engagement isn’t just about getting more people onto the digital channels you implemented during Covid-19; it’s about continuing to evolve those channels to meet their needs, thereby growing their satisfaction and kinship with the brand. Doing that requires a commitment to user research and agile product development, which demands advanced skillsets and innovation-minded individuals.

The link between digital engagement and talent is an important one, and identifying how that link manifests at your bank is likely going to be the trick to success. Now, this doesn’t necessarily mean you should go out and hire 10 developers. It does mean, though, that executives should be thinking about how they can improve on their experiences for customers and what talent they will need to support that. In particular, it’s wise to bring on people who understand that products and services need to be tied tightly to real wants, and that the only way to ensure this is to talk to customers. The Wipfli findings are promising, but we can do even better. Taking that next step into the “What do we mean by this?” is key here. If you’re going to take any page from the fintech story, let it be this one: Hire people who will inform your choices with data and drive those choices all the way home — then, it’s just about keeping them happy.