Banks Miss Out on Best of Breed

March 10, 2022

Banks and Technology Decisions

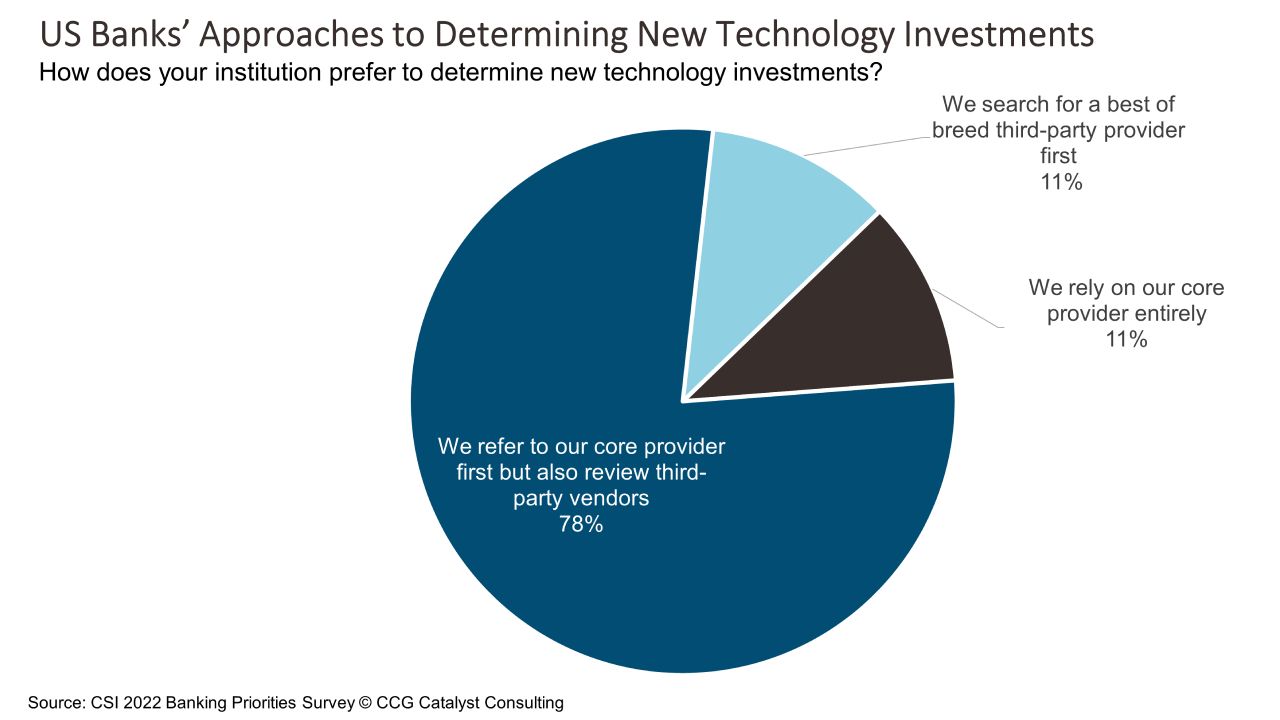

US banks remain heavily reliant on their core provider when making technology investments, according to CSI’s 2022 Banking Priorities Survey. Specifically, a whopping 89% of banks either rely entirely on their core provider or refer to their core provider first when making decisions about new technology. Only 11% said they search for a best of breed provider first. This data is extremely disappointing because it speaks to a lack of drive to truly differentiate at a time when fintech startups and other progressive banking providers are insisting on it. It also flies in the face of banks’ claims that they’re committed to leveraging new and innovative solutions to achieve that differentiation. Put another way, we’re not putting our money where our mouth is.

Banks in the US have long relied on a handful of vendors for all of their technology needs. That’s led to a real commoditization of banking services, with very little in the way of differentiation from a product or technology standpoint. More recently, neobanks like Chime and Varo have moved to change that by focusing more on the customer experience and using technology (often built in-house) to deliver delightfully tailored services. For traditional institutions, this is raising the bar. And they seem to realize it. The problem is the only way to meet fintechs where they are is to stop using the same stuff everyone else is. And the only way to do that is to pursue a best of breed strategy, by which a bank compiles a portfolio of market-leading technology solutions to run its business. Unfortunately, it seems as though very few are actually doing this.

The lack of action here likely comes down to a couple of things. First, the idea of evaluating a set of new vendors for every new technology project is probably daunting for many institutions, especially if you’ve been relying on a few providers for a long time. And second, many banks are still operating on legacy technology that can be very difficult for third parties to integrate with. Luckily, though, neither of these are issues that cannot be throttled. The former is really about mindset; executives need to reframe the way they think about technology. It’s not about getting a solution in place; it’s about getting the right solution in place and what it can do for your business. The latter, meanwhile, is about finding ways to overcome tech debt, of which there are many today if you’re willing to put in the work. Some banks, for example, are implementing application programming interface (API)-based integration layers that help to abstract complexity from their core systems and ease the process.

The truth is the reluctance here, no matter how you look at it, is likely about effort. It takes work to evaluate vendors you’ve never heard of. It takes work to get your infrastructure to a point where it can support a plug-and-play strategy. But doesn’t hard work usually pay dividends? Isn’t it usually all worth it in the end? It’s time to stop making excuses. Let’s fully commit to competing on differentiated experiences. Then, we can start creating propositions designed to win.