It’s no surprise that mobile banking use has spiked during the Covid-19 pandemic. In an age of working from home and social distancing, managing your finances from your phone is certainly a no brainer if it’s an option, even for those used to visiting branches frequently. But, what is interesting is that it looks like these new habits are here to stay, according to data from S&P Global Market Intelligence.

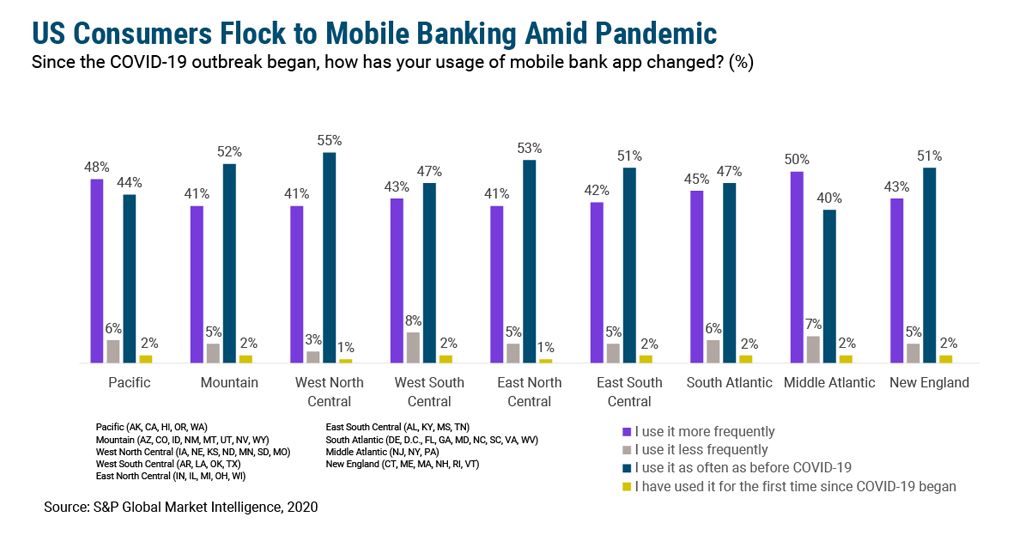

A little less than half (44%) of US consumers surveyed by S&P Global Market Intelligence in 2020 reported using their mobile banking app more frequently than before the pandemic began. That figure holds pretty steady across regions analyzed, with the Pacific and Middle Atlantic regions, home to California and New York, respectively, coming in a bit higher. Very few consumers reported a decline in use or using their mobile app for the first time, while the bulk of the remaining respondents said there had been no change at all. The increased use is likely tied to lower branch visits as people stay at home — 58% of consumers said they visited branches less frequently after the Covid-19 pandemic began.

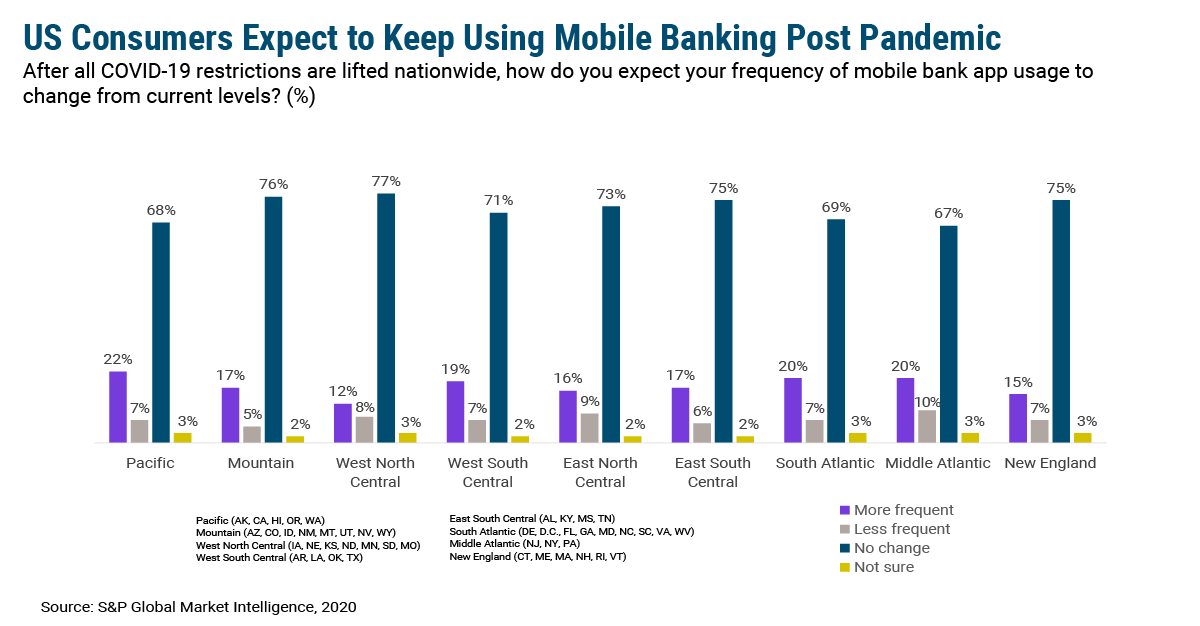

Though the shift to digital among customers last year certainly accelerated transformation at banks, this data would be somewhat banal on its own. However, when asked how they expect their mobile bank app usage to change from current levels once restrictions are lifted, a majority of respondents across regions said they likely wouldn’t change anything. This suggests the Covid-19 pandemic is likely to drive a lasting increase in mobile banking app use across the country, making this digital shift relevant for virtually every bank and credit union in the US.

As customers spend more of their time inside of their mobile banking app, the experience is going to grow more important. That means that a simple, effective app is no longer going to cut it. This is likely to be especially true for those banking institutions operating in markets where customer service is everything. How do you bring that intimacy to a smartphone? Neobanks like Chime and Current are great at this; they take time to deeply understand their customers’ needs and create digital services that cater to them. For example, Chime, which typically targets lower income consumers, offers a round up feature that allows users to save spare change automatically. And it offers real-time notifications of all of these transactions from the app. Current, meanwhile, shows users their spending balance with every transaction notification. These fintechs, while green operationally, nail the customer experience. Their services and the way they are built provide insight into what the future of banking will look like.

By leveraging a next-gen core, these institutions could potentially get to more differentiated products, faster using just a small pool of skilled developers. Yes, this means an upfront cost and commitment, but, on the backend, the return on investment is likely to be high if it means better utilized technology spend overall and a differentiated position with customers.