BaaS Banks Outperform Regionals in Deposit Fight

May 18, 2023

By: Kate Drew

BaaS Banks and Deposits

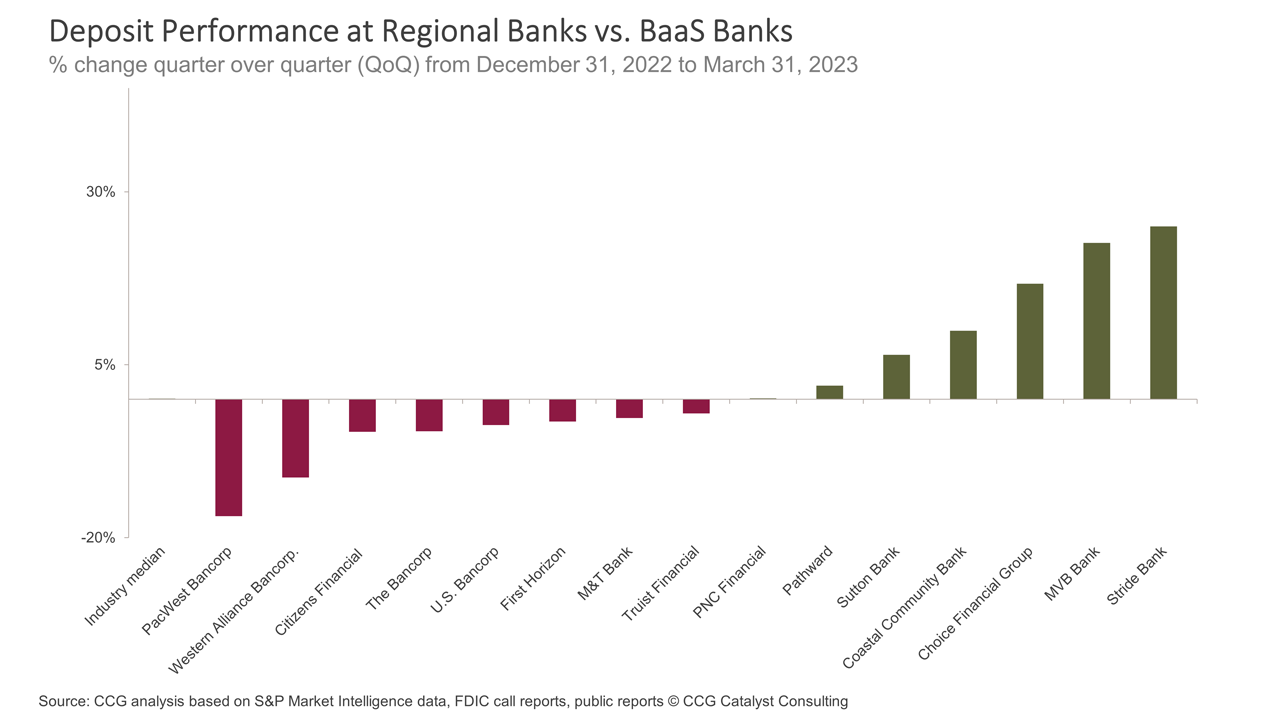

CCG Catalyst recently analyzed deposit performance at BaaS banks compared with regional banks across 15 financial institutions in the first calendar quarter of this year. As expected, regional banks largely posted declines, but nearly all of the BaaS banks we looked at showed deposit growth over that timeframe. This is likely in part due to the success of fintech providers like Mercury and Brex that were able to rake in high volumes of deposits in the wake of the recent bank failures. Those companies are backed by BaaS banks, which ultimately hold the deposits they bring in.

For example, Choice Financial Group, one of the sponsor banks behind banking for startups fintech Mercury, saw deposit growth of nearly 17% from December 31, 2022 through the end of March 2023. That’s likely tied to Mercury’s success in picking up a large chunk of SVB clients by quickly offering a new product, dubbed Vault, which provides up to $5 million in Federal Deposit Insurance Corporation (FDIC) insurance by spreading deposits across a network of banks. This is not a unique story — fintech providers gained a lot of attention in March (and since then) for their ability to move quickly to step in and fill the void left by the collapse of SVB. And the banks working with those fintechs are ultimately benefitting from their innovative nature.

That’s really the point of BaaS, isn’t it? It’s a strategy that allows you to diversify your business and benefit from the creativity fintechs employ when it comes to customer acquisition and customer experience. In that way, it is effectively a hedge against the whims and risks of the traditional market. Fintechs overwhelmingly did well here because they offer streamlined onboarding and can move with speed to introduce products and services that fit a specific need as it emerges. (Note: Fintech providers with their own charters also saw success — SoFi and Varo Bank, for instance, posted quarterly deposit gains of 37% and 43%, respectively, in Q1.) By working with these fintechs through BaaS arrangements, BaaS banks had multiple channels to rely on to bring in deposits as many others were starting to hemorrhage.

This data is a breath of fresh air for BaaS. Last year brought a ton of pressure to the market, from regulatory scrutiny to a tough private capital environment that made finding sustainable fintech clients harder. And those dynamics aren’t going away anytime soon. However, this recent activity feels like a much-needed win for the space and should serve as a reminder of why this model was so interesting to begin with. At the end of the day, BaaS provides traditional banks with a way to tap into innovation and respond quickly to market changes through many different pathways at once. Instead of trying to figure out exactly where we are going, BaaS banks focus on picking the horses who are likely to get there first — wherever that is. This, then, becomes their core competency. The last few months proved that, if done well, such a strategy is not only still viable but also extremely promising in helping banks to future-proof their businesses.