Are Consumers Really Fleeing Smaller Banks?

April 27, 2023

By: Kate Drew

Banks and Deposits

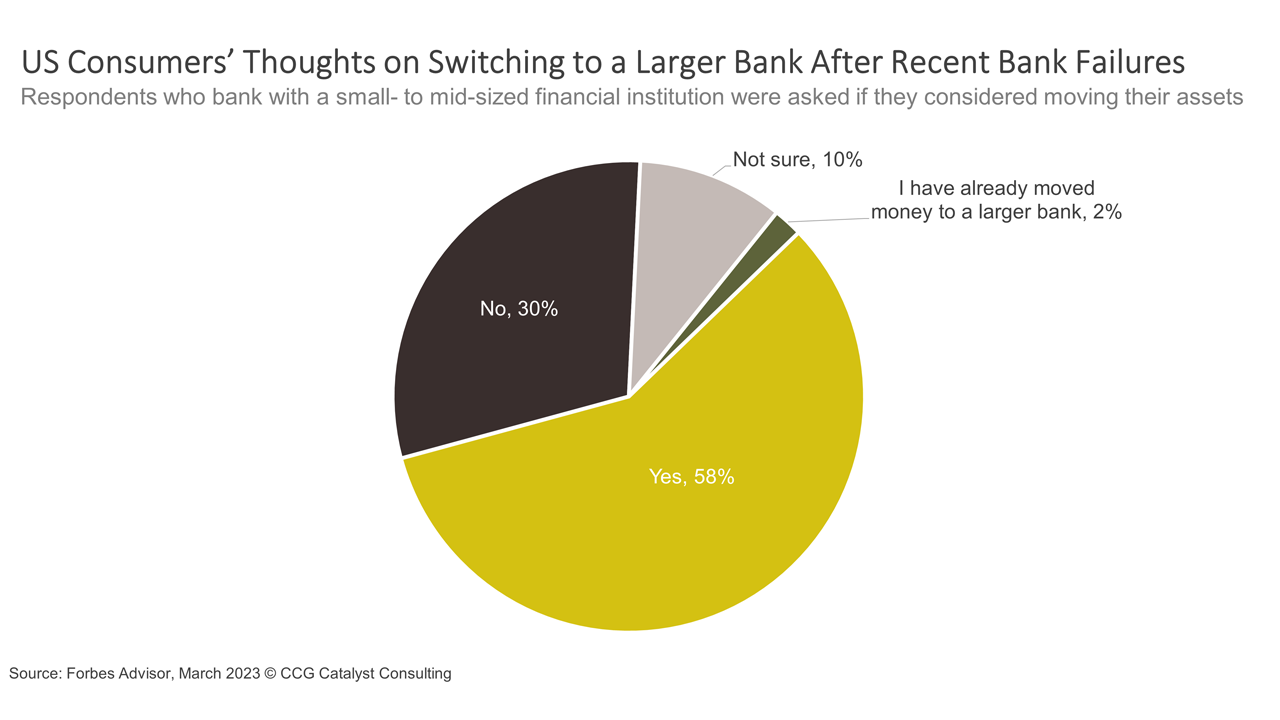

Deposits are in the spotlight these days, there’s no two ways about it. And a major part of the conversation is the potential fleeing of customers (and their deposits) from smaller institutions to larger banks. The latter certainly got a boost from the recent chaos surrounding SVB, and there is data to prove it. However, characterizing the overall risk to the country’s Main Street banks this way may be a mistake — or at least, it may not be quite as materialized a risk as the discourse might suggest. In fact, according to a recent survey by Forbes Advisor (the same one we covered last week), while 58% of respondents who bank with a small- to mid-sized institution said they considered moving their assets to a larger provider, only 2% had actually done so.

This data suggests that the shift to large banks following the fallout of SVB, while apparent and reasonable to worry about, may not be quite so widespread. This creates an opportunity for community institutions to proactively reassure customers and keep them from jumping ship. As we discussed in our prior snapshot, a good way to go about this is by doubling down on the bank’s reputation and history, which is an advantage that many community banks have. Additionally, switching banks is hard, and consumers don’t like to do it, especially when there are relationships involved. So tapping into that reluctance with the right messaging could go a long way in holding on to business. This could include not only working to communicate stability and prudence but also providing educational content that makes people feel like they are better positioned to make decisions by building confidence and understanding.

Another thing to remember is that this isn’t just about large banks. With deposits under pressure even before the recent bank runs, there are other dynamics at play. As a result, smaller institutions need to be thinking about how to stave off competition from all angles — including each other. And that is where your reputation and history become less relevant, because these are attributes that your peers will share. As a result, finding a niche in which you can excel should also be part of this conversation. Communities aren’t bound by only geography anymore. They grow out of other commonalities, and those commonalities represent opportunities to develop unique capabilities that can turn an institution into a go-to provider for a certain gap. Banks that have achieved recognition in Banking-as-a-Service (BaaS) are a good example of this.

Overall, it’s likely that deposits are going to remain top of mind for many banks in the near term, even as we see potential signs of stabilization. And that is completely understandable. But, in order to find the right strategy to overcome those relevant fears, you’ve first got to identify the right threat(s). This isn’t a Wall Street versus Main Street story. Or, rather, it’s not just a Wall Street versus Main Street story. This is a much bigger story about competition that started long before March of this year. As such, developing a path forward will require first grappling with the dynamics of that and how they apply to your bank. Hint: It will be different for everyone.