Overview

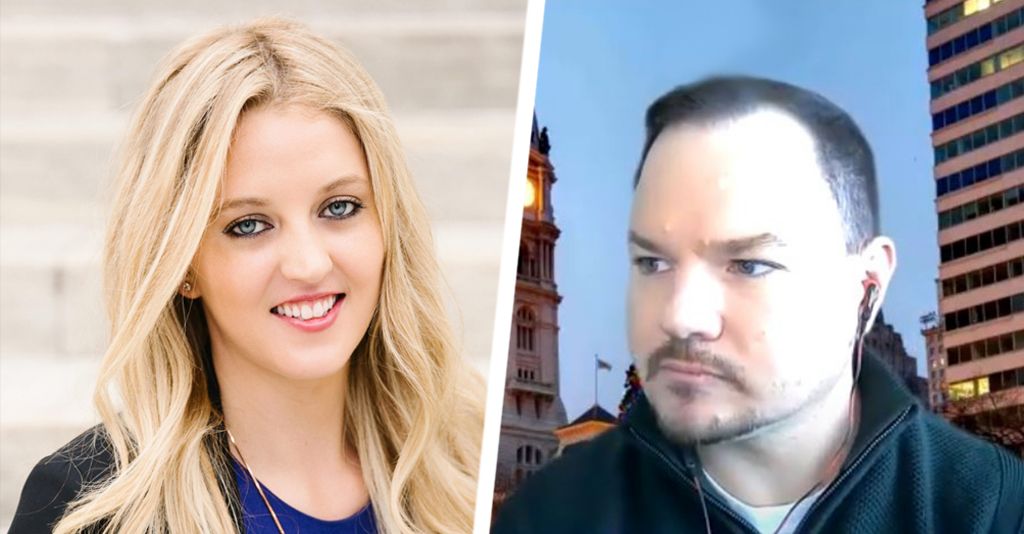

Keith Daly: Hello welcome happy December happy Holidays everyone. I got nice little festive Philadelphia behind me.Hopefully everybody is getting ready to move on to 2021 and put 2020 in the rearview. Happy to have Scarlet Sieber joining me today for a nice little pre-Christmas holiday chat, fireside chat welcome Scarlet.

Scarlett Sieber: Thanks Keith, I’m so happy to be here. We have had this conversation for a while now and I just feel like as December is coming people are winding down that year getting ready for next year. You can’t wind down the year without talking about talent and culture. So I’m excited that we are taking all of these conversations that we’ve had offline and bringing them on line because I think a lot of people are going to feel the same frustrations and opportunities that we see there. But before we get started. Let me just say really quickly who I am and obviously, Keith you are great counterpart in this and one of the reasons why you and I decided to do this is because you know, Travillian and CCG are looking at this from very similar but different lenses, which I think is really powerful, so I am the managing Director, Chief Strategy and Innovation Officer here at CCG Catalyst Consulting and we have clients that range financial services is the high-level bucket. We do a lot of great work with clients from quite small to quite large, but the real focus for us in our vision and future for the future is really around bank fintech fusion and talk about those things without talent and culture so and of course you play a big role with the talent piece right Keith?

Keith Daly: Oh yes, so here at Travillian we pride ourselves on finding that innovative talent so Travillian, it’s interesting because we work with banks that are more traditional but also very we have clients who are very innovative. So that brings me back to culture. Culture has been a hot topic over the past, especially six seven months. As we have this covid crisis and we’re moving more into, you know, working from home and the digital transformation. In your opinion, Scarlett, and we’ve talked about this before. What role does culture play really in that digital transformation?

Scarlett Sieber: It plays everything, it is the key foundation and backbone to this digital transformation component. So I was on a panel earlier this week and one of the this is really about kind of incumbent institutions traditional banks moving towards digital and one of the audience asked a question actually and they gave some information then asked question which was there was a study done by PwC recently that this digital transformation effort was, uh, it was the cost of 1.3 trillion dollars. And they said the 800 billion of that money was a waste, so they wanted to know our response to that, that thought and well, my first thing was truthfully, that’s not really. I think that’s a bit vague to say 100 billion is a waste, because why you liked what you are defining as a waste. There’s a lot of learnings that came out of that and a lot of R&D. But one thing that I will say that truly maybe there is a component of that is when we’re thinking we’re talking about digital transformation and digital In general, you continuously focus on the technology component of it. I’m looking at the legacy systems and all those aspects, but I having now done this myself many times. If you don’t have the culture, then that stuff, even if you do get the right technology, is just it’s next to impossible, and we’ve seen here a CCG where we’ll go in and we’ll have conversations. People reach out to me that hear me speaking about these topics and say, hey, we want to do it. You know, digital strategy assessment, or this, that, and the other, but we end up finding and not in every case. But certainly it’s happened is that you go in there and you see that while the vision you know may or may not be on the right path for the future, one of the things that you start seeing is that. the team, maybe there’s a really visionary CEO, but maybe other people are not necessary on board. That culture has not permeated, not even at the executive team level on we truly believe in this this focus on digital so we can sit here and talk all day about accelerating digital transformation. But if you don’t have that cultural component, we’re kind of dead in the water.

