Contactless Payments Hit Their Stride

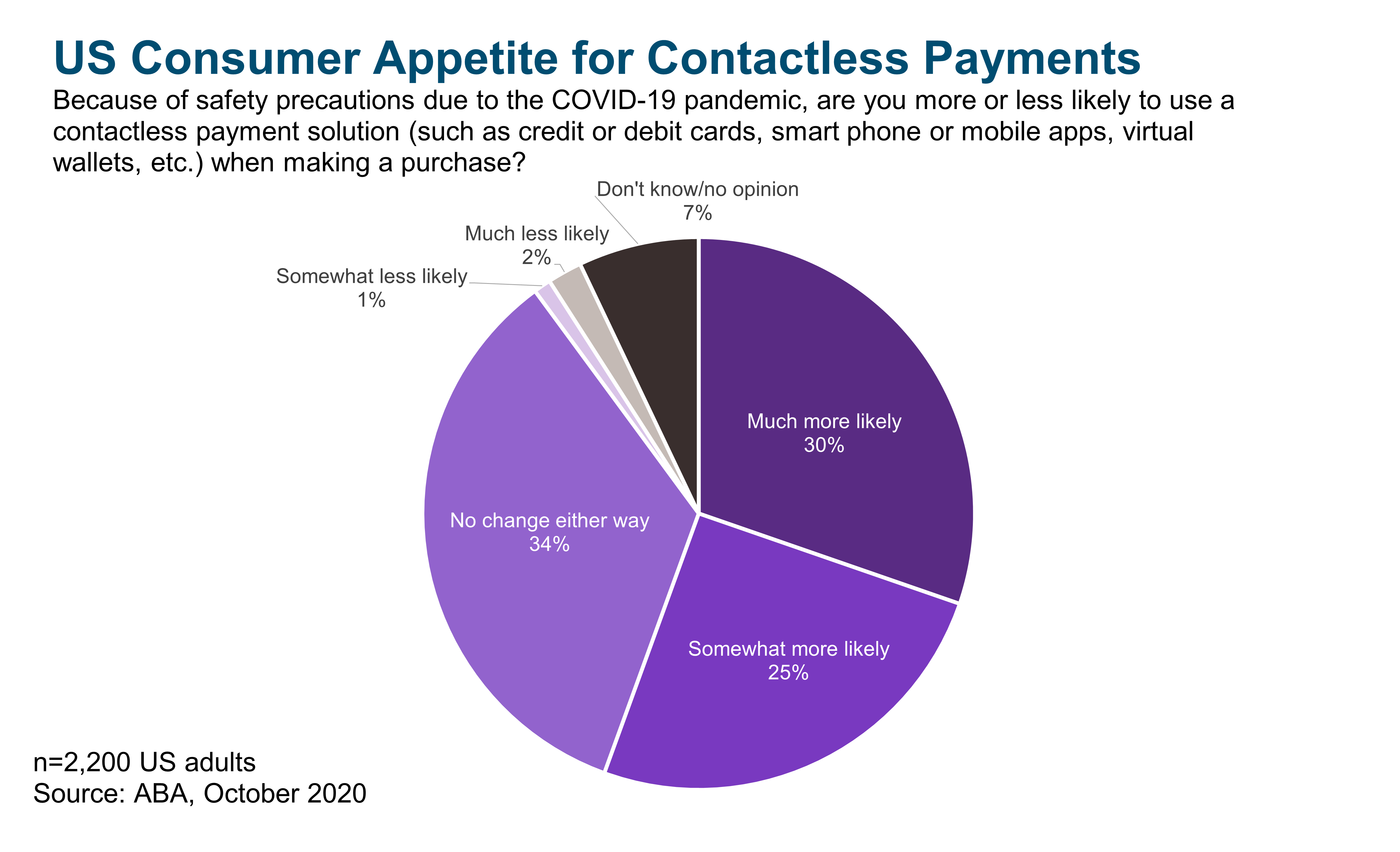

Contactless payments are finally here — for real, this time. Despite a sluggish start in the US, both when it comes to consumer adoption and the rollout of the technology, the trend toward contactless seen in much of the rest of the world seems to be taking hold against the backdrop of the Covid-19 pandemic. More than half of US adults surveyed by the American Bankers Association (ABA) in the fall of 2020 said they were either much more likely or somewhat more likely to use a contactless payment solution (such as credit or debit cards, smart phone or mobile apps, virtual wallets, etc.) when making a purchase as a result of recent safety precautions. Contactless payments, generally enabled by either a contactless card or mobile wallet, allow consumers to tap to pay at merchants rather than inserting their card.

As consumers further embrace contactless payments, there’s an opportunity for banks to improve their stickiness and engagement by making sure to offer the option. While many credit and debit cards can now be added to mobile wallets like Apple Pay and Google Pay, being able to tap your card in-store relies on banks issuing contactless-enabled cards. Big banks like Chase and Bank of America did a good job of embracing this trend pre-pandemic, but many are still in the middle of these rollouts. And smaller institutions are further behind. Those lagging here are not only missing an opportunity to meet evolving customer expectations, but they are also increasing the likelihood that customers will turn to other cards first, hurting their wallet position.

For those that do offer contactless, customer communication is key. The tell-tale sign of a contactless card is a small Wi-Fi symbol on the side, an easily missed marker. Some banks today offer marketing materials and content encouraging their customers to use contactless payments and letting them know the feature is supported. This can help reduce the risk that consumers will use other contactless cards without realizing they have another option, perhaps from their primary provider. Moreover, for those customers that have yet to embrace contactless, this could be a good way to increase loyalty to the brand. If you’re the one to get them on a bandwagon they probably would end up on anyway, you’ll probably reap the most rewards.

There is a slew of new capabilities out there today, and it can be hard to decide what to prioritize and where to focus your efforts. Contactless payments is an area where you can almost surely expect to play in the future. Even before the pandemic, Juniper Research expected more than half of global transactions and one-third of US transactions to be contactless by 2022. So, if not now, when?