Meet Romy Pazick. CEO of Vault, a leader in the student loan benefits technology space. The student loan crisis is real and one that impacts the economy as a whole. As someone who graduated with a tremendous amount of student loans, I can speak firsthand to the anxiety this debt has on students entering the job market. I had many sleepless nights thinking about how my debt would impact my future- my career choice, the city I lived in, my future family, etc. The crisis is real and one that employers need to start thinking about now as they begin to hire the next generation of talent who is looking for a company that cares about them as a person. One chooses a role for much more than a salary and one stays at an organization if they believe that their employer is invested in them as a person. Hiring and retaining talent is expensive and as such now more than ever, employers need to be thinking about how they are setting up their team for success. Watch my interview with Romy below and you can read my further thoughts on the subject in my latest Forbes article.

#TechTuesday Highlight #83: Romy Parzick, CEO, Vault

[powerpress]

How/why did you get into your space?

I believe in building financial services and financial technology as a force for good. The fintech space allows me to leverage my business and technical expertise in interesting and challenging ways that have direct and meaningful social impact.

Specifically, when it comes to the student loan crisis, the private sector can play a transformative role in providing student loan assistance, while also attracting and retaining top talent.

What role do you play in the tech ecosystem and why is that role important?

I am passionate about driving change, solving complex problems, and leveraging talent for high-impact results. I am a champion for change, continuous improvement, and inclusion. Women and people of color are underrepresented in Fintech leadership ranks, and as a Latina CEO, it’s important to me to be an example of what is possible.

How has technology impacted your industry and why is this important?

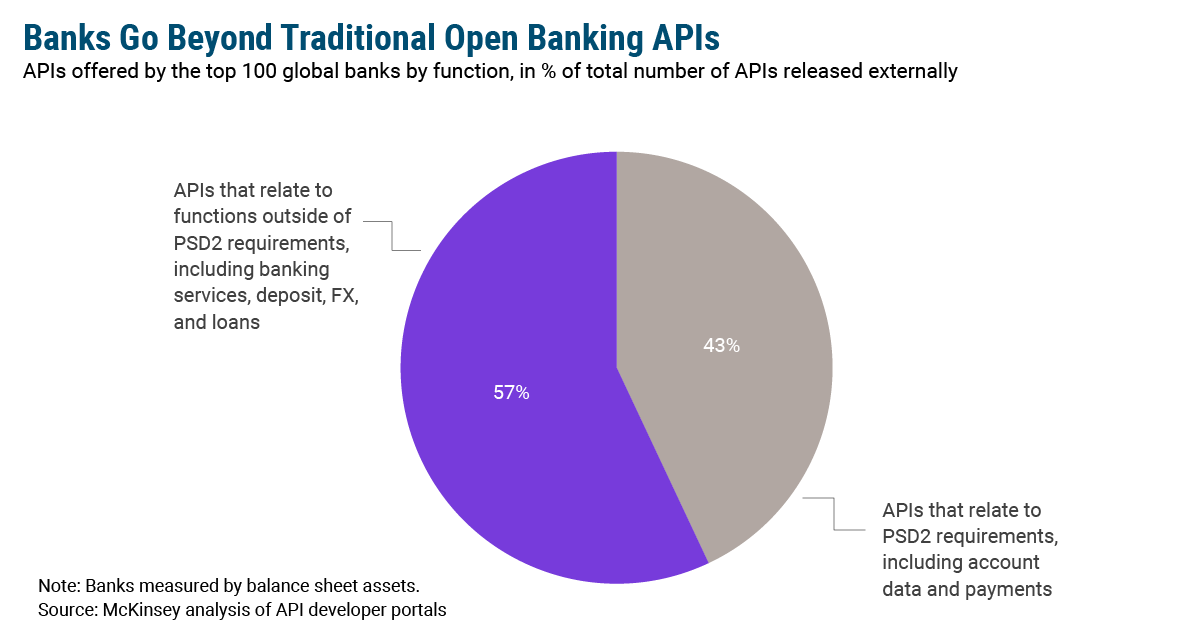

The proliferation and democratization of money movement technologies, payment platforms, and APIs provide even small companies with the tools they need to create user-friendly and accessible experiences.

What do you believe is the most exciting tech trend for 2021 (as it relates to your industry)?

From our perspective, so far the most exciting news of 2021 is policy news. The most recent coronavirus relief bill has extended the ability for employers to make payroll tax-free student loan contributions of up to $5,250 per employee through December 31, 2025. This five year extension via the stimulus bill is an indication to many experts that this provision will become permanent.

According to the 2019 Society for Human Resource Management Employee Benefits report, 56% of employers offer tuition assistance, but only 8% offer student loan assistance. With the new student loan employer contribution tax treatment extended for the next five years, and likely to be made permanent, we expect to see many more companies adding student loan benefits like those provided by Vault.co to their benefits stack.

Who is a person that inspires you in the space and why?

I like Dan Schulman’s vision for how to support the financial health of members of the PayPal ecosystem, including his own employees. “This idea that making a profit and having a purpose as a company are at odds with each other is fundamentally wrong. I actually think if you don’t have a purpose as a company, you don’t see your workers as your most valuable asset and you minimize your profitability.”

What advice would you give to someone who wants to get into your space?

Be intentional about getting experience and exposure to all aspects of financial services. Operations, sales, product management, compliance, etc. The fintech landscape changes quickly, and the most flexible and successful employees understand how any change can impact all aspects of the business and product.

Anything else we should know about you or you want to include?

Since 2015, I have been a fellow with the Aspen Institute First Movers Fellowship Program, the global network and professional development program for corporate social intrapreneurs. I’ve tapped into the knowledge and expertise of the First Movers network to help me align business objectives with improving Americans’ financial wellness, with a particular focus on the challenges faced by women and minorities.

#businessunusual #studentloandebt #studentloans #hrbenefits #socialimpact #financialwellness #financialhealth #caresact #firstmovers

——————–

Have thoughts on this week’s trends or questions for me or Romy? Post your thoughts in the comment section or share them on Twitter. Please include the hashtag #techtuesday and mention me @ScarlettSieber! Until next week. 🙂

You can connect with Romy on LinkedIn and Vault on LinkedIn and Twitter.