Keith Daly: Yeah, that brings me back. We we’ve gotten to know Patrick Sells at Quantic Bank and he was actually he just took a new a new position with hedge fund in New York but we got to know him very well over the last 6 seven months and he has a great great metaphor for what you were just described. He kind of says culture is the soil and technology are like the seats because he comes from Indiana so you can throw all these fancy seeds at the soil and all this new technology and all glitzy. But if you don’t have the culture to really innovate and use that you know use that technology. It’s just going to die on the Vine. So what you’re saying? I actually think the culture part is the hardest part for the banking industry right now. Not too. It hasn’t innovatived as quickly as other industries. You know, there’s a lot of more traditional banks out there. Great banks, community banks, but the shift is just happening so quickly right now and I don’t know if you feel it on your side, but we feel it on our side with the requests from clients. The webinars were doing the feedback we’re getting from consultants such as yourself at CCG, that it is rapidly. Covid just expedited this digital transformation by three to five years.

Scarlett Sieber: Yeah, I certainly know. I certainly agree with that and I think from the conversations that the I and we had had prior to covid, if you speak with these executive teams, which is typically the level that we come come in at. Digital transformation, whatever. It’s not usually always that word, but it’s that pretty much encompasses all these things that we’re talking about will be on their list of priorities, but it was usually towards the bottom of the list, and you know how things go. You don’t necessarily get to all of them, whereas you know Covid definitely accelerated that where it’s now top, you know 3, maybe max 5, so I’ve certainly seen that that component and it’s just culture is is really hard to get right the longer the institution has been around. In some cases, the more embedded that. that legacy or traditional culture is so to try to change that. It does not happen overnight and it’s something that takes a lot of effort and intention from the executive team and then all the way down.

Keith Daly: Yeah, now I couldn’t agree more. So how does talent, how does that component really fit into what you were just describing when you speak with your clients.

Scarlett Sieber: It’s everything, right so your culture is your people is the way that you do things. It’s a way that you operate especially for these institutions small and large. You may have that right vision, that right mission from the executive team even, but if you’re not articulating the why behind it and how it’s going to impact the individuals in your organization, you’re going to be met with a lot of resistance. And that that is, that’s a key component and it gets really, really tricky to do that, right because people are afraid. Now let’s talk about Covid. Even before Covid technology can be very intimidating and they may think well, why am I going to be so open and forward and excited about this when this could take my job or my teams job. So it’s really about for me the talent component is about empowering your team to be successful. And really one of the things that we talk about and our CEO Paul talks about all the time is identifying what you as an institution, what makes you unique? What makes you special? And it’s not as well as oh, we’re customer relationship focused bank. I mean, I think a lot of people say that, but what is it really that makes you unique? Look for those key components in the team that you have. You use those foundational aspects of that that unique sauce and how do you operate? How do you work best together? What type of profiles of people you know makes sense for you? And that’s how you think about everything moving forward and those that people were going to be on board and supportive of this overall cultural shift, which is towards digital transformation.

Keith Daly: No, I couldn’t agree more. Again, it’s it’s at the forefront of everything and it can be tough. It can be daunting and the easiest thing to say, or from my opinion the worst thing you can say is this is how we’ve always done it and hear that a lot. And that’s to me that says that this makes me cringe because there are a lot of innovative banks out there. A ton of fintech is, you know, innovating. You have big tech creeping into the industry. Goldman Sachs, Marcus you know Google partnering with banks so every day they are looking to provide better services and technology and in that relationship. So the banks really have to innovate. Or I say this a lot there it’s going to be very similar to how retail was 15 20 years ago. How Amazon changed everything. That’s how I feel. You know digital banking and fintech relationships are are changing industry so quickly.

