Integration Fears Hinder AI Adoption

January 19, 2022

By: Kate Drew

AI Barriers in Banking

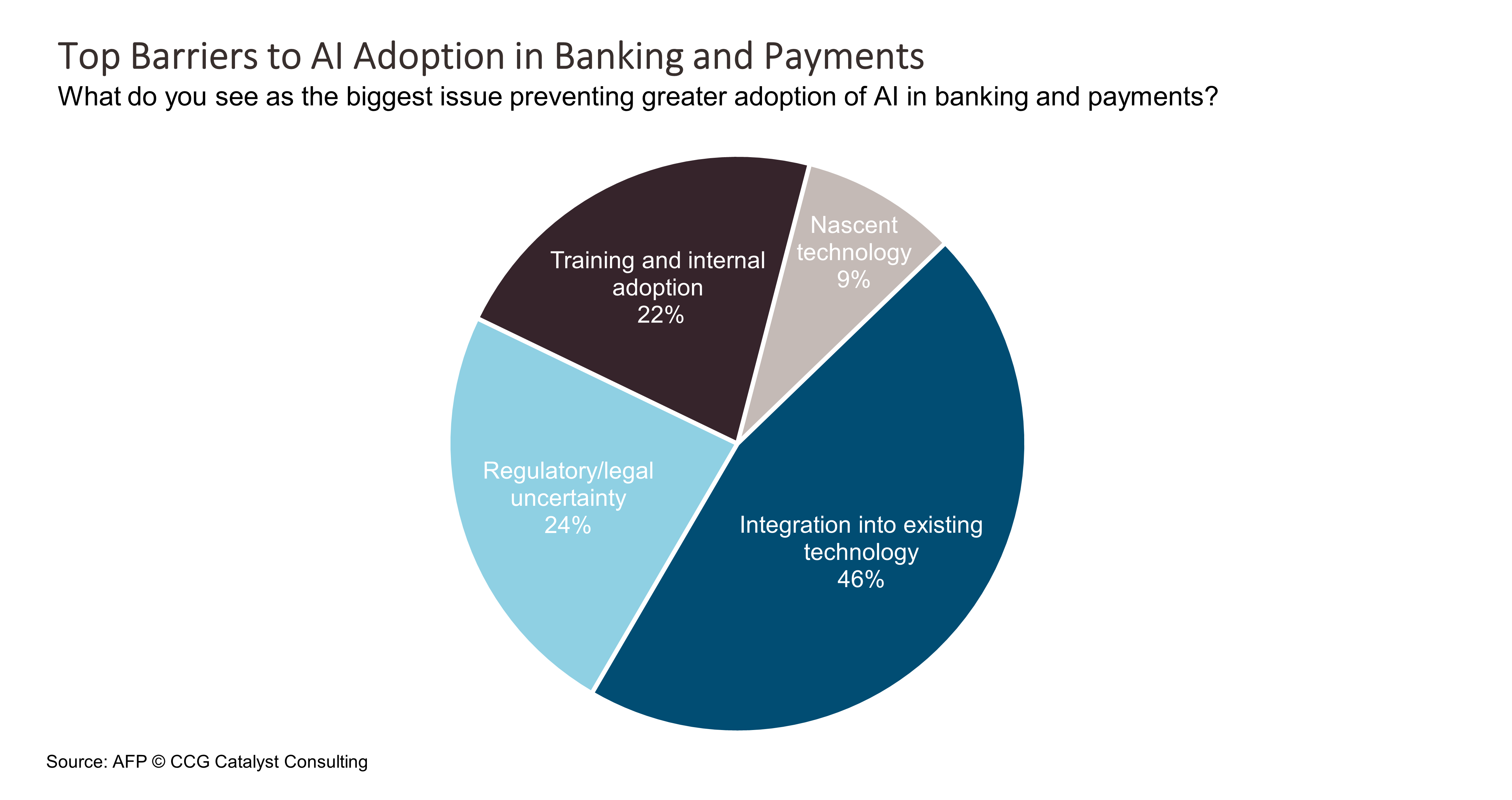

Artificial intelligence (AI) is a buzzy phrase, but it also represents a massive opportunity for financial institutions to drive efficiencies and better service through automation. In fact, as noted in our recent report, AI in Banking: Accessible Applications and Use Cases, the AI in financial services market globally is expected to reach $22.6 billion by 2025. That means we’re probably going to see this technology proliferating in many aspects of banking in the next few years, in all corners of the industry. However, as with any novel technology, bank execs are wary of potential hurdles that could keep projects from seeing success. Topping this list in a survey of financial professionals by AFP is integration into existing technology, aka legacy systems.

This is data is generally unsurprising — an inability to integrate is often blamed for why banking institutions in the US cannot leverage new technologies. That’s because many of these organizations are running on technology that is decades old and not built for ease of integration. It’s a major issue across the board that banks are dealing with as they attempt to move into a future where the ability to “plug and play” is going to be key. As we’ve discussed before, there are a couple of options for how to solve for this, including working with your core provider — all of the leading providers in the US are building application programming interface (API)-based integration gateways to make collaboration easier, though they remain largely at the start of this journey — or implementing an integration layer at the bank either by building in-house or contracting with a managed service provider. Working to modernize your infrastructure today is important because it will make implementing new technologies like AI (and many, many other emerging and promising tools) much easier in the long run, eliminating fears of drawn-out and expensive integration projects.

AI is set to make major contributions in financial services across functions like customer service, loan underwriting, risk management, and more. By automating key internal processes or allowing AI to step in for a customer-facing employee on occasion, banking providers can bring costs down and improve experiences dramatically. However, it’s not just about this one technology, it’s about being able to integrate with an array of solution providers of your choosing easily and at low cost. All vendors including in the AI space will work with you to integrate to systems as needed, but is that really practical? Does it make sense to constantly look to clear just the next hurdle? Probably not. And it’s likely to lead to hesitation to pursue these technologies in the first place. Instead, we should be striving to create an environment that supports an overall strategy of openness. That is the future. And it’s just about here.