Banks Prioritize Digital Over Core

August 11, 2022

By: Kate Drew

Banks and Core System Upgrades

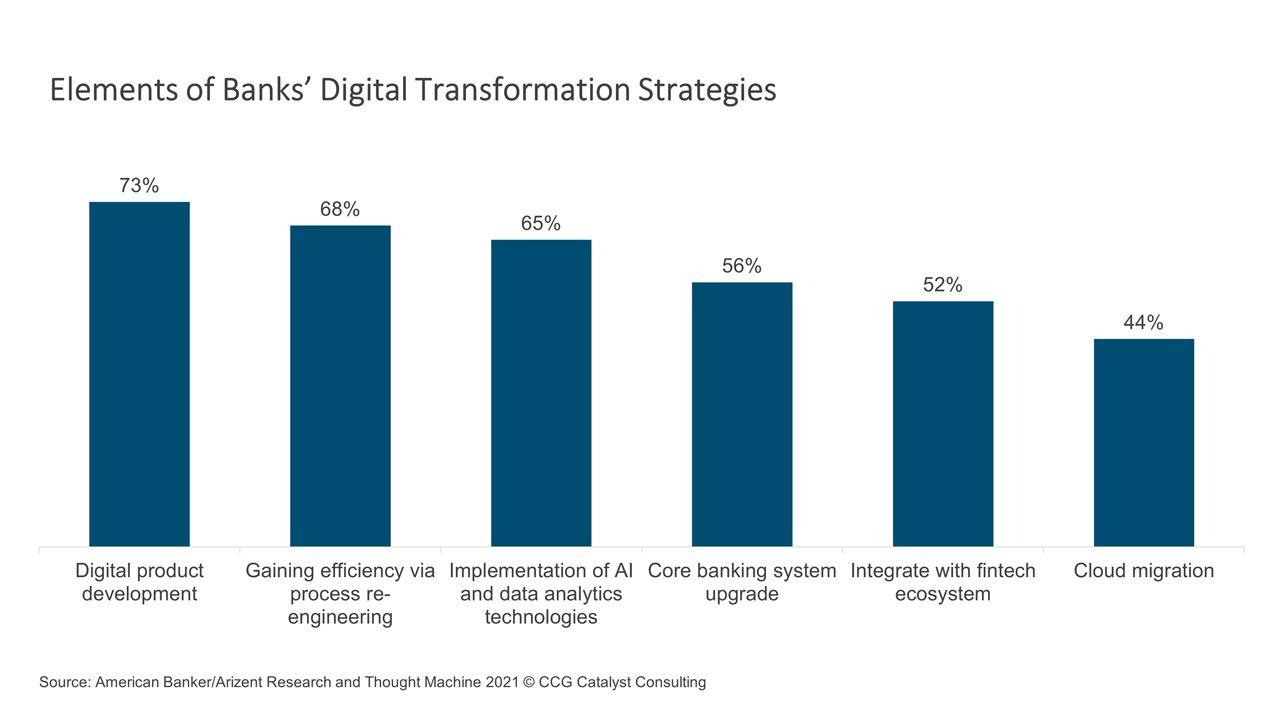

Bank executives are putting more emphasis on front-end product development than core infrastructure upgrades in pursuing digital transformation, according to a 2021 report from American Banker/Arizent Research and Thought Machine. In fact, per the study, 73% of bank respondents surveyed said their digital transformation efforts included digital product development, while only 56% reported incorporating upgrading their core banking system. This gap terribly problematic — as the study points out, core banking system modernization, along with other infrastructure-based initiatives like cloud migration, is critical to achieving the long-term objectives of transformation programs, which means building new things on the customer experience side without modernizing what’s underneath isn’t wise.

The reason for this is flexibility. If you are modernizing your customer-facing solutions, either through a mobile app or online banking or other offerings, you should be doing so in a way that makes further innovation easy and fast. That can only come from modernizing your core system and getting the bank’s underlying infrastructure to a point where it can support anything you’d like to do. Say, for example, a bank upgrades its digital banking platform, implements a new digital account opening solution, and successfully creates a multichannel experience for customers end to end. It takes a ton of effort to get everything working well together, but it’s done. Everything turns out great. But now, there’s a new element you want to add. Maybe it’s a new product like crypto or an additional feature like personal financial management (PFM). Can you do it easily? Unless you are operating on a modern platform that is modular in nature and can support changes at the product level without changes to the core, probably not. This is a very basic example, and there are tons of scenarios that are applicable here; the point is that organizations not currently building on top of a flexible environment are going to have a hard time keeping up with the pace of change in the industry overall.

It’s not surprising that bank executives are focused more on customer experience than infrastructure. Digital product development is the more obvious need to keep up with demand, and core system upgrades are notoriously painful and difficult. The choice between these two things, though, is an illusion. There is no choice. You cannot have one without the other. If banking institutions continue to prioritize digital over core, eventually the clock is going to run out. They will start to fall behind, again. The solution is to take a long-term view that approaches the bank and its systems holistically and creates a modernization plan designed to bring the entire organization into the future. Yes, it will be harder in the short run. But it will pay off in sustainability.