Does BaaS Provide an Answer for Deposit Competition?

November 30, 2023

By: Kate Drew

BaaS and Deposit Competition

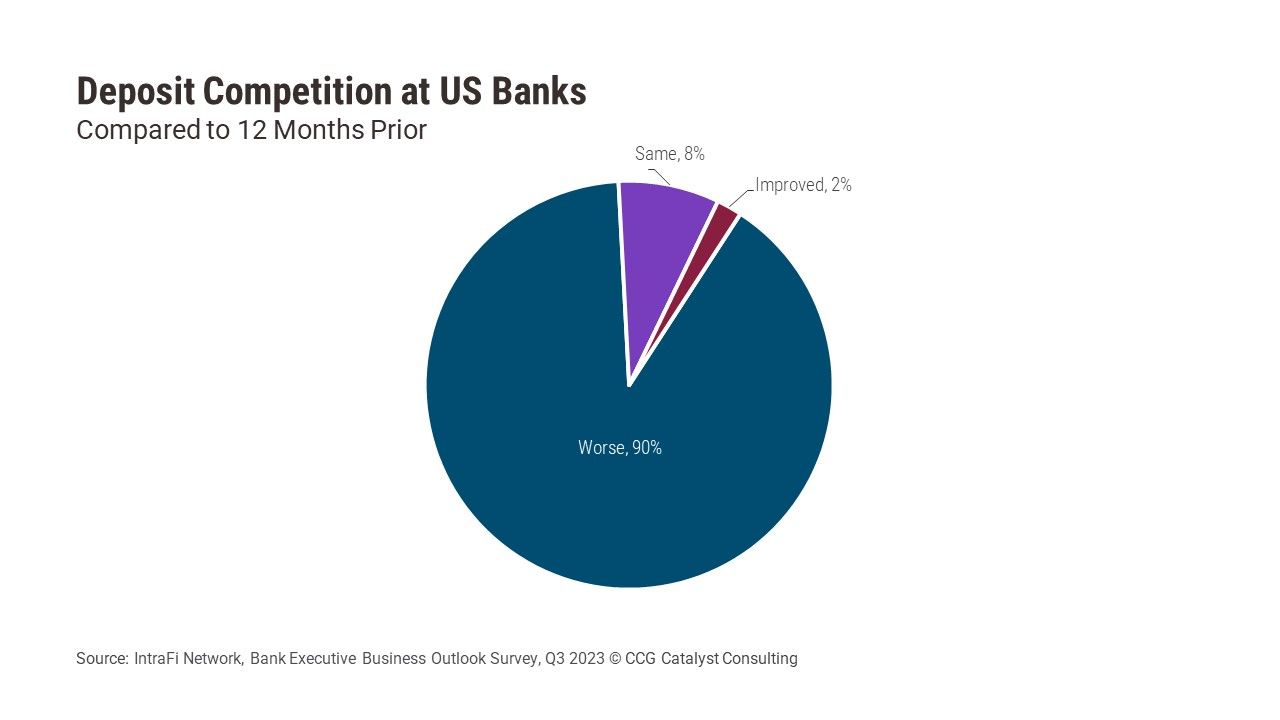

Deposit competition has worsened among US banks, according to IntraFi Network’s Bank Executive Business Outlook Survey for Q3 2023. Specifically, 90% of executives surveyed reported worse conditions compared to the prior 12 months, versus only 8% who said things were the same and 2% who actually saw improvement. This is understandable in the current environment (and not surprising), but it also represents a larger percentage than the 73% of respondents who said they expected deposit competition to worsen at the beginning of the year.

We’ve talked a lot already about how banks can win the deposit fight, including doubling down on brand recognition and moving to deepen customer engagement. These are key levers in first retaining the customers you have, and also pulling in new ones. Those that want to take a more progressive approach, however, are likely to look beyond these tools to areas like Banking-as-a-Service (BaaS) or embedded finance. BaaS and embedded finance are closely related — BaaS refers to providing access to the financial system to allow nonbanks to offer financial services, while embedded finance is an extension of this model that generally focuses on use cases at the point of need — for example, embedding a buy now, pay later (BNPL) offering in an e-commerce website. While BaaS especially has received some serious heat of late, there remains quite a lot of opportunity for those who can get it right, because, at the end of the day, this concept offers an ability to diversify customer acquisition channels beyond the walls of the bank. In an era like this one, that is immensely valuable.

So, what does get it right mean? There’s a slew of elements here, and there is no point in suggesting it isn’t hard or complex to build a sustainable BaaS or embedded finance strategy. Most of the institutions that do this well have been doing it for a long time. But there are a few things they have in common. As we explored recently in our report Reimagining the Last Mile in Banking, these institutions are focused on diversifying their offerings away from typical card programs, and are especially looking to work with business-to-business (B2B) clients that pose less risk than consumer fintechs; they are focused on streamlining their technology to drive efficiency and better serve their clients; and they all have built compliance-first outfits. That last one is incredibly important — taking the time to truly put compliance first is what makes the difference between those who are in the headlines and those who are not.

Any institution who may be interested in taking this approach but isn’t sure where to start should first avoid getting bogged down by the news. Second, they need to get educated. Some of the use cases with the most potential today are relatively sleepy — think disbursements in trucking, for example. This is not about backing a shiny new neobank anymore; it’s about an entirely new way of thinking about delivery. Understanding that, as well as how to capitalize on it with the right controls in place, could turn out to be a very powerful strategy, for deposits and beyond.