The Digital Wallet Opportunity

January 12, 2023

By: Kate Drew

Digital Wallet Use and Banking

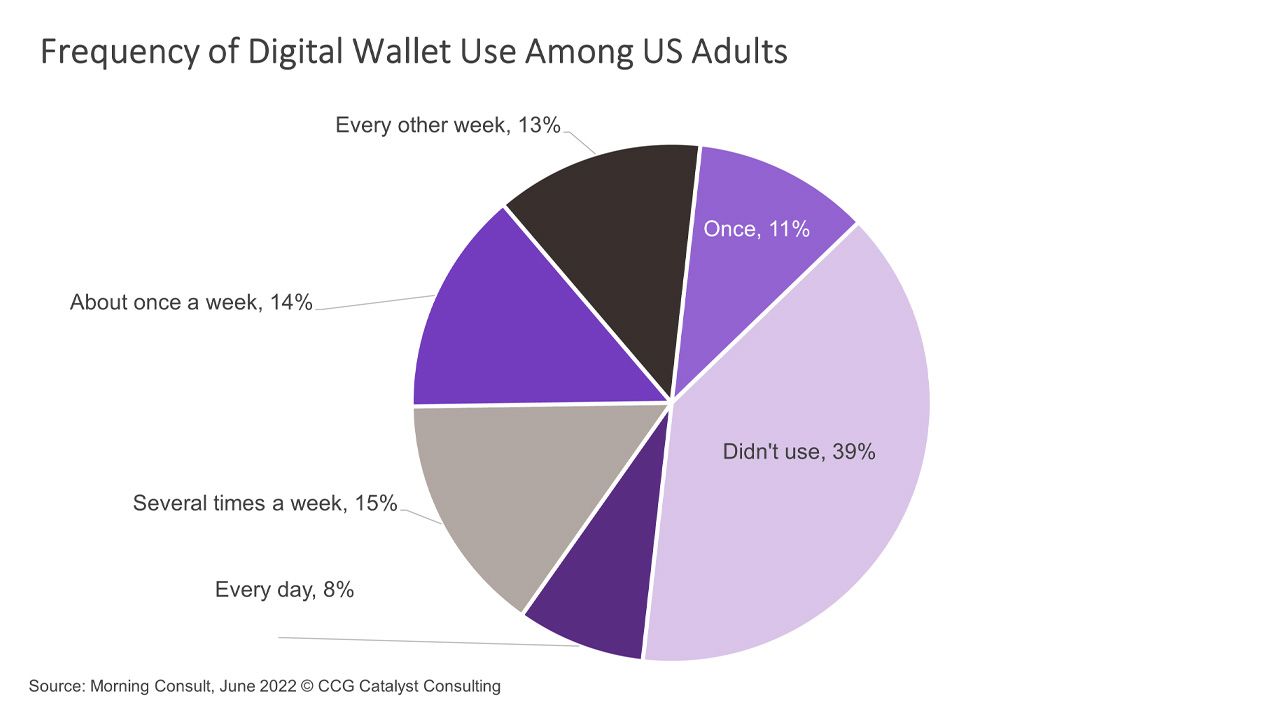

Although the US was admittedly slow to the digital wallet train, it seems as though consumers have finally jumped on. In fact, according to data from Morning Consult, 61% of adults surveyed have now used a digital wallet at least once, with half reporting usage of at least every other week. Digital wallets store customers’ payment information (and in some cases funds) electronically, allowing them to make payments online or in-store via contactless technology. Popular examples are Apple Pay and Google Wallet as well as well-known branded versions from companies like Starbucks. Adoption of such technology is changing the way customers transact, and that has major implications for the country’s traditional financial institutions.

Here are a couple of ways banks can benefit from the digital wallet trend:

- Increased loyalty and stickiness. By making it easy for consumers to add their cards to digital wallets, banks have an opportunity to improve experiences and achieve top-of-wallet positioning, increasing usage. An important tool for this is called push provisioning, which essentially allows a customer to add their card details to popular digital wallets directly from within their mobile banking app. This eliminates the need to manually enter card details and wait for verification, removing friction and making it more likely that your bank’s card will make it into their digital wallet for use. While such features may seem small in scale, they are extremely impactful when it comes to the customer experience. And that can pay big dividends not only in terms of digital wallet adoption but also in regard to customer satisfaction and digital banking engagement overall.

- Powering embedded wallets. Another key opportunity is the ability for banks to provide the licensing nonbanks might need to issue their own digital wallets, especially as branded e-wallets become more popular. For companies like Starbucks that offer closed wallets, or wallets from which funds cannot be withdrawn, this is a bit less relevant. However, there are plenty of use cases emerging for nonbank companies, especially in the e-commerce sphere, to embed digital wallets that would require a licensed financial partner. For example, a company like Airbnb could embed a digital wallet that allows users to pay for services within the platform while also setting aside money for their trip for use at a later date. As embedded finance moves further into the spotlight, taking Banking-as-a-Service (BaaS) arrangements upstream and into a more contextual arena, such opportunities are likely to become even more attractive and top of mind for forward-thinking executives.

The digital wallet opportunity is not particularly new itself, but as it evolves, it is starting to present itself as a frontier with many different possibilities. For traditional institutions, this should feel a bit like what happened with mobile banking apps. Mobile started as a hot thing but quickly became a must-have — and then the fun really began as differentiation and experience moved into the conversation. Digital wallets are on a similar trajectory, and they’re already starting to spawn new use cases and elements beyond their original compositions. As such, banks will want to be thinking now about what their strategy is (beyond, “We should do that.”) It’s easy to miss the boat on the next interface. Try not to play catch up on this one.