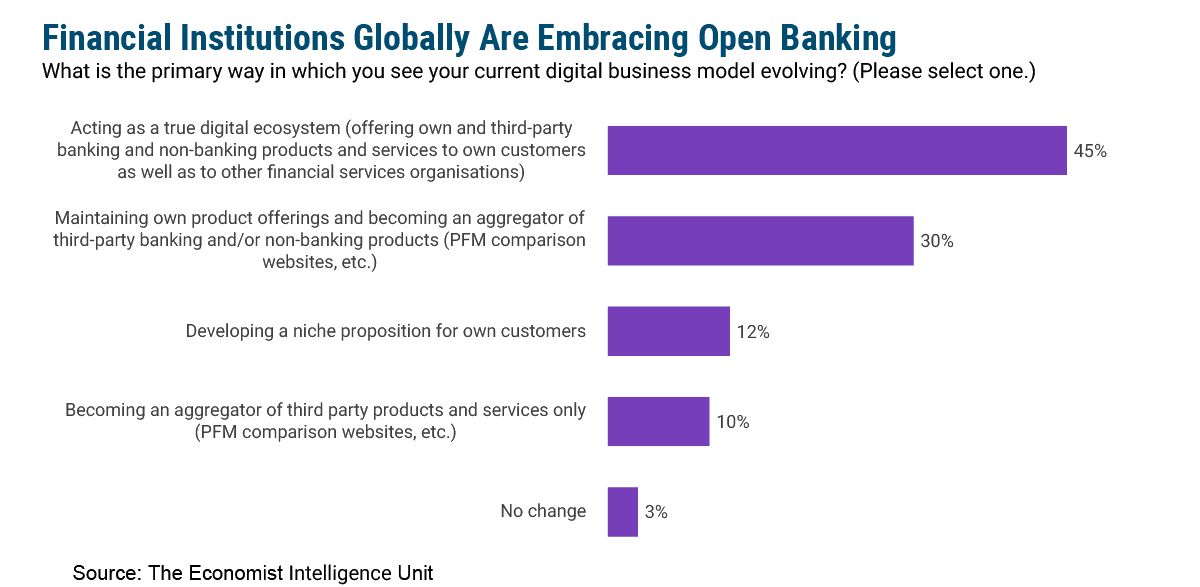

Open banking is growing up. While there are still many definitions floating around, the core tenant of embracing collaboration with third parties by sharing data and functionality seems to be spreading around the globe. No longer a novel idea, open banking is now maturing into a concept that a majority of institutions find significant, if not critical, to the long-term success of their businesses. In fact, 45% of respondents to a 2020 global banking survey conducted by The Economist Intelligence Unit said acting as a true digital ecosystem that offers its own and third-party products is the primary way they see their business evolving, and another 30% expect to maintain their own products and become an aggregator of others’.

The data suggests that we are rapidly moving toward an environment in which working with third parties to offer new value propositions is no longer something to consider but a must-have to remain competitive. This will require a massive mind shift for banking institutions, especially in the US, where firms are used to owning their product sets and tend to acquire all of their technology from a small number of established vendors. But there is a lot of opportunity for banks that do this well — for example, one commercial bank we talked to for our latest report, Open Banking | Is the U.S. Ready?, can do authentication and know-your-customer (KYC) procedures almost instantaneously through its partner Auth0. This eliminates the need for a site visit, meaning it can offer digital account opening to its small business customers; still a rare feature among US banks. That required the bank to embrace a plug-and-play strategy and put an architecture in place that could support its collaboration with third parties.

Getting your infrastructure ready to support open banking is a tricky proposition. For most institutions in the US, the first stop will be their core provider. All of the leading US cores by this point have open banking strategies; they are all creating application programming interface (API) gateways designed to make it easier for their bank clients to integrate with third parties. However, it will take time for these offerings to fully take shape. In the meantime, progressive institutions are implementing their own API layers that sit above the core, making it much easier to expose their systems to market players they want to work with. This is an interesting strategy, because it’s core agnostic, which means it works no matter which core you’re on. The flip side is that it requires development talent and dedicated resources for managing the initiative. Ultimately, the route a bank takes will come back to its strategy — defining what you want to do is the first step; from there, you can begin to look at your technology, determine whether or not its equipped to support you, and start to fill in the gaps.