Are We Done With Overdraft?

November 24, 2021

By: Kate Drew

Banks and Overdraft Fees

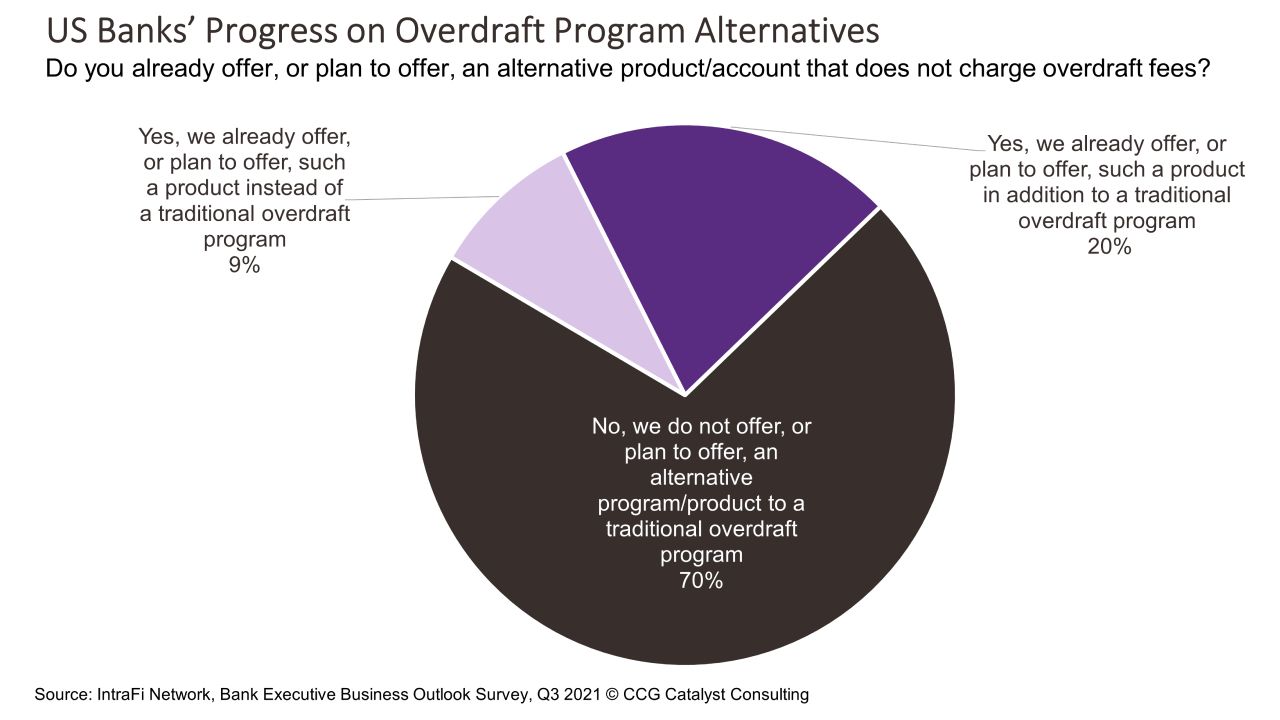

The overdraft debate is heating up in the US. It began in large part with fintech neobanks like Chime entering the market with fee-free accounts that don’t charge for overdraft as part of their value propositions. And, like many fintech trends, this idea has slowly made its way into mainstream banking — this summer, for example, Ally Financial announced that it would also be doing away with overdraft fees, prompting a ton of discussion around whether this would become the norm. Well, it looks like we’re not quite there yet, but the industry is certainly beginning to move that direction. According to IntraFi Network’s Q3 2021 Bank Executive Business Outlook Survey, 70% of respondents do not offer or plan to offer an alternative to a traditional overdraft program; however, 20% offer or plan to offer an alternative as an option, and the remainder provide or plan to provide an alternative as a replacement.

This data suggests that, while we are still quite a way off from a reality where overdraft fees cease to exist, the banking industry is starting to embrace this concept, which means that it could become a common feature, if not the standard, further down the line. Banks move notoriously slowly, and this is a very new trend. So, that nearly a third of respondents to IntraFi Network’s survey are into the idea is actually a very encouraging sign for the removal of overdraft programs long term.

When looking into the future, it’s important for banking institutions to spot trends like these that could become expected while they are still able to provide a competitive advantage. Overdraft fees are a major pain point for consumers, and neobanks have been able to pull in millions of users with accounts that eliminate them completely. For traditional banks today, that offers an opportunity to increase customer satisfaction and demand by following suit. And those that do it early, before the rest of the industry jumps in, will achieve the most in the way of differentiation.

This is about more than overdraft fees, though. It’s about the ways in which fintechs and other tech-savvy competitors are the changing standards for financial services all over the map. This extends to many, many different areas — from digital account opening to mobile banking to payments, and a slew of things in between. As suggested above, keeping up today means maintaining a close eye on the forces setting the pace for the industry overall and getting onboard with the future sooner rather than later. Right now, we might be talking about overdraft fees, but this concept can be applied to virtually every area of banking in some way. It’s those that take the time to understand where we are going and the trends we’re riding to get there that will benefit most in the end.