Tackling Credit Invisibility in Rural Communities

October 26, 2023

By: Tyler Brown

Rural Communities and Credit Access

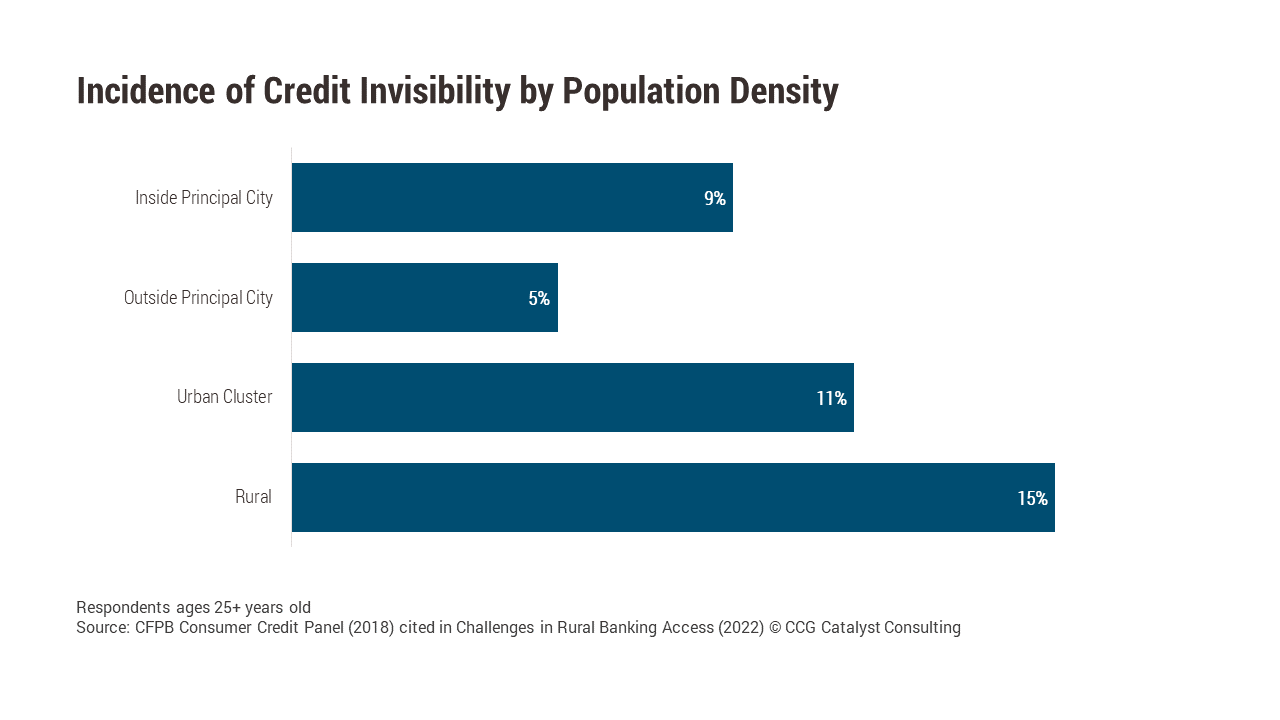

Rural America appears to have a consumer credit problem, according to research by the CFPB and FDIC. It’s not necessarily that a disproportionate number of consumers who live in rural areas have poor credit, although it’s possible that’s the case. The issue revealed by this data is that a significant number are “credit invisible,” or in other words, have no credit history at any of the three national credit bureaus. They’re stuck in a Catch-22 in which they need credit to get access to credit.

Neobanks have tried to solve issues with access to credit. And more recently, Experian unveiled a mobile checking account designed to use bill payments via debit card to help build a credit history. This offering in particular may have a positive impact on access to credit given it has the financial backing of a large corporate parent. But that’s probably less likely to happen outside of urban areas. In cities, there’s no shortage of ways to access the Internet, and there’s every expectation that a well-designed app with good distribution will pose a realistic solution to a financial problem.

That may be different in rural America, where consumers depend disproportionately on branches, and sometimes spotty access to broadband Internet services limits the utility of digital banking. Among the banked population, vastly more rural consumers appear to depend on the branch for basic banking services than their urban counterparts. In 2019, according to the FDIC, about 33% of banked rural households used a bank teller compared with 17% urban and 19% suburban. And relatively few of them have digital banking as an easy alternative. According to the same research, 68% of rural households have access to the Internet in their house compared with about 80% of urban households and 85% of suburban households.

The inclusion problems posed by limited digital access to financial services isn’t an issue that fintechs, by definition digitally native, can solve in the near term. Community financial institutions, which can be de facto civic organizations and still may operate as the epicenter of activity in rural areas, are far better placed to play this role. It’s not going to be easy, that is for sure. But a good place to start may be to look at things their digital-savvy peers have done and replicate those efforts without the Internet-only aspect. For example, a credit builder product that uses a secured credit card in conjunction with a prepaid account can be created outside of a mobile app.

Over time, increased education and greater access to the Internet will likely help pave the way for richer services on this front. Until then, though, community institutions should lean on their deep knowledge of their constituents and a little creativity to ensure they are at the forefront of solving this problem.

Note: The FDIC uses metropolitan statistical areas to illustrate distribution of population. In plain English, these are roughly analogous to “city center,” “suburban,” “town,” and “rural.”