Mobile App Differentiation Hinges on Advanced Features

By: Kate Drew

May 5, 2021

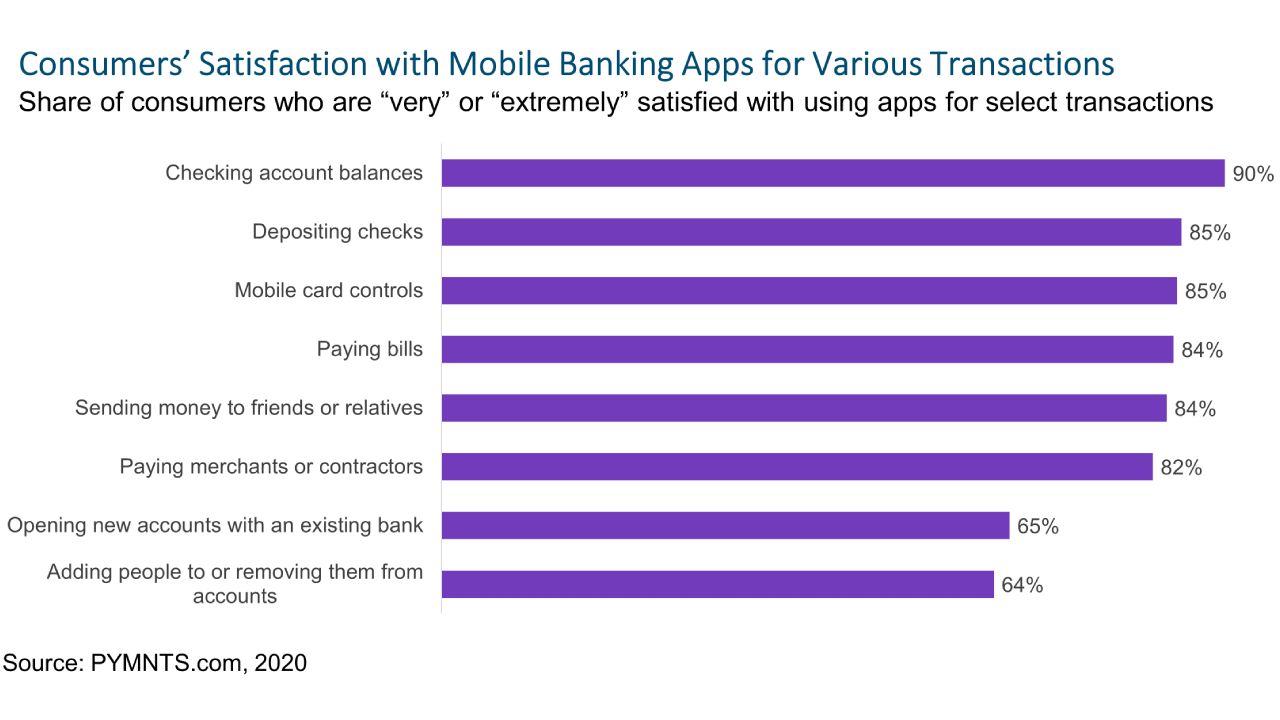

There isn’t much differentiation left in mobile banking. At this point, the ability to perform basic banking functions, like checking a balance or paying a bill, are pretty much ubiquitous. And consumers are generally happy with the way their bank delivers these services on mobile — in fact, according to a 2020 PYMNTS.com survey, a large majority of consumers are either very or extremely satisfied with their mobile banking app for these kinds of tasks. This suggests that baseline mobile banking is no longer a competitive battleground, as most banks offer these tools and provide a satisfactory (and likely very similar) experience. As a result, achieving differentiation is going to require taking a step further, perhaps by considering more advanced functionality.

According to the same survey, consumers were less satisfied with their bank’s delivery of more complex functions on mobile; these include things like opening a new account or adding or removing someone from an existing account. Shifting attention to such areas, which are likely to represent the next wave of key mobile features, can help institutions stay ahead of the game and continue to drive a competitive advantage out of the mobile experience. For instance, quite a lot of focus has been put on digital onboarding the in last year, but ensuring that experience is consistent across channels requires an omnichannel strategy. Based on the survey data, this is an area where banks can still improve overall, meaning a seamless experience is more likely to stand out with customers. Fintech startups tend to do a very good job at this — neobanks like Chime, for instance, can open an account on mobile on under 5 minutes.

But onboarding is only one example; the goal here should be to identify areas that will continue to add value to the customer experience in an intentional way, rather than simply throwing things at the wall. That requires investing time and resources to understand your customers and their needs, while taking a hard look at where the market is headed and which features are unlikely to be optional for much longer. It also means carefully evaluating solution providers to determine who is focused on the future and how they plan to help you get there. The digital experience is not a destination; it’s a constantly evolving proposition that requires flexibility and foresight. That’s true for banking institutions, and it’s true for the partners they enlist to support their efforts.

–Kate Drew is the Director of Research at CCG Catalyst. Contact her at KateDrew@ccg-catalyst.com or 1-480-744-2240. Follow CCG Catalyst on LinkedIn and Twitter.