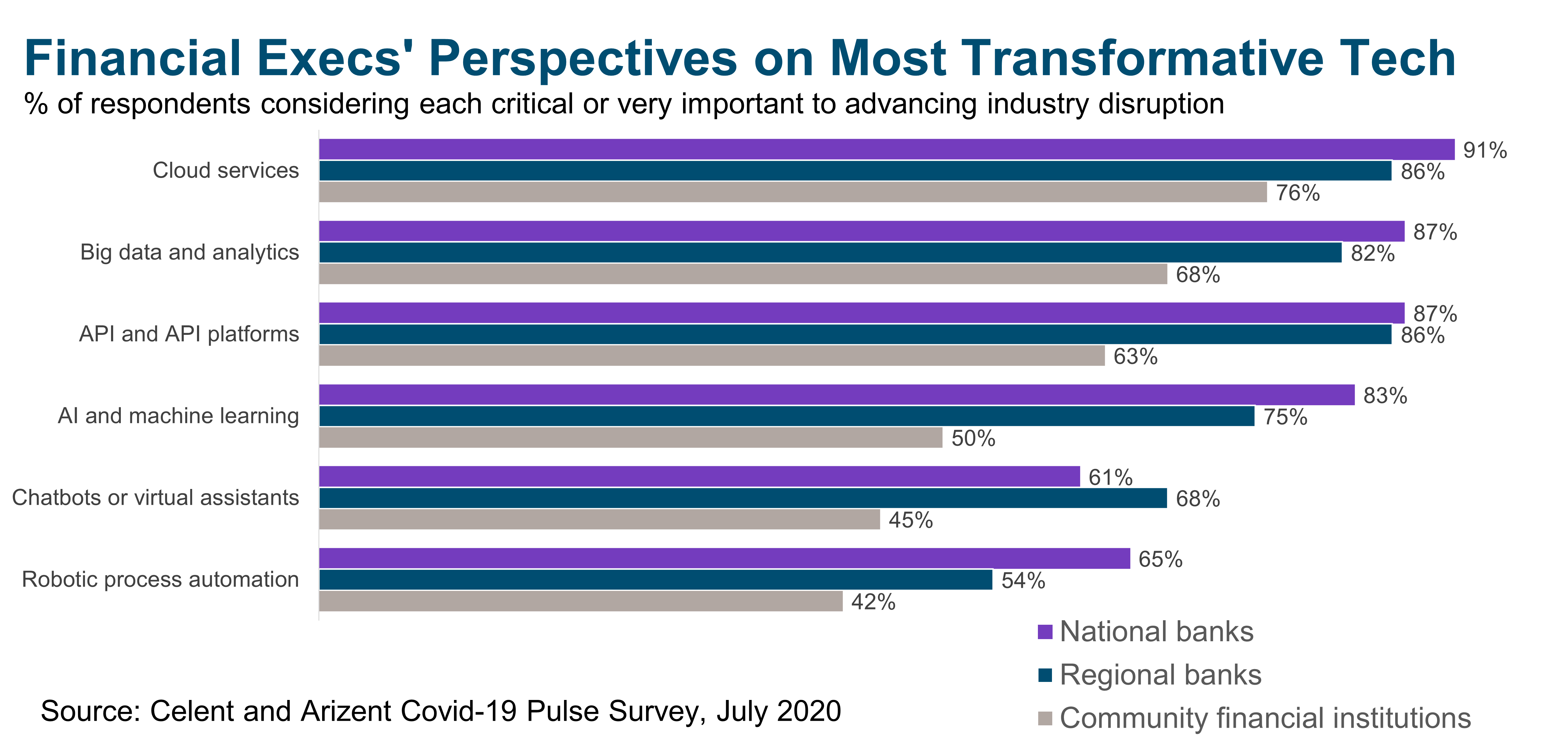

Banking execs are split on their perceptions of disruptive tech. A 2020 survey by Celent and Arizent reveals major discrepancies in how larger institutions view disruptive technologies like cloud services, big data, and application programming interface (API) platforms compared with smaller institutions. For example, while 91% of national banks agree that cloud services will be critical or very important to advancing industry disruption, the same is true for only about three-quarters of community institutions. There are similar gaps across the board, all the way down the category list, with the largest schisms in the expected impact of APIs and AI/machine learning.

These gaps are extremely concerning because they suggest that many community institutions don’t know what they don’t know. It’s one thing to be a bit behind the curve because of budget or resources, or even concerns about security, but it’s quite another to believe that the trends your industry peers are tracking and embracing aren’t particularly relevant. The adoption of standardized APIs that encourage interoperability, for example, is not just a trend in the US but globally. As noted in our recent report, Open Banking | Is the U.S. Ready?, 92% of global banks surveyed by Finastra in 2020 were looking to leverage APIs to enable open banking capabilities in the next 12 months, up from just 69% in 2019. That tracks pretty well with the 87% of national banks in the Celent and Arizent survey that said API platforms are set to have a critical impact on disruption, but community institutions are far behind on this thinking, with just 63% saying the same. This suggests that US community institutions are not only trailing larger US banks in their perspectives but also the rest of the world.

Keeping up is about more than just a change of perception, though. It’s also about strategy — and planning. Here’s where there may be an opportunity to close the gap. While larger institutions are better at anticipating the impact certain technologies will have, they are still largely in the process of incorporating them into their operations. As American Banker points out, while 83% of surveyed banks assert that cloud is critically or very important, just 44% say they have implemented a cloud migration strategy. That means that there is a window for community institutions to adjust their thinking, make a real effort to understand these technologies and how they’re impacting the industry, and develop a strategy for how to make the most use of them. The window is small, and it needs to be taken advantage of before many of these technologies become table stakes, but it is there nonetheless. Those that are wise will climb on through.