Is BaaS Headed for the Back-Burner?

January 19, 2023

By: Kate Drew

BaaS and Investment

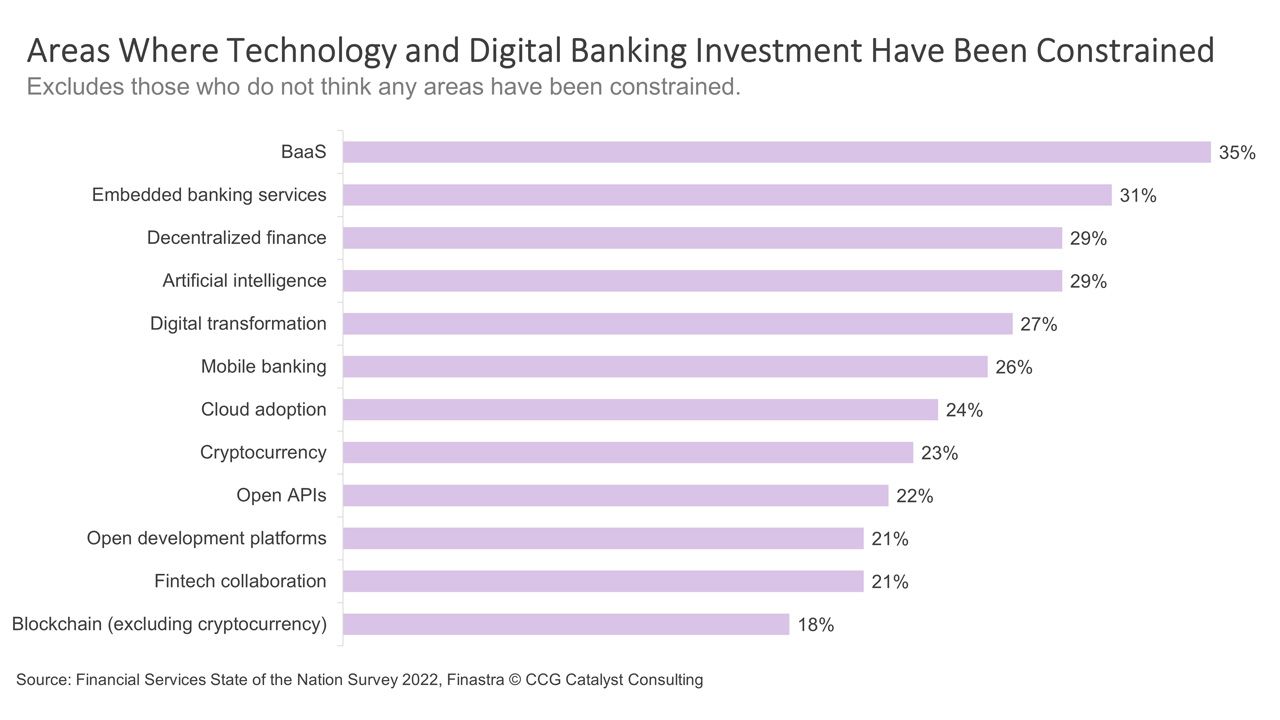

Banking-as-a-Service (BaaS) — the novel model by which a chartered institution provides the regulatory umbrella necessary for a nonchartered company to offer financial services, and once the innovation darling of the financial services industry — took a hard fall in 2022. Or, rather, it took a series of stumbles that added up to a ton of scrutiny and reined in aspirations on all sides of the table. As a result, banks are being forced to reconsider their plans for and approaches to BaaS. And, unfortunately, recent data isn’t very promising — in fact, according to Finastra’s Financial Services State of the Nation Survey 2022, when respondents were asked which areas they felt were seeing constrained investment across a range of options, BaaS came out on top.

Such data could suggest that BaaS is headed for the back-burner as executives shy away from regulatory scrutiny and look to avoid potential risk of client failures in a tightening environment. More likely than not, though, traditional banks are still interested in the concept and are instead shifting to a “wait-and-see” approach. These institutions may be hitting pause on investment until they can figure out exactly how the market will be regulated and where they can place bets safely. The problem with this strategy is that the winners on a new frontier aren’t usually the ones waiting on the sidelines. Those players often end up getting in the game too late once the stars are already minted. This points to a critical point many fail to understand, which is that making the most of any innovative field, including BaaS, requires gumption and foresight.

Recent pressures are undoubtedly creating challenges, but they’re also creating opportunity for those with the right view and approach. Those that are able to separate the winners from the losers, who can distinguish between perceived risk and actual risk, and who can make themselves attractive enough to win clients with proven business models will still have a ton of room to run in this arena. However, that arena is also getting narrower — bets have to be sharper, and banks are going to be competing for a smaller pool of clients as greater diligence comes into play. As such, looking forward and developing a strategy for how to compete today is likely wise. It’s those institutions that use this time proactively, rather than watching from afar, that will reap the most. That’s true in terms of business, but also when it comes to the learnings and experience that will be required to capitalize on the evolution of this space.