Climate Disclosures Remain Tough Nut To Crack

September 15, 2022

By: Kate Drew

Climate and Banking

Environmental sustainability efforts, in response to regulatory and other pressures, are underway across industries, including banking. And, with the Inflation Reduction Act set to give the current administration’s climate agenda some real momentum, those initiatives are likely to accelerate in a bid to stay ahead of the curve. That means getting an environmental sustainability strategy in place for US banks is becoming more and more relevant to future-planning efforts. However, across industries, companies are really struggling to put intentions into practice in tracking their carbon footprints.

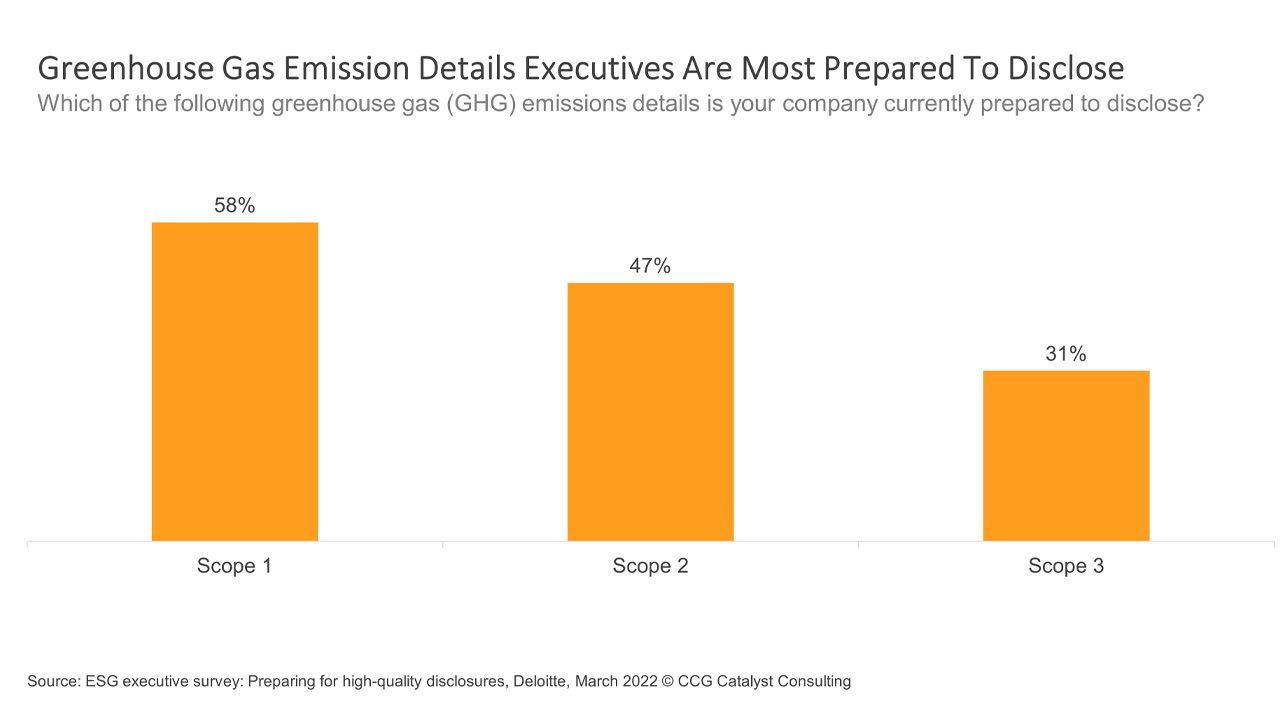

In order to track, measure, and ultimately reduce its carbon footprint, a company (any company, including a bank) needs to consider its emissions across three classified scopes, which include direct and indirect emissions as well as emissions related to your entire value chain. Unfortunately, as of now, very few companies are in a position to track and report on their emissions across these scopes, according to a recent survey by Deloitte. Specifically, while 58% and 47% of executives surveyed said they felt prepared to disclose their Scope 1 and 2 emissions, respectively, only about a third said the same about Scope 3. (Note: The survey’s respondents reflect a cross-industry representation of US public companies with revenues greater than $500 million, and percentages are likely to be even lower among privately held financial institutions.) For context, per the GHG Protocol, Scope 1 emissions come directly from sources owned or controlled by a company, Scope 2 emissions occur from purchased electricity a company consumes, and Scope 3 covers all indirect emissions outside of Scope 2.

As we discussed recently in our latest report, Environmental Sustainability in Banking: Rising to the Occasion, Scope 3 is the hardest of the reporting classes because it entails accounting for things that are out of a company’s control. That’s likely why so few companies are prepared on this front. For banks, though, Scope 3 is perhaps the most important of the three scopes, as it includes emissions that come from investments, which are estimated to be 700 times greater than direct emissions for financial institutions, according to a 2021 CDP report. That means tracking Scope 3 is central for any bank looking to conduct an emissions inventory.

Given this, despite all of the difficulties that come with Scope 3, it will be key to ensure the right tools are in place to address this category as financial institutions take on environmental sustainability initiatives. Of course, it’s easier to start with Scopes 1 and 2, and the goal is really to get out of the gate at this point. But, given how challenging it can be to tackle, and how important it is in accurately monitoring the carbon footprint of a bank, it’s wise for those shepherding these efforts to at least be thinking about Scope 3 early on. That could mean bringing in outside specialists to provide support from the start or leveraging technology for Scopes 1 and 2 that can support Scope 3, as well. Either way, keeping an eye on the horizon will undoubtedly help to avoid problems or delays down the line, especially as reporting on such areas grows more formalized.