Scarlett Sieber: Yeah, I think you’re right and you hit on a few key components there. So I think one of the first ones is around so you mentioned Fintech, because we’re talking a lot about culture, we keep referring to the the the banks. But the same is true for Fintech. So one of the things that are seeing is that when you’re a young and I’m not talking, I’m talking about in terms of the life cycle of your company when you’re a young company, you’ve got a lot to focus on product market fit, you know, go to market strategy. All these other things that I my opinion is, sometimes they overlook that cultural component, which, by the way is equally if not more so crucial for them, because people are joining them at a much more of a risk. You know, because they’re just getting started, so you really have to buy into that vision. You really have to believe in this opportunity, but if that cultural component is not set like that’s where fintechs have the opportunity because they get to build this from the ground up. They don’t have this legacy behind them. They can start from scratch, but if they don’t do that on day one, maybe it doesn’t have to be day one, but it should be day one in my opinion. If they wait until too long, that’s when you see these companies have hyper growth and then they’re trying to figure out culture in their 200 people and they have got into some trouble and you see the press headlines but on the talents in case I just You are on the front lines you spend so much time with your clients talking about this so I would I would love to hear from from you because you have so many you know unique perspectives and thoughts on this. What are some of the biggest challenges right now that your your clients or you’re seeing as the industry from banks and community banks? Really in terms of talent? Where where is the the obstacle?

Keith Daly: Well beyond kind of the culture aspect, succession planning Scarlett is a huge issue right now for a lot of smaller community banks. Very traditional community banks. Lot of ’em. I don’t want to say all don’t have a real succession plan in place. Succession planning is not just an Excel spreadsheet saying you know Bob will be the CEO in five years. As you know it’s a process that you have to get this person ready to be CEO, but even even down to know other very niche rolls. If the person who’s running the AOM modeling or chief risk decides to leave or retire or wins, the lottery always feel like win the lottery and just walks out. Who is there? I mean, it’s a huge risk. Who is there to pick up the slack, but especially at the CEO level, because right now banks and boards have to decide is the CEO who took us from point A to point B over the last 5, 10 15 20 30 sometimes 40 years the right person in place to take us from 2021 to 2025 and beyond? Because that nothing against the CEO. He could have been great and you know building the relationships and getting that bank to where it is now. Now with this changing landscape and changing culture is that the right person. And that’s a tough discussion to have, especially a lot of these bank boards and CEOs are very close community knit. Are you going to be able to look in the mirror and say, wow, I’m just not you know, the person that take us to that next level or beyond what we’re doing right now, but you’re already seeing it, Scarlet we have, you know, S&P Global market intelligence. We get alerts on all the retiring’s and firings and hirings and just within the last, like four or five days I’ve seen an uptick in alerts, people retiring next year, and my colleagues and I have been talking about this a lot. I think Covid gave people that time and that perspective, to say look, I’m done. I don’t wanna deal with this. I want to spend more time with my family. I was going to ride this out for a few more years, but now with the uncertainty next year and everything that’s happened in 2020, I think you’re going to see a large amount of retirements at the C level within the next 6 to 12 months. And who is going to move in there after that? Who was that leader to come in and take that bank to the next level? Or is the bank just preparing itself for sale, which we really we don’t want that to happen. We love community banks. They’re you know they’re the lifeblood of the American small business economy. Some of these banks been around for 200 years. We don’t want them to just sell to a larger bank. I mean, I tell my clients all the time, my greatest fear is just 50 mega banks in 20 years, that’s that’s not good for anybody, so it’s going to be tough, though if you don’t have that leader or those leaders who are going to move into those seats for the next year to three years and a lot of banks just don’t have that.

Scarlett Sieber: Yeah, you said so many things that resonated with with me in the way that that I and we see at CCG think about things too. I certainly think that we’ve seen similar trends that you that you’ve mentioned and part of that too, is at an that that challenge of succession is not, you know, again, not just on the bank side. It’s on the fintech side, right? So that’s actually a very common thing in tech companies. The original founder that visionary to build it out get things going is the right person to a certain extent but then when they get to a certain level of scale or scope or whatever. It’s not uncommon for that person to be replaced, so that’s pretty that’s a much more you know, common practice on the on the Fintech side but it is a struggle on the banking side and thinking about that proactively as opposed to reactively is certainly is certainly important. And how are you identifying? What are you looking at? What are you thinking about when you want that next leader or that next group of leaders to take your attention to the next level? So that makes a lot a lot of sense. So from that you guys were thinking about taking to the next level. During your conversation with, you know with your clients or what you’ve been seeing in the industry. How are they thinking about attracting talent now? Is it easier or harder post covid and what type of talent are they looking for.

