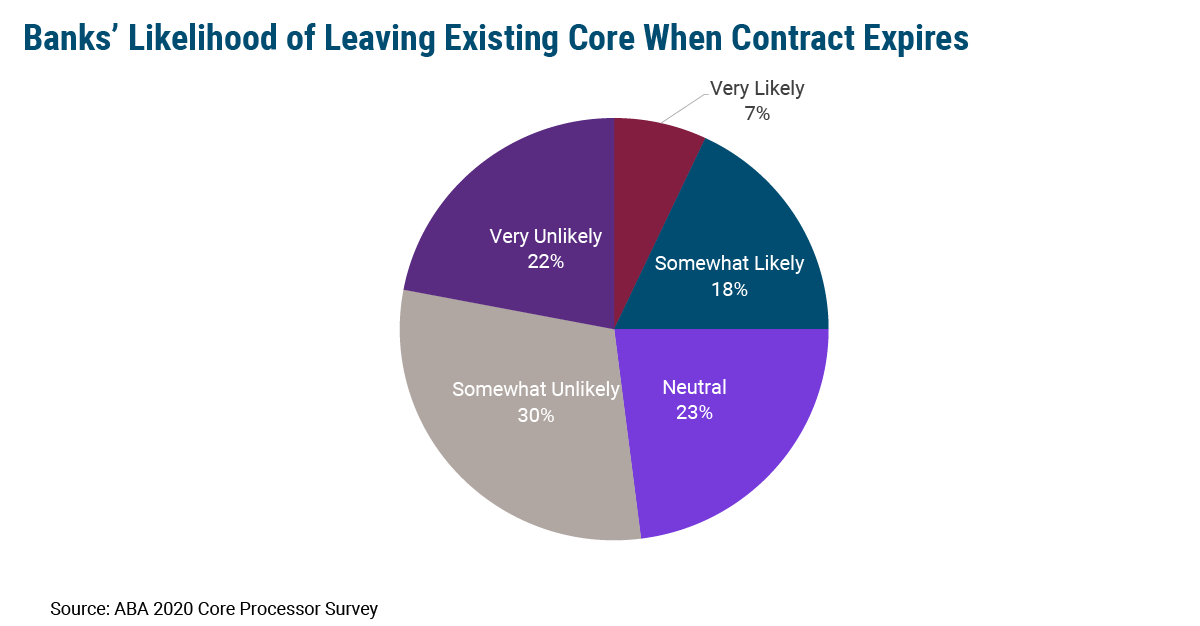

A quarter of banks surveyed by the American Bankers Association (ABA) in September 2020 are likely to leave their existing core provider when their contract expires. That is probably a testament to the increased focus across the industry on cloud-based, application programming interface (API)-based systems, which traditional core providers are lagging behind on getting to market. Competition is also heating up as foreign providers like Temenos and TCS and newer platforms like Finxact and Neocova enter the space with the modern, next-gen systems that banks are looking for.

Top of mind for execs today appears to be freedom — the ability to customize and integration with other technology/APIs were ranked as the top two challenges these banks face with their current provider relationship. These institutions know that they are moving quickly to an environment where working and integrating with third parties will be key to success — nearly half of global financial institutions (FIs) surveyed by PwC say they have fully embedded fintech into their strategic operating model, and only 4% have no strategy for fintech at all. Those banks that don’t have the infrastructure to support integration will struggle to keep pace. To be fair, the leading providers in the US, including FIS, Fiserv, and Jack Henry & Associates, have API strategies by this point. The issue is that their offerings are still taking shape and access to these services is not democratized across all clients.

An expiring contract means an opportunity to revisit how well your core provider is handling your needs, and potentially look for a new provider. But it’s also an opportunity to think about what future capabilities need to be baked into your contract to begin with, even if a bank decides to stay with their current vendor. Providers can charge large sums for API access, often per call, as well as maintenance fees. Banks that are proactive at securing favorable terms on these next-gen capabilities during contract negotiations are likely to benefit handsomely in the long run. Regardless of whether or not you plan to jump ship, thinking through what capabilities you are going to need down the line can help secure a better deal and futureproof your business. This will require a real strategic approach at the point of negotiation; with many of these contracts lasting years, it should be viewed as a time to ensure that not only is your bank getting access to the innovations necessary to succeed, but also securing that access in a way that makes sense.