Banks Commit to Fintech Engagement

October 20, 2021

By: Kate Drew

How Are Banks Engaging With Fintech?

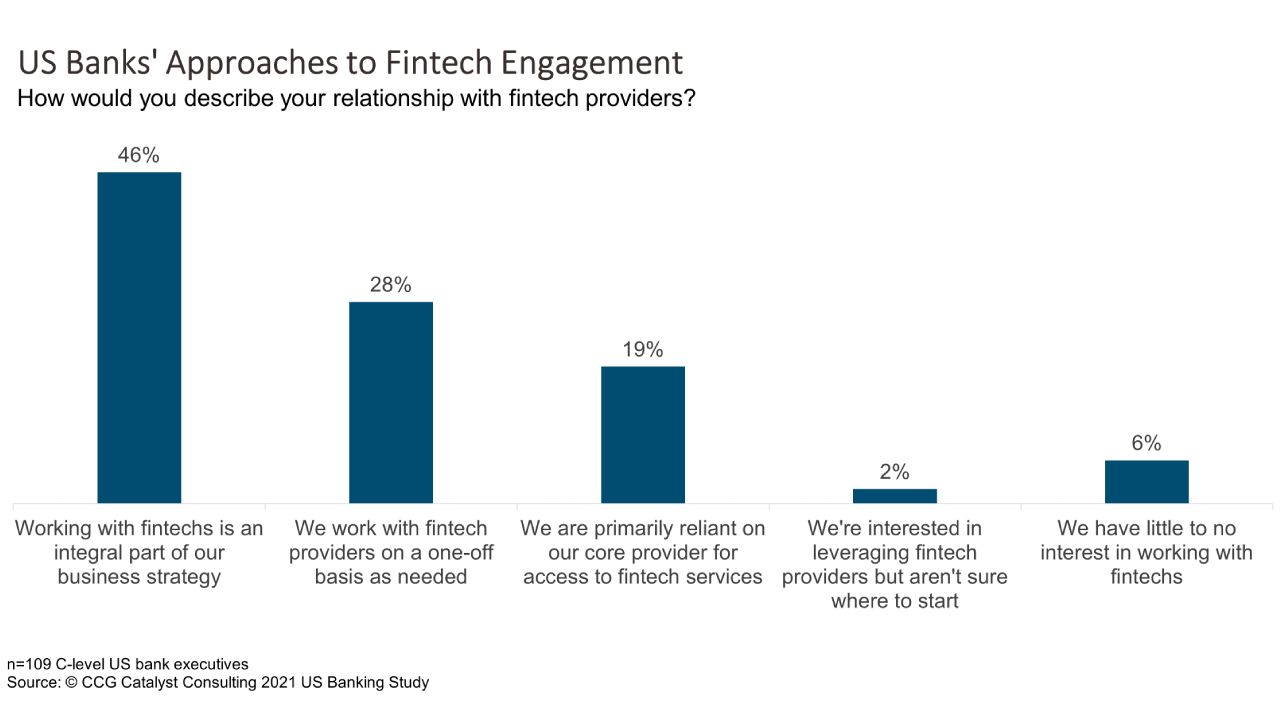

Bank execs are committed to working with fintechs. According to CCG Catalyst’s 2021 US Banking Study, nearly half of C-level bank executives surveyed in the US said working with fintechs is an integral part of their business strategy, and another 28% said they work with fintech providers on a one-off basis as needed. The data reflects a trend toward a best of breed approach to infrastructure, by which a bank compiles a portfolio of market-leading technology solutions to run its business, rather than getting everything from a handful of vendors. Think, leveraging a digital account opening solution not built by your core or digital banking provider or implementing a snazzy new personal financial management (PFM) tool for your retail customers.

The ability to work with fintech providers to implement technologies that can support the bank internally as well as on the customer side gives traditional financial institutions (FIs) the opportunity to bring differentiation back into their offerings. For a long time, banking was pretty commoditized from a product and technology standpoint, with only people serving as a bank’s real differentiator, especially in small communities. The rise of fintech neobanks like Chime and Current have changed all that by doubling down on the customer experience and using technology to deliver better products and services. That’s pushing banks and credit unions in the US to do the same.

Being able to pursue a best of breed strategy, however, requires a bank to have a flexible foundation from an infrastructure standpoint. Yes, we’re talking about integration here. Without the ability to easily integrate with new and different solutions, it will be extremely cumbersome (and expensive) to work with an array of providers in an effective way. That means institutions should be thinking about ways to overcome tech debt and open up their core systems to enable plug-and-play strategies. The fintech industry can support traditional FIs, but it’s also competing with them — and it moves fast. Time to market is just as important as getting the right solutions in place.

And for those that are still waiting in the wings — about a fifth of respondents said they are reliant on their core provider for access to fintech services, while the remainder are either unsure where to start or lack interest — it’s time to think about your strategy. While not every bank needs the latest bells and whistles, it’s very possible that we are moving toward a future where even remaining current requires flexibility and a well-defined approach to fintech. Getting left behind is a real risk here, especially given how committed bank execs are broadly to this effort. Even those who can stand to be a bit behind the curve generally should be thinking about getting a plan in place, or they risk allowing a capabilities gap that’s too wide for ongoing success.