Keith Daly: Yeah it’s it’s tough. Community banking is you know it’s a tough industry to recruit, and from my personal background, you know when I was in college, I don’t remember community banks being on the top of the list of where my friends and I were looking. You know, as Wall Street or Silicon Valley or now it’s Fintechs, however, and we always say this to the candidates. If you have that entrepreneurial spirit, community banking, there’s so many opportunities to become a young, Innovator, C-Suite executive. I mean, we see people in their late 20s in the C-Suite in community banking. You know, early 40s for larger community banks, regional banks, which is literally impossible if you go to JP Morgan Chase or Bank of America and if you go to one of these innovative banks I’ve been speaking with and there’s going to be more coming down the road, you get to work on some really exciting stuff partnering with fintechs looking at data analytics. AI is coming quickly. It’s really a fun industry right now. When you think about it, there’s so much happening with these fintech relationships that it’s exciting. It’s not community banking as it used to be and nothing against that at all. But if you’re coming into this tech culture and you went to school for you know MIT or whatever, you can do some really interesting things at a community bank and be at a C level position very quickly. However, marketing that and in getting that to the candidates or too universities or business schools is tough, and they’re starting to make some headway now that there’s a digital banking school that just started up in Wisconsin. I I forget his name, but I think it’s Eric Cook, but I’ll go back and check that. But they’re starting to make headway and now with this post covid, there’s going to be a lot of opportunity for talent. But you also have to have that core banking talent too. It’s a tough industry to just come into from the outside and just hit the ground running day one. It’s not like going from one tech company to another tech company. You have to understand regulations clients how you work with auditors, how you work with the FDIC. It’s very tough, so having that core kind of banking background along with some of the tech knowledge is something that we pride ourselves here at Travillian on finding and locating. But it’s tough to find because it’s either one or the other. There’s not a lot of people, and you might be seeing this too that have both that or banking background understand it and also have that innovative kind of digital culture also in their background.

Scarlett Sieber: No, you’re 100% right and I smiled many times throughout that because I rarely give this stat up, but I will because it’s relevant to what you said. I I was a CIO of a public bank when I was in my 20s. So I’m in a perfect example of that, although I don’t necessarily share that often, but I think in this case it would make sense. Provides context what you’re talking about and the fact that you know before then I was I was at BBVA and they hired me with zero banking background. But what you said at the end is the really crucial part right? Which is having those type of leaders who see and are excited by people who think differently because it’s not, you know, we talk. We can talk about DNI, and that is something that’s obviously I shouldn’t say, obviously, but it’s definitely very important to me. But what I’m talking bout the thinking differently piece. That’s a whole that’s a whole other world, because if you have, if you’ve been in banking for a long time, you are an expert. You understand all of those areas, risk, compliance, legal, you know, you, you name it, but you’ve been surrounded by like we all as humans and the kind of copying what we see around us and in our little in our little silos. So if you’re bringing someone from outside the industry the way that they think about things is going to be very different. They are going to challenge you in new ways and you’re going to challenge them. So the key thing that I think that you were alluding to is really this idea of balance. Like you definitely need those those people, and it doesn’t have to be in the same person, but in the same leadership team, the people who are thinking differently who are challenging the status quo. The people who are, you know, innovators. Whatever the word is. I mean, it’s it’s a buzzword, but it’s it’s really trying to articulate people who you know, challenge things are always looking for something new and thinking differently, and then the people who are maybe, you know, the more risk averse and who are true true experts that they should balance each other out and so that is a that’s a really key key component there. For those institutions who, and like you said, there are a lot of opportunities at these smaller institutions and it’s a nice way to go in and not deal with some of the there’s always bureaucracy when we’re talking about corporate life, but not to the same level. And you actually have the ability to get things done. You mentioned you know a connection of of yours and with with Patrick Sells, right? Like he was able to accomplish things to become that digital banker of the year in American banker Because his leadership team empowered him to do so.

Keith Daly: That is funny, Patrick said, he came in from outside of banking completely, and he had to sit with Steve Schnall, the CEO basically at his desk for like a year to learn bank. Because it really is impossible to just come in and say, OK, let’s do this and grand plans and then you have the regulators Chief Risk Officer saying that we can’t do that. So you’re right, the balance is needed and that diversity of thought on the board and on the C in the C Suite is needed. You need that person who understands regulations and compliance backwards and forwards to kind of ground the innovator who has the big dreams. But you also need that to to challenge the compliance person on what they can do and how far they can go. And that’s where the culture comes in. And it’s not combative if it’s just opinions on reality versus pie in the Sky. So yeah, it’s it’s definitely that that I like to think of it as like a gray area of banking and innovation coming together for a similar mission. It can;t be like you said, two people on each other side trying to it just won’t work at all it has to be like one team.

