What a BaaS Bank Should Provide

September 22, 2022

By: Kate Drew

BaaS Capabilities

Banking-as-a-Service (BaaS), even with all of its complexities and recent tumult, is still one of the most talked about opportunities in banking today. There is little question about that — in fact, more than three-quarters of C-level bank executive respondents in our 2022 US Banking Study said they’re at least somewhat interested in providing BaaS services, if they don’t already do so, with more than half saying they’re very interested. But, as this frontier matures, it’s creating many questions, including, “How can banks participate safely?” and, “What does an increasingly crowded space mean for differentiation?” These two questions are likely at the crux of the matter for those looking to enter the BaaS market — and it’s very possible their answers are linked.

BaaS started out as a new model for fintech engagement by which a chartered institution provided the regulatory umbrella necessary for a nonchartered company, often a neobank, to offer financial services. This is what’s referred to when we discuss the “rent a charter” setup that’s become so common across the industry. However, there are many things a new, inexperienced financial services provider needs beyond a charter to sit on — and a major one is compliance expertise, an area where traditional banks have not only a vested interest but also deep capabilities.

Nonbank providers like fintechs, especially startups, have a dearth of knowledge when it comes to compliance. As a result, getting their operations to a point where they can conform to the policies and procedures of their bank sponsors with effective oversight is notoriously difficult. This lack of experience has led to a number of problems, from issues with fraud

to slaps on the wrist from regulators. And, of course, financial institutions working with these companies can face trouble if things don’t go well. However, by leaning on their own compliance expertise to provide greater support to fintech clients, banks have a real opportunity to add more value and de-risk their own operations simultaneously. Such support could perhaps even rise to the level of creating something that looks like a Compliance-as-a-Service (CaaS) offering by which the bank acts as a fintech’s compliance arm, moving the bank from overseer to operator on the compliance side of the house. Regardless of how exactly it manifests, though, beefing up their compliance support and offerings would allow banks to kill two birds with one stone, helping to keep their fintech relationships aligned with regulators while also making their own propositions more competitive.

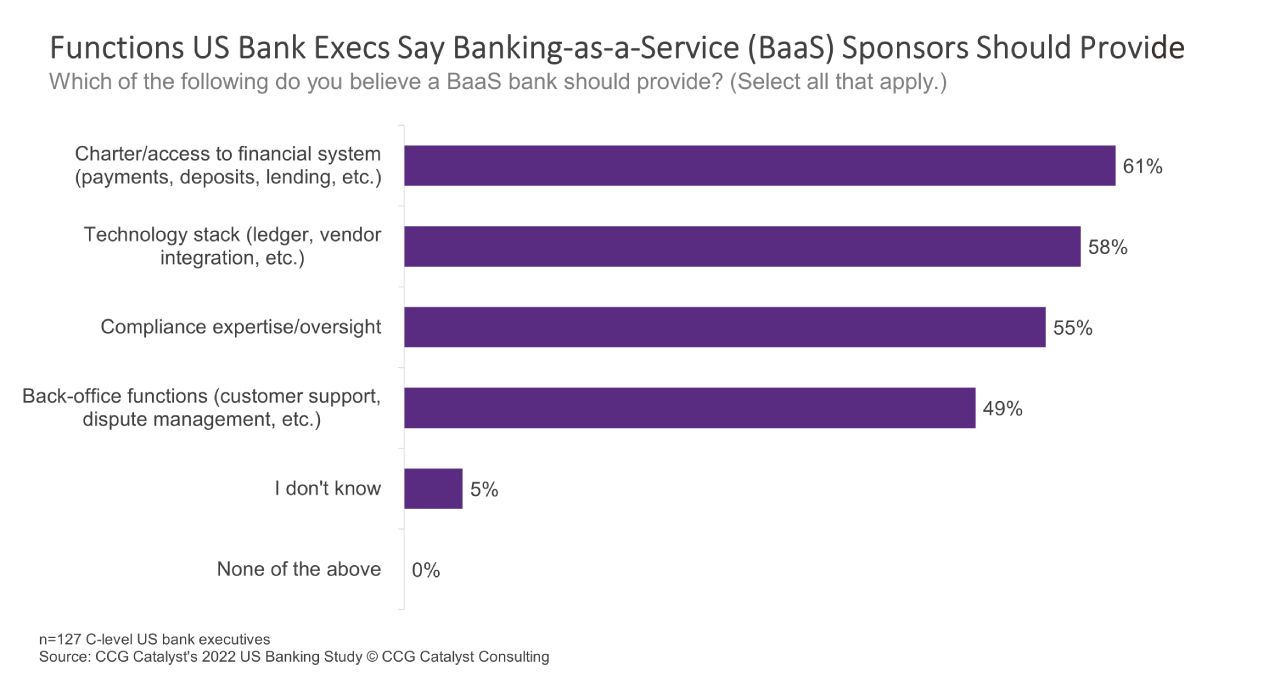

It’s important to remember that this conversation isn’t just about compliance, however. It’s also about the way BaaS is evolving over time and likely toward a future where coming to the table with only a charter isn’t going to cut it anymore. In fact, while access to the financial system came out on top in our survey when respondents were asked what a BaaS bank should be providing, other elements like technology and compliance expertise were not all that far behind. As such, the most successful BaaS banks will likely be those that figure out how to wrap additional services around their charter, creating more attractive and, hopefully, more lucrative propositions in the process. Formalized compliance support, while just one example, represents a meaningful way that banks can start to better leverage their own core strengths and capabilities to improve their fintech relationships and operations.