Cloud Powers Broad AI Use Cases in Banking

December 14, 2023

By: Tyler Brown

Artificial Intelligence and Cloud

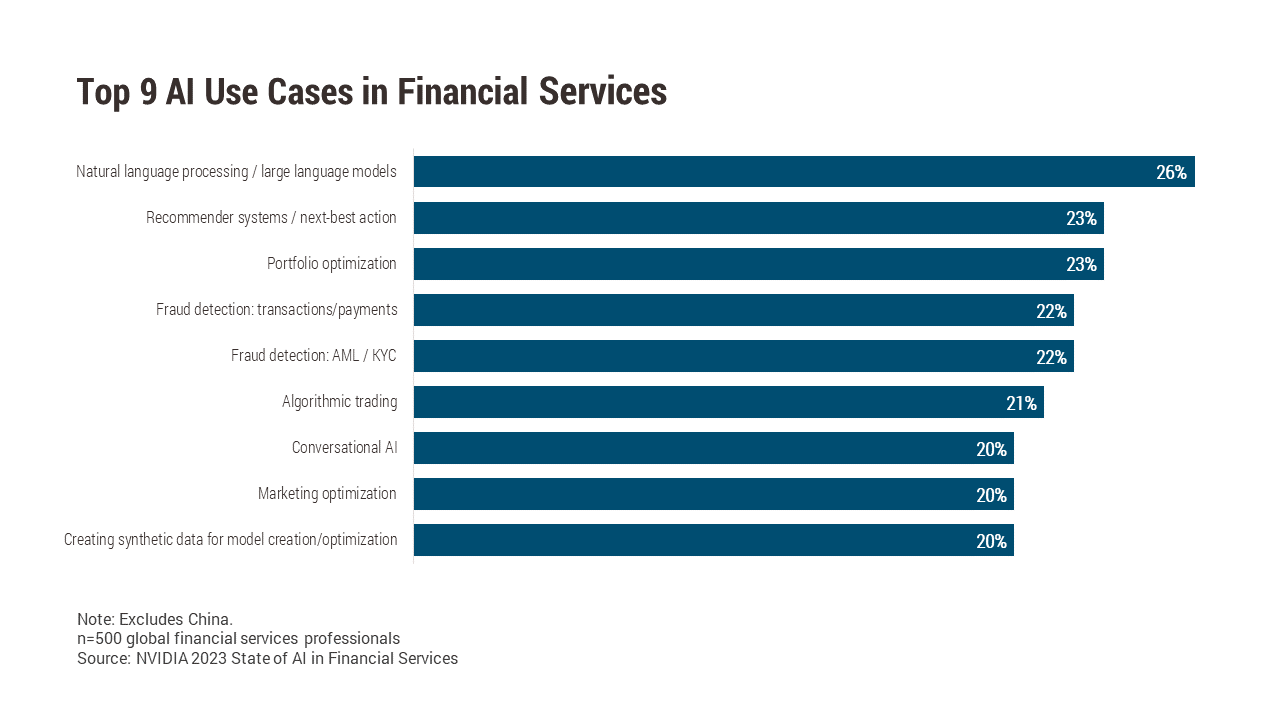

The most common application of artificial intelligence (AI) in financial services is natural language processing (NLP) and large language models (LLMs), according to NVIDIA’s 2023 State of AI in Financial Services. Those are followed by recommender systems (which target content to users) and portfolio optimization. Meanwhile, 57% of respondents to the survey use AI for more than one use case. This is likely because NLP LLMs, which have dominated the conversation about AI since ChatGPT was introduced to the public, have numerous applications within general AI use cases. They are instrumental to better digital self-service capabilities, like chatbots and virtual assistants, and can be used to create marketing collateral that is used in targeted offers or to generate synthetic data for model building.

A problem that many financial services companies have with AI, however, is the high cost of the technology that it runs on. Specifically, according to the data, the upfront investment related to owning the infrastructure necessary to power AI can be prohibitive. As a result, many are beginning to shy away from on-premise data centers in favor of a “hybrid” of cloud and on-premise infrastructure to run their AI workloads. Per the report, 44% of financial services companies (excluding those in China) now run their AI on hybrid infrastructure, and 32% do so on the cloud alone. This suggests that cloud migration strategies are turning out to be a major enabler for AI use cases in financial services.

In addition to greater efficiency, another likely reason behind the transition to cloud is that powerful hardware and complex software can be outsourced. That can help companies to overcome another barrier to AI adoption — scarce talent. At the time of the report’s publication, extreme demand for AI experts and data scientists had not slowed. In fact, more than a third of respondents said that recruitment and retention were among the biggest challenges to achieving their company’s AI goals. These companies may instead turn to products outside the organization provided as a service and developed by some of the talent they are trying to attract. Goldman Sachs, Bloomberg, FICO, and FIS, for example, are AWS partners. Among general applications, Google Cloud notes AI-supported solutions for anti-money laundering (AML), contact centers, customer data platforms, and regulatory reporting.

By enabling the adoption of AI across financial services, the cloud will help democratize AI-based applications for firms of all sizes. This will likely translate to turnkey solutions that evolve to use AI, for example, a customer relationship management (CRM) system with automated call transcriptions built in. That is a solution that anybody can buy, versus a bespoke tool like Bank of America’s Erica. The latter depends on company resources and volumes of in-house training data that it’s likely only a megabank or large technology firm would have. The cloud represents a way of hosting and delivering sophisticated software that will make AI available beyond the largest and most technologically sophisticated firms.