Consumers Want the ‘Bank’ in Embedded Banking

August 24, 2023

By: Tyler Brown

Banks and Embedded Finance

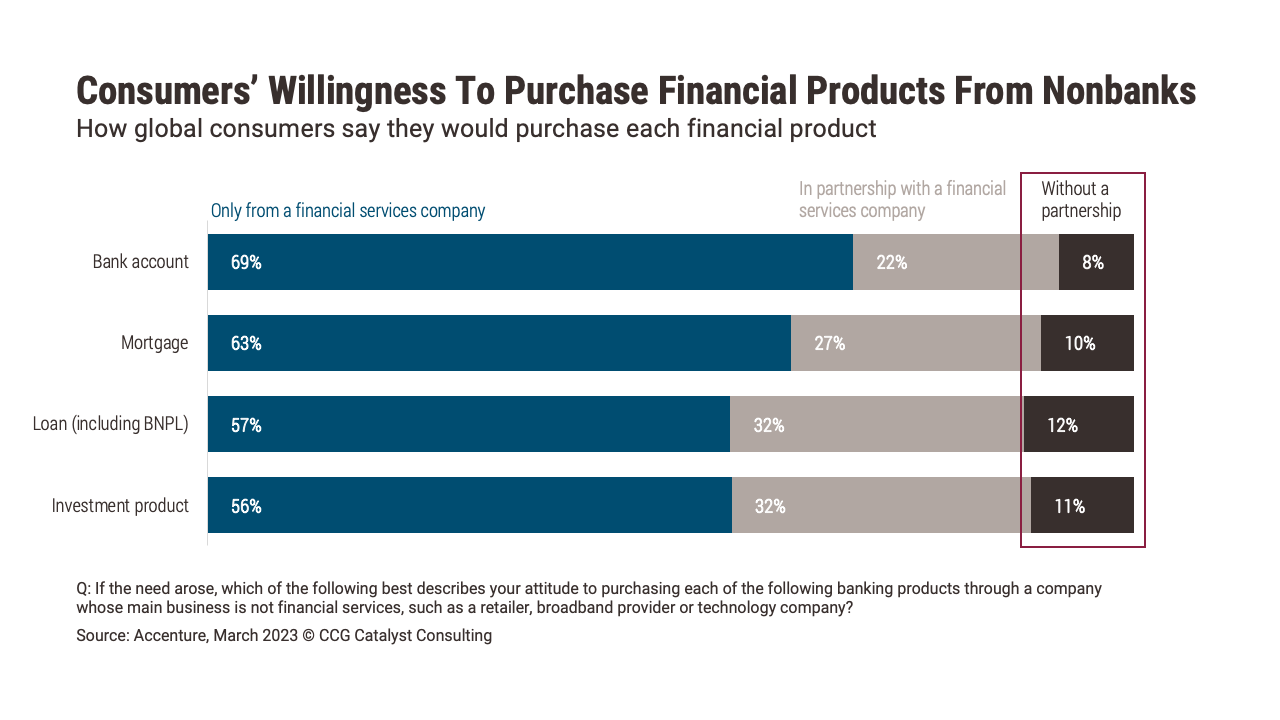

Despite the industry buzz about embedded finance — or the embedding of financial products in nonfinancial channels — only a small slice of consumers globally would jump at the idea of buying financial services through companies whose main business is not in this area, according to the 2023 Accenture Global Banking Consumer Study. In fact, 12% or fewer said they would purchase a bank account, mortgage, loan, or investment product (all potential applications of embedded finance) from such a company — when the product isn’t visibly managed in collaboration with a bank.

That distinction between working with a bank or not is an important one. While there are some cases in which a company whose main business is not financial services might obtain a license to provide financial offerings, often, a bank is necessary to provide access to the financial system. For example, although Apple provides lending products through its own financial services subsidiary, it is partnered with a sponsor bank (currently Goldman Sachs) on Apple Card and Apple Savings. On Apple Card (which came first), the bank is featured in a cobranded model. And Apple has been able to garner considerable user interest in these products — Apple Savings has reportedly raked in over $10 billion in deposits.

According to Accenture’s data, consumer awareness of a bank’s involvement is important to attracting them to the financial products a nonfinancial company offers. In the case of Apple, it is leveraging not only Goldman Sachs’ licensing but also its name to bring credibility to its offerings. The flip side of this is that partnering with a bank on certain products may well result in strengthening the positioning of other offerings. The Apple Pay Later product, for which Goldman provides only the Mastercard payment credential used to complete purchases, launched after the technology company had already cut its teeth in financial services with the bank in the foreground and is already beating out existing players on market share.

This suggests a future for embedded finance in which financial brands coexist with consumer brands. A brand may host some bank-branded financial products within its user experience while providing financial products under its own name (either by partnering with a bank in the background or through its own financial services arm). Importantly, however, having a bank involved in some outward capacity appears poised to be a valuable element for driving uptake.

Such a future is extremely promising for institutions interested in participating in embedded finance but who are worried about a dumb pipes scenario, as it suggests that banks can bring more value than just their charters — they can bring their reputations. As we move forward, those with Banking-as-a-Service (BaaS) or embedded finance units need to think carefully about the arrangements that they support in the future. A handful might play a niche role as part of a syndicate of deposit accounts for established fintech brands like Cash App. (And, of course, commercial uses cases are a different story.) But, overall, we may be looking at the emergence of far more cobranded opportunities, at least when it comes to nonfinancial brands.