SMEs Show Interest in Embedded Finance

May 12, 2022

SMEs and Embedded Finance

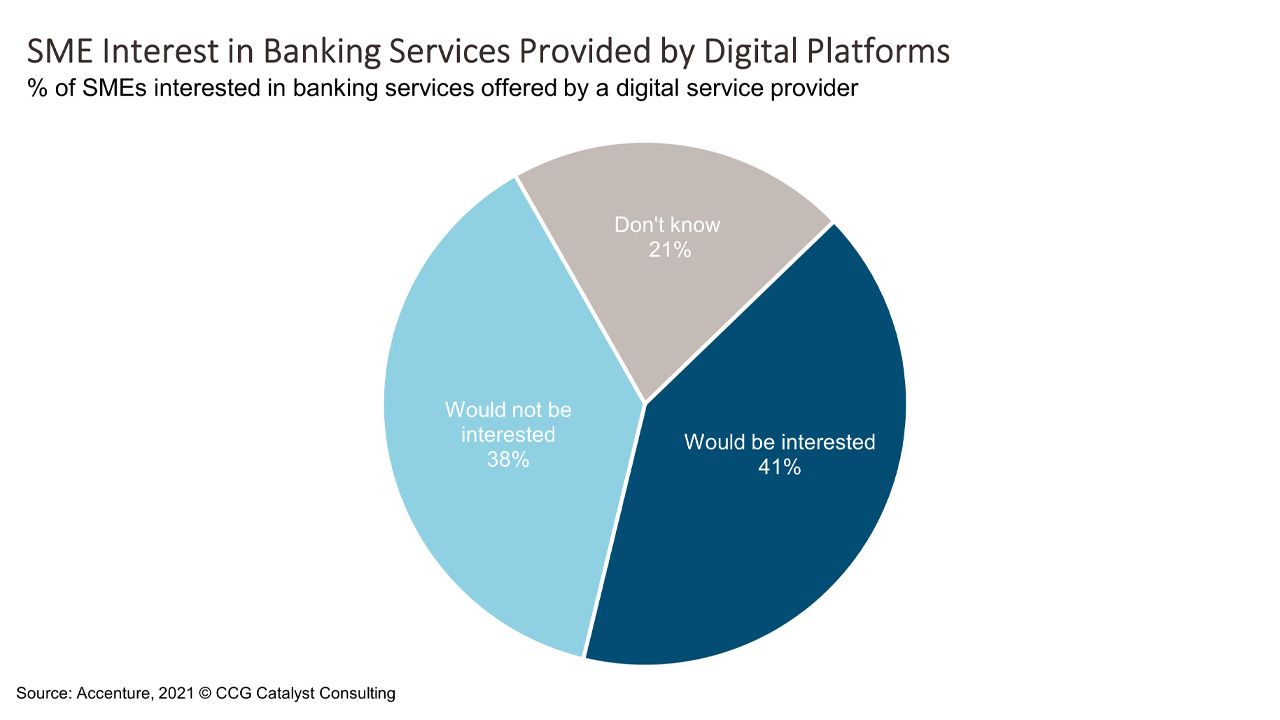

The small and midsize enterprise market represents a huge opportunity for embedded finance. In fact, a recent Accenture analysis forecasts that embedded banking for SMEs could capture more than a quarter of global SME banking revenue by 2025, with 41% of SMEs surveyed by the company expressing interest in such services. The reason for this is likely tied to SMEs’ reliance on digital service offerings, which help them play in new areas like e-commerce or handle their operational needs like accounting. Think, Shopify or QuickBooks. These companies are integral to SMEs’ daily processes — 43% of respondents to Accenture’s survey reported using digital services in their day-to-day operations, with 10% saying they rely on such platforms for at least half their revenue. That central role makes them a natural fit to provide financial offerings, as well.

Obviously, this is going to come across as a bit of a threat to traditional banking institutions. As digital platform players swoop in with financial services, it will begin to chip away at their share of the market; that’s how it works. But it doesn’t have to be that way. These service providers are generally not chartered financial institutions, which means there is a role for banks to play in powering their offerings. This probably sounds a lot like Banking-as-a-Service (BaaS), and it should — these concepts are related, but embedded finance brings a contextual element to the table, as well. For example, say an SME is selling on an e-commerce platform, that platform might be able to offer the company a short-term loan based on its sales activity. This is meeting the customer at the point of need, and it’s why this area has so much potential.

Digital service providers are already experimenting with creative ways to serve up financial services to their customers — Shopify, for example, offers a bank account through its Shopify Balance product and loans that can be paid back as a percentage of sales through Shopify Capital. The e-commerce platform partners with financial institutions like Evolve Bank & Trust, Celtic Bank, and WebBank to provide these products. Over time, such platform companies will likely push further into financial services, and as illustrated by Accenture’s data, will probably be met with considerable demand. Banks should be thinking about how they can get in the game. Most of these companies will be looking for partners. So how do you become one of them?

Institutions interested in this area really need to do two things (at least from a business standpoint, infrastructure is another story): First, stop worrying about becoming “dumb pipes”; unless you’ve got a team of engineers and a data strategy that will allow you to create the contextualized products these companies are, the real money is in partnerships. And second, learn how to sell yourself as an advisor. The companies poised to win big in embedded finance are not small neobanks or fintech startups — they are big brands and technology companies. You’re going to have to win them over. In particular, lean on your compliance expertise and ability to fill those gaps where experience-focused players might be lacking. That’s where a bank can really bring value. In short, take the conversation beyond the charter. The truth is embedded finance probably has even more room to run than BaaS on its own. Why? Because of the context. Context is so important, and those who understand how to successfully inject it into financial services are likely to see immense gains. They know that, so coming to the table with a strategy and a story is going to be key.