Consumers’ Financial Health Is a Long-Term Opportunity

December 7, 2023

By: Tyler Brown

Technology and Financial Wellness

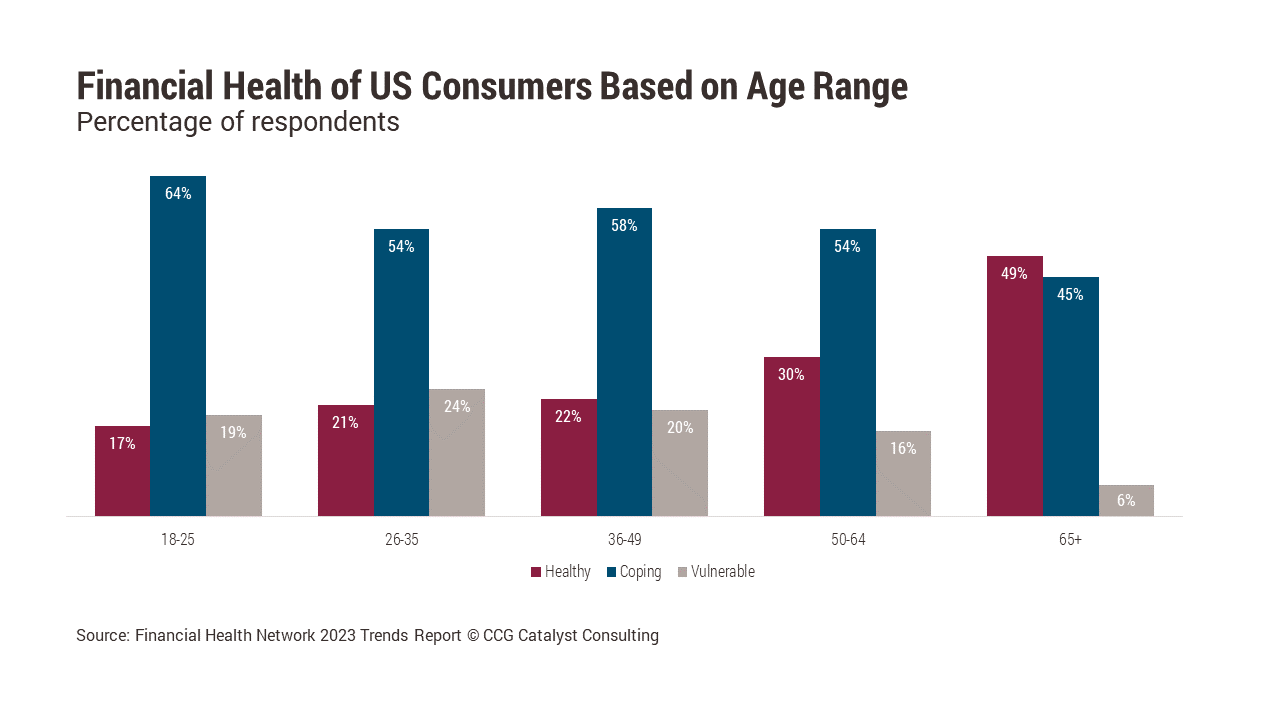

Consumers under the age of 65 aren’t as financially healthy as their elders, according to a recent study by the Financial Health Network (FHN). And the financial health of the younger cohorts materially declined between 2022 and 2023. Per the survey’s results, a high proportion of those consumers are financially coping or vulnerable, including 81% of the 18-25 age bracket (Gen Zers), 75% of the 26-35 age bracket (millennials), 80% of the 36-49 age bracket (older millennials and younger Gen Xers), and 84% of the 50-64 age bracket (older Gen Xers). In contrast, consumers aged 65 and over are evenly split between healthy and coping or vulnerable.

The FHN rates financial health as “healthy,” “coping,” or “vulnerable,” based on four factors measured in a consumer survey: Spending (net income and on-time bill payment), saving (enough cash savings and confidence in long-term financial goals), borrowing (manageable debt and credit score quality), and “planning” (insurance coverage and financial planning). Two macro trends stand out, according to the FHN, that are hurting millennials and Gen Zers: inflation and the cost of debt. Top general concerns for both Gen Z and millennials, according to a recent Deloitte survey, reflect these trends. Both Gen Zers and millennials are most worried about the cost of living (35% and 42%, respectively). The second-most common concern for Gen Zers is unemployment (22%). It’s third-most for millennials (20%).

Younger consumers’ finances will hopefully improve and stabilize. A stronger economy and generational wealth could help improve the state of their financial lives as time goes by. Key questions to track these consumers’ financial health on that journey, however, are: Can they pay their bills? Afford to work only one job? Perhaps to start a family, have enough income to outpace inflation, or set aside savings? Can they cover the cost of education and the lifestyle they want

You can’t fix macro issues, but you can be customers’ ally today and plan for trends in technology and policy. One concrete step financial providers can take is to invest in and innovate with financial wellness. There are a few pieces to consider. One is a focus on holistic wealth management over a customer’s life cycle. Leap beyond basic personal financial management (PFM) features built into digital banking to artificial intelligence (AI)-driven functionality like financial planning and recommendations that tailor services to life events, and help address worries over long-term financial challenges like consumer debt. Financial institutions can also do more to help their customers manage cash-flow events.

Ultimately, you have a data challenge. A tactical part of financial wellness, which Bain calls the “re-bundling of financial information,” is closely associated with universal access to financial data through open banking and open finance. The consumer financial data right, which the Consumer Financial Protection Bureau (CFPB) is likely to enforce soon, means financial services (banks, and ultimately fintechs, insurance companies, and brands that participate in embedded finance) will be able to structure financial services around a holistic picture of a consumer’s finances, with wellness in mind.