Moving Forward in a Post-SVB World: Part I

June 15, 2023

By: Kate Drew

Bank Failures and Stability

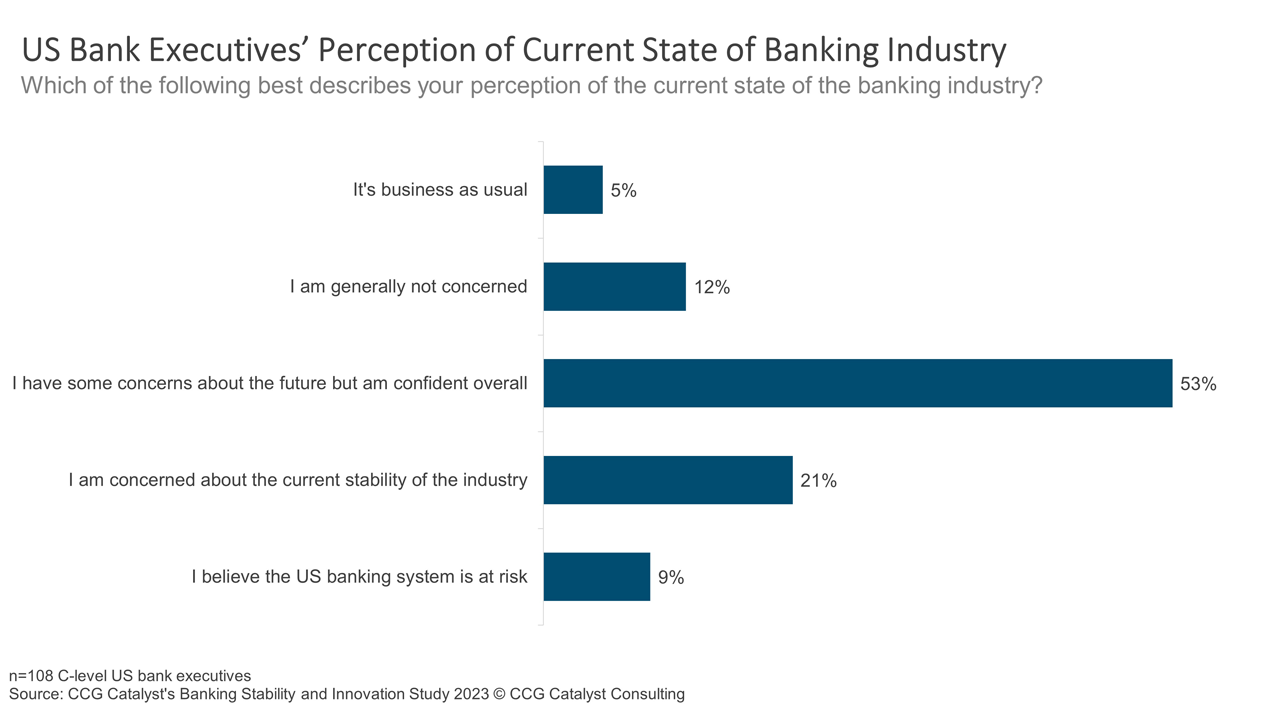

Concern about the stability of the banking industry is percolating. Specifically, according to our Banking Stability and Innovation Study 2023, which surveyed 108 C-level bank executives in the US, 83% of respondents said they have at least some concerns about the future. (Note: The survey was fielded in May-June of 2023 following the string of recent bank collapses.) This data suggests that turbulence over the past few months is having a real impact on how bankers are thinking about the future and speaks to the degree to which they’re taking things seriously. However, it’s important to point out that it is not all doom and gloom — in fact, while 30% of executives expressed deeper concern, most fall into the “somewhat concerned but confident overall” bucket.

Digging a little bit further, we also asked about how they perceive opportunity and risk in the current environment. This revealed an interesting dichotomy — although 73% of respondents said their bank is either much more (15%) or somewhat more (58%) risk averse than 12-18 months ago, a majority (59%) also reported seeing more opportunity in the market today. While these responses may seem surprising at first, they actually aren’t so much when you consider the generally moderate level of concern executives are expressing. Overall, it seems like most of these bankers are feeling both cautious and optimistic about the future, which is not a bad place to be given the circumstances. A good analogy might be an athlete coming back from an injury — you’ve got to be careful, but there is plenty of promise, as well. And, critically, you can still play.

There’s no doubt we’re living at a strange time — the banking industry is obviously shaken, the fintech sector has taken some serious hits, and things often generally feel “Meh.” However, technology is also moving faster than ever before (hello, ChatGPT), and it’s quite possible that the difficulties fintech is experiencing will only lead to a stronger market down the line as weaker propositions are weeded out and compliance becomes a greater focal point. This two-sided dynamic is so important because it speaks to how we get out of this mess. If bank executives can keep focused on the opportunities still out there, without pulling back too hard out of fear, there is likely a major opening for them to navigate their way into a sustainable and productive future. Luckily, the sentiment we’re seeing from industry leaders seems to suggest a good handle on this. The question then becomes, what exactly does that sentiment mean for next steps?

This is the first post in a series of installments that will explore answers to that question through the data we’ve collected from this survey. Over the next couple of weeks, we will dive into how recent events have impacted banks’ businesses, what changes (if any) they are making to their strategic direction and innovation efforts, and how we all move forward from the chaos of the last quarter or so. The goal is to shed some light on how bank executives are grappling with current challenges and where they are directing their efforts for the future. Stay tuned for more.