Are Neobanks Headed for a Reckoning?

July 7, 2022

Neobanks and Profitability

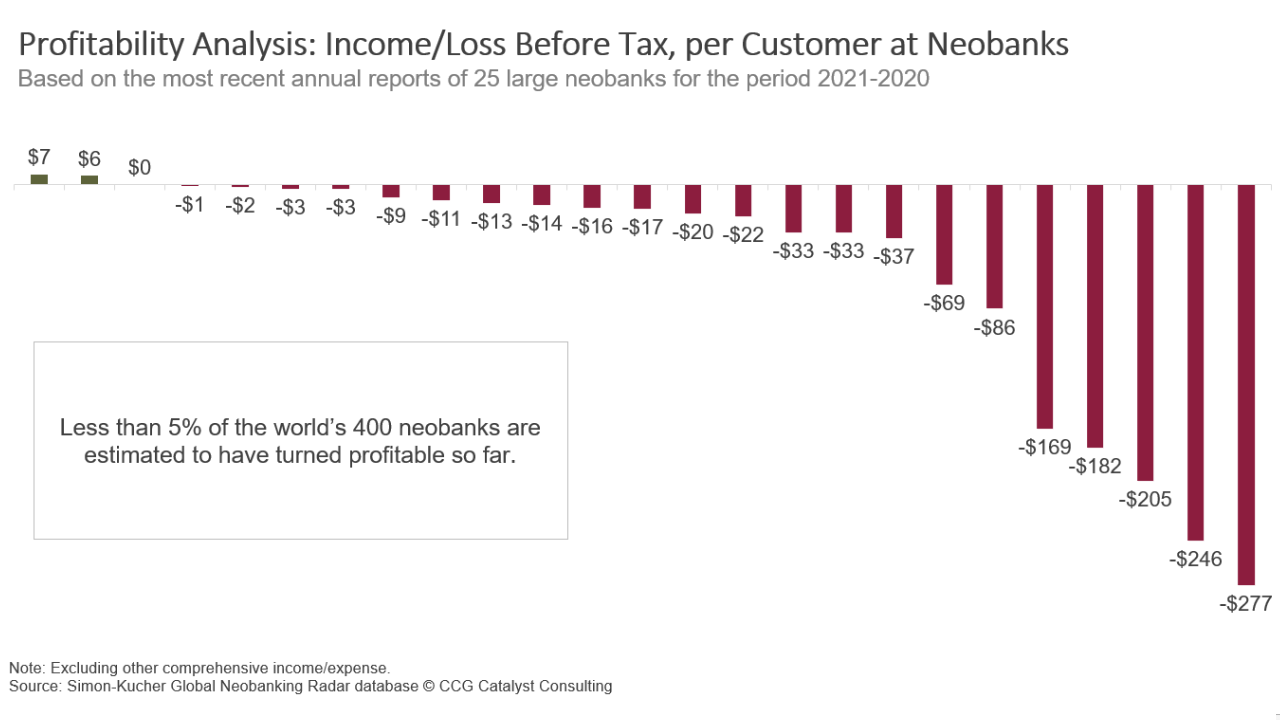

Neobanks have a profitability problem. This isn’t a secret. But new data from Simon-Kucher reveals just how prevalent that problem is — in fact, according to a profitability analysis by the firm, only two neobanks out of 25 reviewed are showing signs of profitability. Moreover, Simon-Kucher extrapolated these results to estimate that less than 5% of neobanks globally are currently profitable. This is an extremely worrisome dataset for the fintech industry, but it’s also one that is important for traditional institutions, especially in the US where nearly every neobank is backed by a chartered bank in a Banking-as-a-Service (BaaS) arrangement.

BaaS — by which a regulated bank provides its charter to a nonregulated brand, enabling the latter to offer financial services to their customers — is an extremely hot topic in banking today. Bank executives are talking about how to leverage the opportunities it presents constantly, and new BaaS banks have been launching at a rapid pace. However, the success of a BaaS bank depends heavily on the success of its fintech partners, which means that, their profitability problem isn’t theirs alone. BaaS banks have made tremendous investments in their infrastructure and operations to support these initiatives, and this data suggests that meaningful gains on those outlays will rely greatly on their ability to pick the right horses. Unfortunately, it seems that very few horses in the race are running all that well, begging the question, “How many BaaS banks will actually see returns from these investments?”

Ultimately, we are likely headed for a reckoning. That’s for a couple of reasons beyond profitability that have a lot to do with timing. According to Simon-Kucher, while few neobanks are profitable, many seem to be getting closer to at least breaking even. This suggests progress is being made as these organizations iron out the kinks in their business models and begin to operate more efficiently. The issue is they may be running out of time to do so. These companies subsist largely on private capital, and investors are tightening their purse strings amid recent economic uncertainty. Moreover, the private markets are putting much more emphasis on cash flow today than they have in the last few years when money was flowing quite freely. As a result of these shifts, there are likely many, many startups out there that raised capital and secured bank partners when everything was flying high that will simply not survive. Remember, the fintech industry at large has not yet seen a real downturn, and we are not exactly sure what it will look like when it does. That means, for banks, it’s more important than ever to look for the right things in your partners. What does their business model look like? How do they plan to reach profitability? And, most importantly, when? These questions have always been relevant, but they are absolutely critical now. BaaS is still a land of opportunity, but we’re going to have to get a little sharper on our bets.