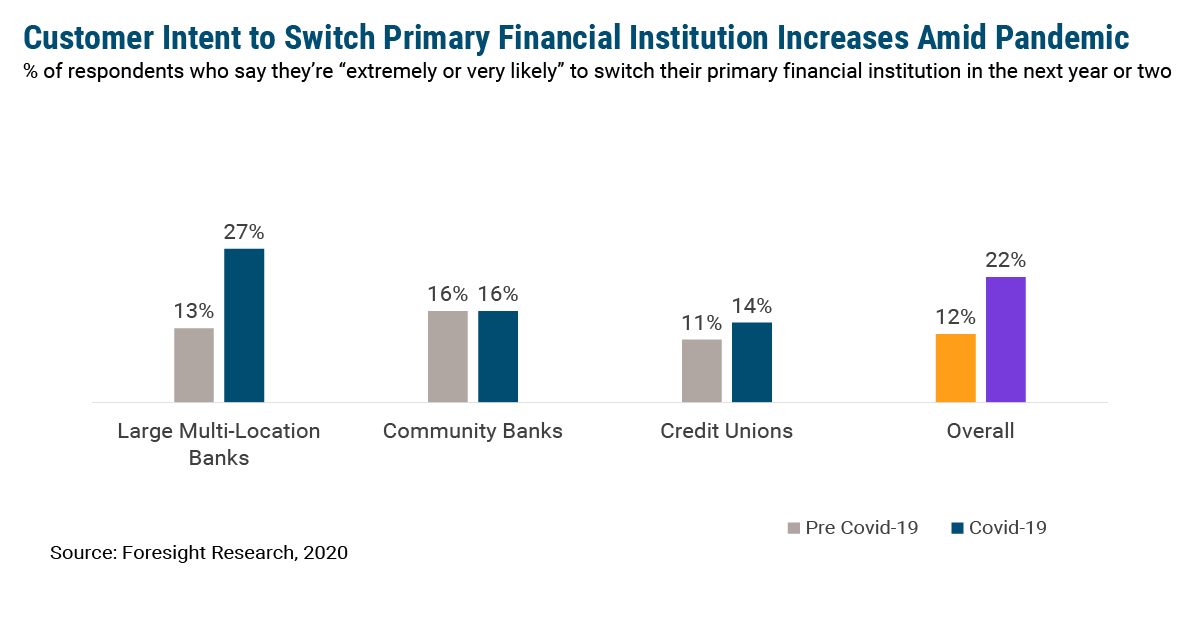

Customer churn at financial institutions (FIs) could spike in the next two years, according to Foresight Research data cited by the Financial Brand. Foresight conducted a pair of studies exploring customers’ intent to switch their primary FI in the fall of 2019 into 2020 and in the summer of this past year. While just 12% of customers surveyed prior to Covid-19 were extremely or very likely to switch, nearly a quarter of respondents said as much when asked in July. Now, it’s important to note that intent doesn’t always translate into behavior. However, given consumers rarely change banks to begin with, that so many more are now even considering it is somewhat stunning.

The bulk of the jump came from changes in attitudes toward larger institutions — just 13% of their customers planned to jump ship before Covid-19, compared with 27% in the later survey. Community banks, meanwhile, held steady at 16% through both studies, and credit unions saw a 3-percentage-point increase in customers claiming they would be extremely or very likely to leave. The data suggests that larger FIs are likely to be the biggest losers here if customers follow through on their intentions, creating an opportunity for other institutions to swoop in and attract new business, especially within the coveted Millennial and Gen Z demographics; of those considering switching providers, nearly three quarters hailed from those groups.

The report notes that most of the churn is likely to be for financial reasons, given the economic climate, meaning customers are looking for better deals elsewhere. While this creates a marketing opportunity for institutions that want to scoop up new customers, they could lose out to digital-only upstarts if they aren’t careful. Neobanks like Chime and Current are already drawing in users in droves with fee-free checking accounts, penalty-free overdrafts, and value-added services like early access to their paychecks. These are exactly the kinds of offerings that customers wanting to switch banks during hard economic times are going to be looking for. And, for the Millennial and Gen Z users up for grabs, the slick digital interfaces that these fintechs provide is likely to add to their appeal. Banks and credit unions hoping to win them over (or keep them from leaving) will have to get creative to compete. This could be a huge opportunity to lock in a cohort that is only going to become more valuable in the years ahead, but traditional marketing alone is unlikely to mint many winners this time around.