Friction Still Plagues Online Banking Interactions

July 27, 2022

By: Kate Drew

Friction and Online Banking

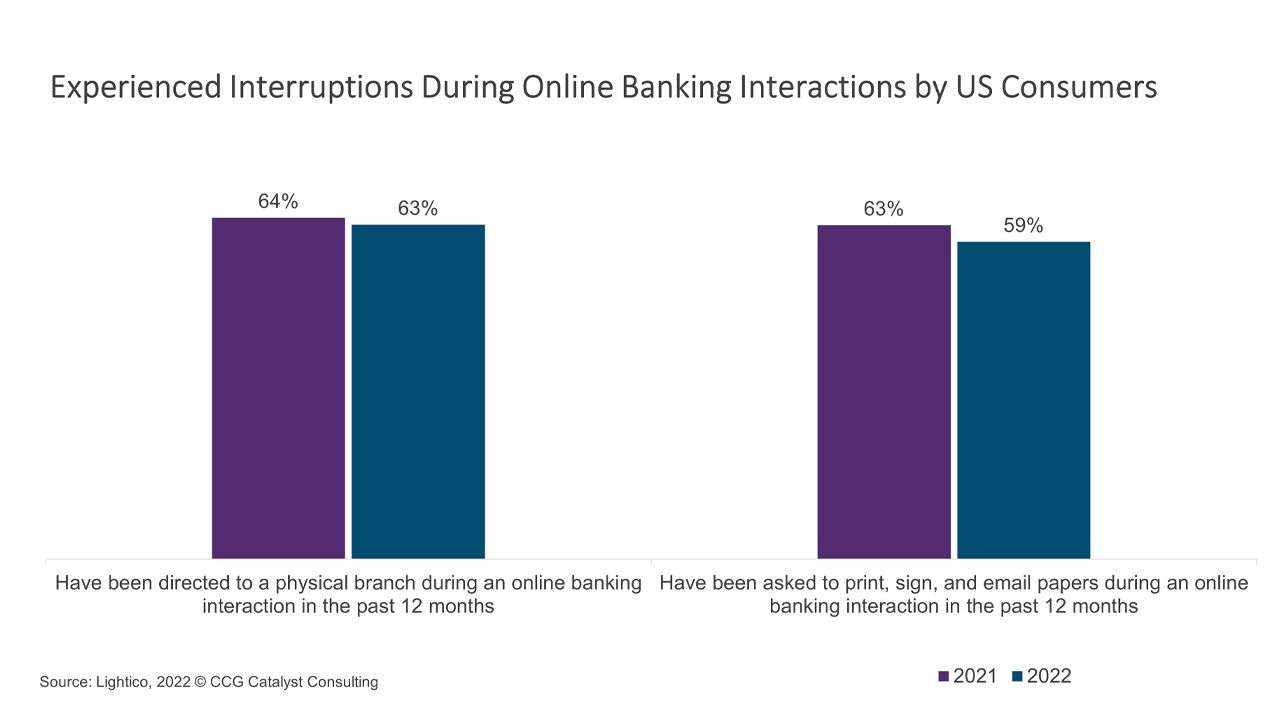

Banks across the US have made tremendous progress in building out their digital channels, especially in the last few years. However, offering online tools is not a checkbox exercise. And, unfortunately, those channels are often still rife with friction points that can disrupt the customer experience. For instance, according to a recent survey by Lightico, 63% of US respondents said they had been directed to a physical branch during an online banking interaction in the past 12 months, and 59% said they’d been asked to print, sign, and email papers during an online banking interaction in the same timeframe. These numbers are quite high, signaling it remains pretty common for customers to experience interruptions during their online banking interactions, and that could damage their perceptions of their provider.

The goal of any digital experience — financial or not — is to keep the customer from thinking too much about what they are doing. It should be seamless, intuitive, and achieve a desired outcome with as little friction as possible. As such, taking a customer out of a digital experience to perform a physical task is probably the worst thing you can do as a service provider. It’s not completely avoidable, but it should be as rare as possible. So, why isn’t it rare? It’s likely down to one big mistake that banks have in common: too much focus on the “happy path,” or the path that users experience when everything goes according to plan. It’s very easy to design for this ideal scenario at the expense of thinking through how to remove friction from other pathways. And, while this is understandable, the truth is many users don’t end up on the happy path. As a result, we are left with many other paths that are friction-filled and fairly well-traveled.

A lot of fintech product managers will tell you that the way to solve for this is to become obsessed with scenarios outside of the happy path. They will say to look for as many possible points of friction across as many paths as possible and try to remove them. That’s why these startups are able to create such delightful experiences because they are always looking for potential points of interruption and working to alleviate them. Sure, some customers will still need to talk with a person or perhaps print and sign a document. The goal isn’t to eliminate these points entirely; instead, it’s about trying to smooth and reduce them as much as you can. In order to do this, though, traditional banks need to spend more time on interactions that seem like outliers, because they may not be outliers at all. That’s what’s really at the heart of this — thinking beyond the core digital experience and putting your effort there. Then, you can begin to truly make improvements, building loyalty and engagement in the process.