Scarlett Sieber: Absolutely. By the way, one comment there you mentioned boards and I’m really happy that you did because I mentioned that earlier. So when we were talking about succession planning, we were focusing on, you know the C-Suite and other players at that level, the board oh my gosh, I would start to the board, the board level, some shake up there because that I mean the board, we all know this at you know, the most obvious level. The board plays a huge role, but I mean it really does as we know. This movement towards digital so if you have all board members who have been there for not necessary that position, but in the industry for 30 40 50 years you want those oh my God, you need some of those, but they should my opinion they shouldn’t be only those because now no one is challenging the status quo there.

Keith Daly: No, I completely agree. And if you go to the stats on boards, there’s a big issue there. Aging, but diversity of thought and background. If you go to the innovative banks and coastal community bank who we actually partnered with recently on a placement, if you go to their board, oh man, they have people from Silicon Valley. They have an investment banker on their completely diverse backgrounds and you could tell at these board meetings. It’s probably not just let’s sit down. Go to the numbers and then head to dinner. There’s probably an engaging conversation on where the bank should go and who they should partner with, and you can tell they’re partnering with Google and you know, they just have that diversity of thought, but there’s 5200 banks out there. How many board banks or bank boards have that type of diversity of thought and background? A lot of them are just local business people, which is fine. Like you said, you need balance. I think the keyword is balance coming out of this conversation. Because in banking regulations aren’t going to change. They might even get worse. Compliance is not going to change. They might even get harsher. There’s going to be more compliance on, you know cryptocurrency, bitcoins come down the road, you know it. So you need people who understand that backwards and frontwards. But you also need people challenging the status quo on how this business is in this bank can survive and thrive in the next five years.

Scarlett Siber: Absolutely, completely agree with you.

Keith Daly: And. What do you think you know, speaking with your clients, especially at the CEO level, the most crucial role of any organization? What what things should they be looking for? You know, executive talent, you know, focused on the digital side.

Scarlett Sieber: So it’s a good question. You know, it certainly applies to some conversations with our clients, but more even broadly across the industry. I think that you know we like to categorize our clients in a few buckets because it helps us to better serve them where they are and meet their needs where they are. So if you look at some of the more traditional players, even if they say we want to be first of all, we have to help them kind of baby step them too make sure that they know where they are on that journey, because I think maybe one or two people have this idea of who they are, but then once you actually kind of get down into the nitty gritty’s of the business and even the strategy, there may be a bit further along further behind than they expected or they want to be doing these great big things, but you actually go look at their client basements like, but your client base is growing and this isn’t they don’t give a crap about this stuff, so maybe you know really focus on where where you are the most. So so with that I would say the key things are if you are one of those more traditional players than you, and that is your culture back to what we were talking about earlier. You need to find talent that fits into that that wrapper right. If you are a progressor and maybe or maybe you’re somewhere in between, but you want to move to a progressor you need to have that talent who is thinking about things differently?

Business Continuity: Unlocking Digital Commercial Banking Capabilities

Financial Brand Article: Over the COVID Horizon, Mobile Banking Demands Strategic Clarity

Digital Dreams – Expanding Commercial Banking Capabilities

The Digital Ultimatum – A Catalyst for Change

Financial Brand Article: Is It Finally Time for Open Banking’s Debut in America?

Scarlett Sieber

Managing Director, Chief Strategy & Innovation

CCG Catalyst Consulting Group

Chief Strategy & Innovation Officer Scarlett Sieber is one of the world’s premier voices in financial services. She is among the industry’s most sought-after speakers as a thought leader and innovator with expertise in driving organizational change at both startups and enterprises across the financial services and fintech ecosystem. Scarlett has been invited to speak at over 100 prestigious financial services and technology conferences globally, including Money20/20, Finovate, South Summit, and NASA’s Cross Industry Innovation Summit.

Scarlett’s experience includes founding her own startup as well as working at banks such as BBVA, USAA, and Opus Bank. She is a leading fintech influencer, included on lists such as Top 100 Women in Fintech 2019 and Top 10 Fintech Influencers in the U.S. Scarlett also has deep experience in digital strategy and innovation implementation, making her a key asset to building cutting-edge programs for our clients.

Keith Daly

Search Director

The Travillian Group