Strategic IT Roadmap by CCG Catalyst Consulting Group – View as JPG

The steady advance of digital banking, pushed by consumers’ rapid adoption of new technologies, has forced banks of all sizes to adapt. This means new marketing strategies, new sales strategies, and a new IT strategy.

Unfortunately for many institutions, an IT strategy consists of merely keeping the lights on. When (or if) new features are introduced, they are bolted onto the existing structure, resulting in disparate data streams, competition for customers between departments, and a siloed experience for customers. Without a budget and a plan to utilize it, banks will find it nearly impossible to create innovative products, and even being a fast follower of the leaders in the space will prove difficult.

Partering with fintechs may allow FIs to launch products more quickly and cost-effectively, but working with small agile companies brings challenges of its own. Which group in the bank will work with the startup? How will the startup’s technology be integrated, particularly when most banks are reliant upon their core vendor to add new features?

The persistence of legacy cores has complicated things for traditional banks wishing to compete with digital upstarts and the larger banks with deep IT pockets. But there is also a growing market of middleware products that can deliver superior digital experiences and, through APIs, allow third-party products and services to be offered. There are many choices for banks to make in the race to produce the kinds of products that will delight their customers, but it is impossible to pursue all the opportunities available.

Pursuing these opportunities sometimes exposes neglected areas. Is there a technology lifecycle? The industry is very product and “digital”-focused right now. Is the infrastructure of an elastic nature to support new offerings without significant capital expense? Is the infrastructure prepared to provide the 24×7 availability that the digital consumer expects? Are the IT department’s policies and processes hardened enough for change? Change management, risk management, real-time monitoring, and many other processes are paramount.

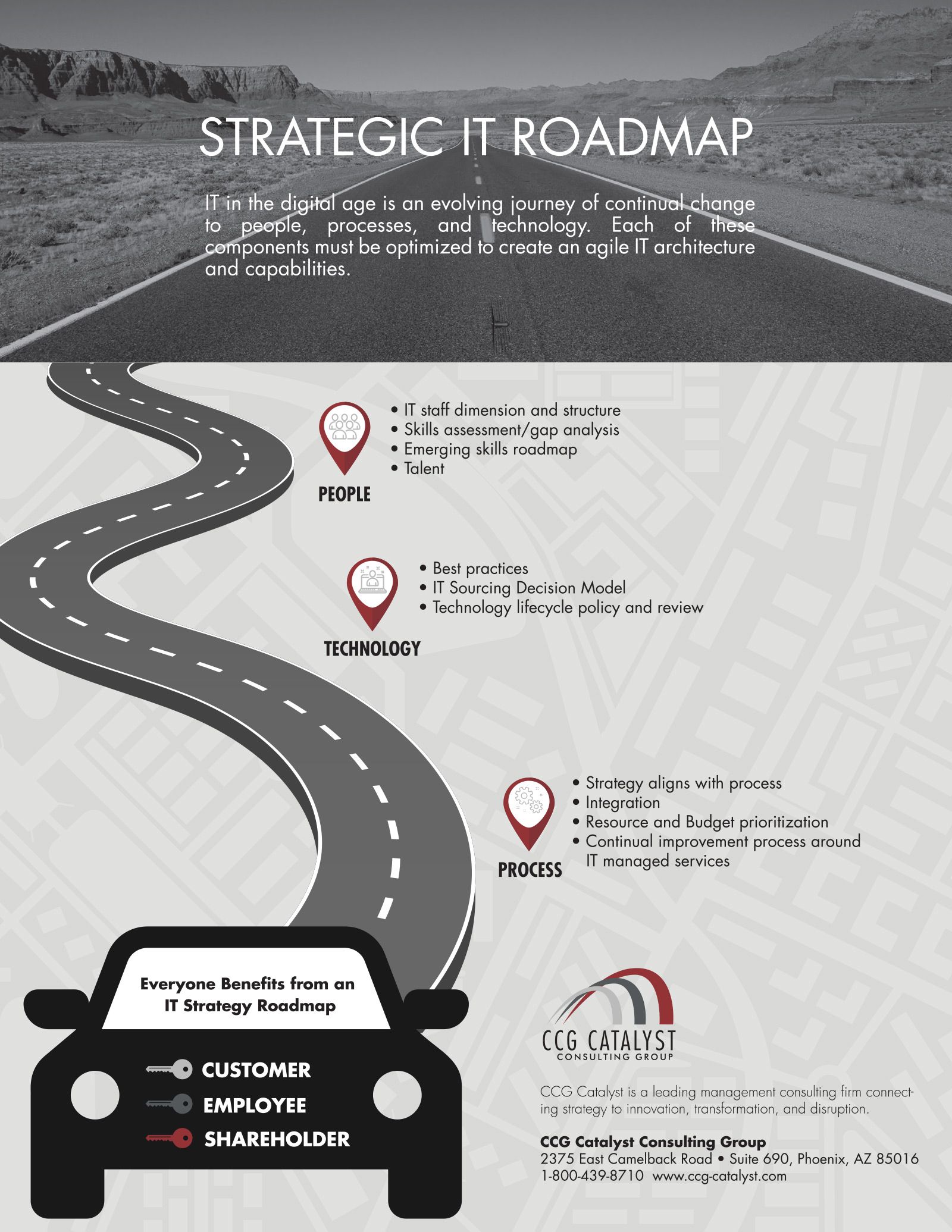

A roadmap is needed that follows the bank’s strategy. Which segments are currently underserved? Which new customers are you pursuing? What experiences do you need to deliver? Answering these questions will help determine which path is best to follow.

A well thought-out roadmap will guide your organization for years to come. It will take into account the resources, including personnel, at hand and the resources still required to achieve your goals. Do you need to create a strategic IT roadmap?